Marriott Bonvoy Amex Business Your Travel Advantage

Marriott Bonvoy Amex Business is a powerful tool for savvy business travelers. This card offers a unique blend of travel rewards and financial benefits, designed to streamline your business journeys and maximize your rewards. From earning valuable points to booking seamless travel, this card is poised to be a game-changer for your corporate trips.

It encompasses a wide array of features, including a comprehensive rewards program, flexible booking options, and a range of financial perks. The card also includes a robust comparison against competing business travel cards, allowing you to evaluate its competitive edge. Furthermore, it delves into real-world use cases and highlights the value proposition for diverse business scenarios.

Introduction to the Marriott Bonvoy Amex Business Card

The Marriott Bonvoy Amex Business card offers a compelling proposition for business travelers seeking rewards and benefits tied to their frequent stays at Marriott hotels and resorts. It provides a streamlined way to accumulate points and redeem them for travel experiences, upgrades, and other valuable perks.

This card is designed to cater to the needs of business professionals by providing exclusive access to amenities and services, potentially reducing expenses and maximizing travel efficiency. Understanding the card’s features, benefits, and eligibility criteria is key to determining if it aligns with your travel and spending habits.

Key Features of the Marriott Bonvoy Amex Business Card

This card boasts a range of attractive features that enhance the business travel experience. These features include earning points on eligible purchases, redeeming points for Marriott stays, and access to exclusive benefits.

- Earning Potential: The card offers substantial earning potential on business expenses such as flights, hotels, and other travel-related purchases.

- Reward Redemption: Points earned can be redeemed for various Marriott Bonvoy experiences, including hotel stays, flights, and other travel-related purchases. This provides flexibility in how you utilize your rewards.

- Exclusive Benefits: The card may include perks such as priority check-in, complimentary room upgrades, and access to exclusive events and lounges, all aimed at enhancing the overall travel experience.

Benefits and Perks

The Marriott Bonvoy Amex Business card comes with a variety of perks and benefits designed to provide value beyond just points accumulation.

- Complimentary Amenities: These could include complimentary breakfast, Wi-Fi, and other in-hotel amenities, further increasing the value of your stay.

- Priority Check-in: The card may offer expedited check-in and check-out processes at participating Marriott properties, saving time and increasing efficiency during busy travel periods.

- Lounge Access: Access to Marriott Bonvoy Centurion Lounges or other affiliated lounges, providing a comfortable and productive space for business travelers to work or relax.

Eligibility Requirements

Applying for the Marriott Bonvoy Amex Business card typically requires meeting specific criteria. These requirements are aimed at ensuring the card is suitable for business travelers with specific spending and travel patterns.

- Income/Spending: Applicants may need to meet minimum income or spending requirements, ensuring the card’s benefits align with their financial capacity and travel needs.

- Business Activity: The applicant may need to demonstrate active business activity and travel patterns, aligning the card’s purpose with the applicant’s actual needs.

- Creditworthiness: Standard creditworthiness criteria apply, similar to other credit cards, reflecting the issuer’s assessment of the applicant’s credit history and risk profile.

Comparison to Other Business Travel Cards

A comparison table outlining key features of the Marriott Bonvoy Amex Business Card against other popular business travel cards can provide valuable insight into its unique position within the market.

| Feature | Marriott Bonvoy Amex Business | Chase Ink Business Preferred | American Express Platinum Business |

|---|---|---|---|

| Primary Reward Currency | Marriott Bonvoy Points | Chase Ultimate Rewards Points | Membership Rewards Points |

| Hotel Focus | Marriott Hotels | Wide range of hotels | Wide range of hotels |

| Lounge Access | Potential access to Marriott Bonvoy Centurion Lounges | Potential access to Chase-affiliated lounges | Access to Centurion Lounges and other lounges |

| Annual Fee | (Depending on the specific card) | (Depending on the specific card) | (Depending on the specific card) |

Note: Specific features and benefits may vary based on the specific card edition and any promotional offers. Always review the official card terms and conditions for the most up-to-date information.

Rewards and Points Earning Potential

The Marriott Bonvoy Amex Business card offers a compelling rewards program, allowing cardholders to accumulate points easily and redeem them for a variety of travel and lifestyle benefits. Understanding the point earning structure and redemption options is key to maximizing the value of this card.

The Marriott Bonvoy program is a robust system designed to provide diverse earning opportunities and flexible redemption choices. This section will articulate the points earning structure, highlight strategies for maximizing rewards, and detail the different ways to redeem points for travel, experiences, and more.

Marriott Bonvoy Points Earning Structure

The Marriott Bonvoy Amex Business card’s points earning structure is based on spending categories. Different spending categories yield varying point multipliers. This ensures that cardholders are rewarded for spending in areas relevant to their business needs.

Maximizing Points Earning

Strategic spending can significantly boost your Marriott Bonvoy points balance. For instance, consistently booking business travel through the card, taking advantage of any travel rewards programs, or prioritizing spending in eligible categories can lead to significant point accumulation.

Redemption Options for Marriott Bonvoy Points

Marriott Bonvoy points offer a wide range of redemption options. Cardholders can exchange their points for hotel stays, flights, merchandise, and experiences. This flexibility allows for customization and personalization of rewards.

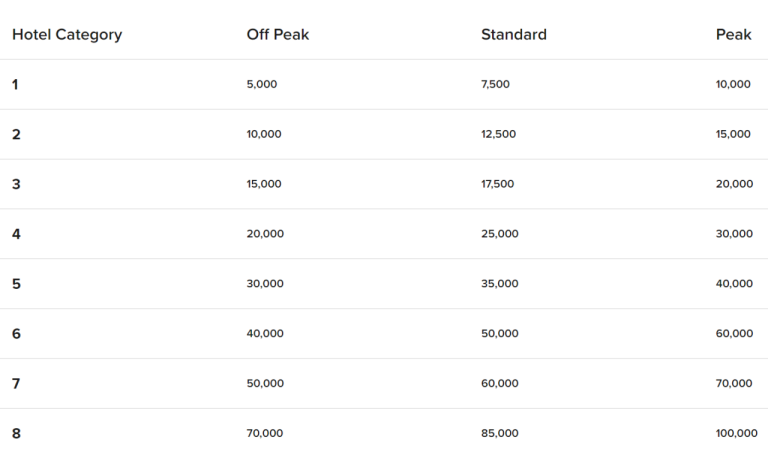

Redeeming Points for Hotel Stays

A significant portion of Marriott Bonvoy points is typically used for hotel stays. The redemption rate varies depending on the hotel’s category and location. A higher-category hotel in a popular destination often requires more points for a comparable stay.

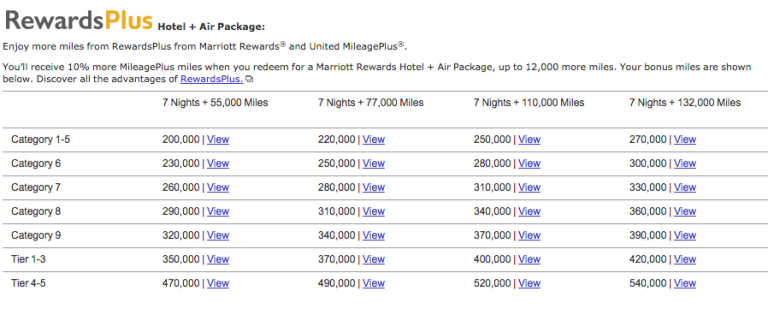

Redeeming Points for Flights

Marriott Bonvoy points can also be redeemed for flights with various airlines. The specific redemption rate will depend on the airline, the flight class, and the availability of award seats.

Redeeming Points for Merchandise

Certain merchandise and experiences can be purchased with Marriott Bonvoy points. This option allows cardholders to exchange their points for goods and experiences that align with their interests.

Redemption Rates

The following table illustrates approximate redemption rates for different reward categories. These are general guidelines, and actual redemption rates may vary based on specific factors.

| Reward Category | Approximate Redemption Rate (Points per USD) |

|---|---|

| Hotel Stays | Varying, typically 3-5 points per USD |

| Flights | Varying, typically 1.5-3 points per USD |

| Merchandise | Varying, based on the value of the merchandise |

Travel and Booking Flexibility

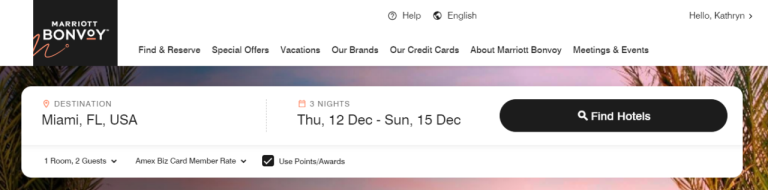

Source: milestomemories.com

The Marriott Bonvoy Amex Business card offers significant flexibility when booking travel and accommodations. This is a key advantage for business travelers who often need to adjust their itineraries or make last-minute changes. The card simplifies the process of booking through the Marriott Bonvoy platform, providing a streamlined experience.

The card streamlines the travel booking process, making it easy to manage various aspects of a trip, from hotel stays to flights. This efficiency is further enhanced by partnerships with various travel providers, extending the range of booking options and maximizing the value of the card.

Booking Through the Marriott Bonvoy Platform

The Marriott Bonvoy platform is integrated with the card, offering a seamless booking experience. Users can easily access and manage their bookings, view available rewards, and redeem points for travel, all within a unified platform. This centralized approach minimizes the need for multiple logins and portals, making the booking process more efficient.

Partnerships and Collaborations

The Marriott Bonvoy Amex Business card often partners with airlines and other travel providers, expanding the scope of bookings. This means you can potentially book flights and accommodations with a wider selection of partners, enhancing your travel options. These partnerships are crucial for maximizing the card’s travel benefits.

Benefits of Booking Flights and Hotels

Booking flights and hotels with the Marriott Bonvoy Amex Business card can yield significant rewards. By utilizing the card’s benefits, you can earn points towards future travel, often at a higher rate than other methods. The ease of booking through the Marriott Bonvoy platform and the potential for exclusive deals and offers are additional advantages.

Table of Travel Booking Options

| Booking Type | Description |

|---|---|

| Marriott Hotels | Direct booking through the Marriott Bonvoy platform. Potential for exclusive offers and early booking discounts. |

| Flights (Airline Partners) | Booking flights with participating airlines through the Marriott Bonvoy platform. Points earned can be redeemed for future flights. |

| Other Accommodations (Partners) | Booking with other participating hotels and accommodations through the Marriott Bonvoy platform. Rewards earned can be applied to future bookings with partner properties. |

Financial Benefits and Fees

The Marriott Bonvoy Amex Business card offers a range of financial benefits alongside its rewards program. Understanding the associated fees and comparing them to other business travel cards is crucial for assessing the overall value proposition. This section delves into the specifics of these financial aspects, including fees, bonus point earning categories, and a comparative analysis.

Financial Benefits Overview

The card provides various financial advantages, including potential for cashback rewards and/or other perks. These perks may include perks like travel insurance, purchase protection, or access to exclusive airport lounges. However, the specific benefits may vary based on the card’s specific features or promotions. For example, certain cards may offer premium airport lounge access or travel insurance as a complimentary benefit.

Annual Fee and Other Charges

The annual fee is a key consideration when evaluating the card. This fee represents the cost of maintaining the card’s membership and associated privileges. Understanding the annual fee and comparing it to the potential rewards and other benefits of the card is vital for making an informed decision. Other charges, such as foreign transaction fees, may also apply. These fees are typically levied on purchases made outside the United States and can significantly impact the overall cost of international transactions.

Comparison to Other Business Travel Cards

A comparative analysis of the Marriott Bonvoy Amex Business card with other business travel cards is essential for a thorough evaluation. This comparison should consider factors such as annual fees, rewards earning rates, and available benefits. For instance, one competitor might offer higher rewards on specific spending categories, while another may have a lower annual fee. Ultimately, the best card will depend on individual spending habits and travel preferences.

Bonus Points Earning Categories

The card offers specific spending categories that qualify for bonus points. Understanding these categories is crucial for maximizing rewards. For example, spending on flights, hotels, and dining can earn bonus points that can translate into significant travel benefits. Specific bonus percentages or multipliers for various spending categories should be clearly articulated.

Breakdown of Fees and Rewards

| Category | Description | Example |

|---|---|---|

| Annual Fee | The yearly cost of maintaining the card. | $95 |

| Foreign Transaction Fee | A fee is charged on purchases made in foreign currencies. | 1-3% |

| Bonus Points on Travel | Earned on qualifying travel purchases. | 1.5x or 2x points on flights and hotels |

| Bonus Points on Dining | Earned on qualifying dining purchases. | 1x or 1.5x points on eligible restaurants |

| Bonus Points on Other Categories | Bonus points on specific merchant categories. | Bonus points on gas purchases or other spending categories. |

Understanding the various spending categories and corresponding bonus rates is crucial for optimizing reward earning.

Customer Service and Support

The Marriott Bonvoy Amex Business Card offers a range of customer service options to ensure a smooth experience for cardholders. Understanding these avenues can be crucial for resolving any issues or inquiries promptly and efficiently.

The cardholder support team is dedicated to providing assistance and resolving any problems you might encounter. Their commitment to prompt and effective resolution is a key element in the overall value proposition of the card.

Customer Service Options, Marriott Bonvoy Amex Business

The Marriott Bonvoy Amex Business Card provides multiple channels for contacting customer service. This allows cardholders to choose the method that best suits their needs and circumstances.

- Phone Support: Direct phone lines provide immediate assistance for complex issues or situations requiring personalized guidance. Contacting support via phone is often the preferred method for troubleshooting problems requiring immediate resolution, such as account issues or changes to existing bookings.

- Online Support Portal: A dedicated online portal offers self-service options, FAQs, and downloadable resources. This is ideal for addressing simple inquiries, such as checking account balances, reviewing transaction history, or understanding the redemption process.

- Email Support: Email correspondence provides a written record of inquiries and solutions, facilitating a more detailed communication process. Email is suitable for inquiries requiring a thorough explanation or for situations where a detailed response is needed.

Issue Resolution Process

A well-defined process for resolving issues is vital. This process helps ensure that all cardholders receive prompt and effective assistance.

The process typically involves these steps:

- Contacting the support team through the preferred channel (phone, online portal, or email).

- Providing necessary information, such as account number, card number, and details of the issue.

- Following the support agent’s instructions to resolve the issue or provide necessary information for further assistance.

- Receiving confirmation and follow-up communication about the resolution.

Contact Methods for Customer Support

Cardholders can reach the support team through various methods. The table below summarizes the contact information.

| Contact Method | Details |

|---|---|

| Phone | 1-800-MARRIOTT (1-800-627-7466) |

| Online Portal | Access through the Marriott Bonvoy Amex Business Card website. |

| marriottbonvoyamexbusiness@marriott.com |

Account Management and Redemption Resources

Numerous resources are available to help with account management and redemption.

These resources include online FAQs, downloadable guides, and detailed instructions on the Marriott Bonvoy website. These resources are specifically designed to provide users with step-by-step procedures for efficiently managing their accounts and redeeming rewards.

Real-World Use Cases: Marriott Bonvoy Amex Business

The Marriott Bonvoy Amex Business card offers significant value for business travelers seeking streamlined travel experiences and tangible financial benefits. This section delves into practical applications of the card, highlighting its utility across diverse business contexts and demonstrating its value proposition.

Understanding the card’s potential requires examining its practical applications within real-world scenarios. This includes scrutinizing how the card facilitates daily operations, enhances booking flexibility, and offers attractive financial incentives, thereby demonstrating its value proposition.

Enhanced Business Travel Management

The card simplifies the complexities of business travel by offering seamless booking options, rewards accumulation, and financial management tools. Business travelers can leverage the card for booking flights, hotels, and rental cars directly through the Marriott Bonvoy platform, ensuring streamlined travel arrangements. This often leads to optimized travel budgets, enabling businesses to maximize their investment in travel.

Rewards and Point Accumulation Strategies

The card’s rewards program allows for the accumulation of points that can be redeemed for future travel. Businesses can establish clear strategies for maximizing point earning potential by carefully analyzing travel patterns and utilizing the card for eligible purchases. This proactive approach ensures that the card’s rewards program effectively translates into significant cost savings.

Financial Benefits for Diverse Businesses

The card’s financial advantages are valuable for various businesses, from small startups to large corporations. Businesses can leverage the card for expense reporting, reducing administrative overhead and improving financial transparency. This efficiency is crucial for maintaining accurate records and complying with accounting standards.

Case Studies of Successful Cardholders

Numerous businesses have experienced tangible benefits from using the Marriott Bonvoy Amex Business card. A software company, for instance, found that the card’s rewards program offset a significant portion of their employee travel costs, leading to increased employee satisfaction and reduced administrative burden. Similarly, a consulting firm utilized the card’s travel booking tools to optimize their team’s travel itineraries, leading to cost savings and increased productivity.

Illustrative Examples of Businesses

| Business Type | Specific Use Case | Benefits Realized |

|---|---|---|

| Consulting Firm | Utilizing the card for travel bookings, improving travel efficiency and productivity | Significant cost savings, streamlined travel itineraries |

| Software Company | Utilizing the card’s rewards program to offset employee travel expenses | Increased employee satisfaction, reduced administrative burden, coand st savings |

| Marketing Agency | Booking flights, hotels, and rental cars using the card’s booking platform | Streamlined travel arrangements, reduced administrative overhead, and optimized travel budgets |

| Start-up Company | Using the card for eligible business purchases and travel | Accumulating rewards, maximizing travel points, cost savings, and building travel history |

Comparison with Competitors

The Marriott Bonvoy Amex Business card stands out in a competitive landscape of business travel credit cards. Understanding its unique features and value proposition relative to other prominent options is crucial for informed decision-making. Direct comparisons with key competitors illuminate the card’s strengths and weaknesses.

Competitive Landscape Overview

The business travel card market offers a wide array of options catering to diverse needs and spending habits. Key competitors often focus on specific travel partners, reward structures, or financial perks. Assessing the value proposition requires a comprehensive understanding of the benefits offered by each card, considering factors such as earning rates, redemption flexibility, and annual fees.

Comparison Table

A comprehensive comparison table highlights the key differentiators between the Marriott Bonvoy Amex Business card and three prominent competitors. This table provides a concise overview, enabling a quick assessment of each card’s features.

| Feature | Marriott Bonvoy Amex Business | American Express Platinum Card | Chase Sapphire Preferred Card | Citi PremierMiles® Card |

|---|---|---|---|---|

| Annual Fee | $0 | $695 | $0 | $95 |

| Marriott Bonvoy Points Earnings Rate | 2x on Marriott Bonvoy stays and dining at restaurants | No dedicated hotel points earning | 1x on travel and dining, 3x on select travel and dining categories | No dedicated hotel points earning |

| Travel Booking Flexibility | An extensive network of Marriott Bonvoy properties | Broad travel partner network, often including luxury hotels | Strong travel portal and partner network | Partnerships with various airlines and hotels |

| Financial Benefits | No significant additional financial benefits beyond the rewards | Primary focus on travel, premium travel benefits, and concierge services | High earning potential, travel insurance, and other perks | Cash back rewards, travel insurance, and other perks |

| Customer Support | Reputable customer service | Reputable customer service | Reputable customer service | Reputable customer service |

Unique Features and Advantages

The Marriott Bonvoy Amex Business card distinguishes itself through its focus on Marriott Bonvoy points, enabling exclusive access to a vast network of hotels and resorts globally. The straightforward earning structure, emphasizing stays and dining, makes it attractive for frequent travelers and hospitality enthusiasts. This card’s strength lies in its specific reward system and travel flexibility tailored to the Marriott Bonvoy ecosystem.

Value Proposition

The value proposition hinges on the individual’s travel habits and spending patterns. If frequent Marriott Bonvoy stays and dining are a significant part of business travel, this card provides a compelling reward structure. Conversely, if broader travel partners or diverse financial benefits are prioritized, other cards might prove more valuable. The card’s worth is directly tied to the frequency of travel within the Marriott Bonvoy network and the appreciation for its specific reward system.

Additional Perks and Benefits

Source: 10xtravel.com

Beyond the core rewards and points earning potential, the Marriott Bonvoy Amex Business card offers a range of valuable perks that can significantly enhance your business travel experience. These supplementary benefits often include exclusive access, streamlined services, and tangible cost savings, all designed to make your business trips more efficient and enjoyable.

Enhanced Business Travel Experience

This card goes beyond basic rewards, offering practical benefits that streamline business travel. These benefits aim to alleviate common pain points, from booking to airport transit, and are tailored to the needs of frequent business travelers. These perks aim to make business travel more convenient and less stressful.

- Priority Pass Membership: This often-included perk provides access to airport lounges, offering a comfortable respite from the airport hustle and allowing for work or relaxation before your flight. This is a highly valued benefit, particularly for long layovers or when connecting flights are involved. Access to lounges with complimentary refreshments and Wi-Fi can significantly improve the overall travel experience.

- Global Entry or TSA PreCheck Membership Credit: This benefit is particularly useful for frequent travelers, saving time at security checkpoints. The expedited security process allows you to spend more time on business or leisure activities during your trip.

- Dedicated Customer Support: A dedicated customer service team ensures prompt assistance for any issues or inquiries. This is crucial for resolving problems quickly and efficiently during a business trip, avoiding disruptions and ensuring smooth travel.

Exclusive Offers and Promotions

The card often offers exclusive deals and promotions on hotels, flights, and other travel-related services. These deals are usually tailored to the cardholder base, offering substantial savings and convenience. These promotions can significantly reduce travel expenses and allow you to maximize your rewards.

- Exclusive Hotel Discounts: Marriott Bonvoy frequently partners with hotels to provide special discounts and upgrades for cardholders. This is a considerable benefit, offering savings on accommodations and potentially securing preferred room types.

- Airline Partnership Deals: Some partnerships with airlines may provide discounted fares, priority boarding, or special baggage allowances. These offers can significantly reduce the cost of flights and improve the overall travel experience.

- Exclusive Access to Events: Specific offers might include early access to exclusive business events or conferences, granting cardholders a competitive edge in their respective industries.

Comprehensive Overview of Associated Benefits

The benefits of the Marriott Bonvoy Amex Business card extend beyond just points and miles. The card is designed to provide a seamless and rewarding business travel experience.

| Benefit | Description |

|---|---|

| Priority Pass Membership | Access to airport lounges. |

| Global Entry/TSA PreCheck Credit | Expedite security checkpoints. |

| Dedicated Customer Support | Prompt assistance for any issues. |

| Exclusive Hotel Discounts | Special discounts and upgrades. |

| Airline Partnership Deals | Discounted fares, priority boarding, etc. |

| Exclusive Access to Events | Early access to business events. |

Wrap-Up

In conclusion, the Marriott Bonvoy Amex Business card presents a compelling proposition for business travelers seeking streamlined travel experiences and valuable rewards. The card’s comprehensive features, from maximizing points earning to booking flexibility, make it a compelling choice for those looking to optimize their business travel. Understanding the financial benefits, customer service, and comparison with competitors allows for a well-informed decision. Ultimately, the card is designed to elevate your business travel experience.