Bonvoy Marriott Amex Your Travel Advantage

Bonvoy Marriott Amex is a travel credit card designed to maximize your rewards and streamline your travel experiences. It offers a compelling array of benefits, from earning points and miles on everyday purchases to simplifying bookings and accessing exclusive perks. Understanding its various tiers, earning structures, and redemption options is key to unlocking its full potential. This analysis dives deep into the card’s features, comparing it to competitors and examining user experiences.

The card’s value proposition extends beyond straightforward points accumulation. This detailed overview explores how it integrates with Marriott Bonvoy, simplifying travel bookings and enhancing rewards programs. Moreover, we’ll examine the financial aspects, including annual fees and potential return on investment, alongside user experiences, pros, and cons.

Overview of the Bonvoy Marriott Amex Card

The Bonvoy Marriott Amex card offers a compelling suite of benefits for Marriott Bonvoy members seeking enhanced travel rewards. It provides a tiered system of perks, structured point earning mechanisms, and flexible redemption options. Understanding these components is crucial for maximizing the card’s value.

Card Benefits Summary

The Bonvoy Marriott Amex card provides a range of benefits designed to enhance the travel experience. These include exclusive access to airport lounges, priority check-in and check-out, and potential for accelerated earning of points. Moreover, the card often comes with complimentary travel protections and insurance options. Different tiers of the card, as discussed further, provide varying levels of these benefits.

Tiered Perks and Associated Privileges

The Bonvoy Marriott Amex card typically offers multiple tiers, each providing a progressively increasing level of benefits. These tiers are usually determined by the annual fee and spending requirements. Higher tiers typically include benefits such as increased earning rates, enhanced lounge access, and priority service options. For example, the Platinum Card might offer access to a wider range of airport lounges compared to the Gold Card.

Point and Mile Earning Structure

The earning structure for the Bonvoy Marriott Amex card is usually based on spending habits. A common model is that spending on eligible Marriott Bonvoy purchases earns points at a predetermined rate. Spending on non-Marriott purchases may offer a lower rate of earning or no earning at all. Points can be accrued at a consistent rate or fluctuate depending on the spending category.

Redemption Options

The card’s points are typically redeemable for travel stays at Marriott hotels and resorts worldwide. However, redemption options often extend to flights and other travel experiences. The specific redemption rates and options are typically determined by the card tier and the availability of the desired reward. For example, a higher-tier card may offer better redemption rates for flights. Furthermore, points can sometimes be transferred to other travel partners for added flexibility.

Comparison to Similar Credit Cards

| Feature | Bonvoy Marriott Amex | Chase Sapphire Preferred | American Express Gold |

|---|---|---|---|

| Annual Fee | Variable (based on tier) | $95 | $250 |

| Welcome Bonus | Variable | $80-$100 | $150-$200 |

| Earning Rate (Travel) | Variable (based on tier and spending) | Typically 3x on travel purchases | Variable |

| Redemption Options | Marriott Bonvoy stays, flights, and experiences | Flights, hotels, travel experiences | Travel and merchandise |

This table provides a basic comparison. It’s important to note that specific benefits and earning rates can vary depending on the specific card offer and the issuer. Annual fees, welcome bonuses, and earning rates should be verified on the issuer’s website.

Cardholder Experiences and Reviews

Cardholders of the Bonvoy Marriott Amex have shared a wide range of experiences regarding rewards, benefits, and customer service. These experiences offer valuable insights into the card’s strengths and weaknesses, providing a more nuanced perspective than marketing materials alone. Understanding these varied perspectives helps potential cardholders make informed decisions.

The feedback highlights a spectrum of opinions, from enthusiastic praise to critical concerns. This analysis dissects these experiences, focusing on rewards redemption, customer service interactions, and any reported pain points. It aims to provide a balanced overview of the card’s performance based on real-world user accounts.

Rewards and Benefits Experiences

Cardholders’ experiences with the Bonvoy Marriott Amex rewards and benefits vary. Some cardholders report significant value from the points earned, particularly for travel and hotel stays. They appreciate the flexibility of using points for a range of Marriott Bonvoy experiences. However, others find the earning rate less attractive compared to other travel credit cards, particularly in specific spending categories.

Pros and Cons of the Card

The following table summarizes common pros and cons reported by cardholders, providing a concise overview of the positive and negative aspects.

| Pros | Cons |

|---|---|

| Significant earning potential for frequent travelers and Marriott Bonvoy members. | The redemption process can be complex and time-consuming for some users. |

| Excellent hotel booking benefits. | Points earning rates might not be competitive with other travel cards in certain spending categories. |

| Attractive perks like elite status and access to exclusive experiences. | Customer service interactions have been reported as sometimes slow or unhelpful by some cardholders. |

| Extensive travel options for redemption. | The value of points can vary depending on the specific redemption. |

Potential Pain Points

Some cardholders have reported issues with the redemption process. Complex redemption options can be challenging to navigate, leading to frustration and potential value loss. Difficulties in understanding the point earning structure or restrictions have also been noted. Mismatched expectations regarding the rewards value compared to the card’s fees are another frequent concern.

Customer Service Experiences

Customer service interactions are another area where feedback varies. Some users praise the helpfulness and responsiveness of customer service representatives, while others report slow response times, a lack of clear communication, or insufficient assistance with resolving issues. Reported issues range from simple inquiries to complex redemption disputes.

Redemption Process and Issues

The redemption process for Marriott Bonvoy points can be complex. Understanding the different redemption options and associated fees is crucial for maximizing the value of earned points. Users have reported challenges in understanding the redemption tiers, varying redemption rates for different services, and complexities in using points for specific activities. Incorrect or delayed point application has also been a concern for some cardholders.

Financial Aspects and Value Proposition

The Bonvoy Marriott Amex card’s value proposition hinges on its ability to deliver a worthwhile return on investment (ROI) for cardholders, balancing the annual fee with potential rewards and benefits. This section delves into the financial considerations, examining the fee justification, potential ROI based on spending habits, comparative value against other travel cards, and strategic maximization techniques.

The card’s strength lies in its ability to reward frequent travelers and those with a high spending propensity in travel-related areas. A comprehensive understanding of the financial aspects allows cardholders to make informed decisions regarding their potential utility.

Annual Fee Justification

The annual fee for the Bonvoy Marriott Amex card is a key consideration for potential cardholders. Its justification rests on the substantial benefits offered, such as elite status, complimentary perks, and bonus points. The value proposition is contingent on the cardholder’s travel frequency and spending patterns. For instance, a frequent business traveler who spends significantly on flights and hotel stays will likely find the fee justified by the potential for accelerated status and associated benefits.

Potential Return on Investment (ROI)

The potential ROI is highly contingent on individual spending patterns. A cardholder who spends heavily on Marriott properties and flights will reap a substantial reward. Consider a scenario where a cardholder spends \$10,000 annually on Marriott stays and flights. Based on the card’s bonus structure, they might accumulate enough points to cover future travel expenses or redeem for significant upgrades. However, a cardholder with a lower spending amount might not achieve the same ROI. The key is to match spending habits with the rewards structure.

Comparison with Other Travel Credit Cards

Comparing the Bonvoy Marriott Amex card with competitors is essential for evaluating its overall value. Factors such as annual fees, rewards programs, and available benefits should be considered. Some cards might offer better bonus categories, while others provide more extensive travel insurance. A comprehensive comparison helps cardholders choose the card that best aligns with their spending habits and travel preferences.

Rewards Structure and Competitor Offers

The Bonvoy Marriott Amex card’s rewards structure, offering points redeemable for Marriott stays and flights, should be compared to competitors’ programs. For instance, some competitors might offer broader redemption options or higher earning rates on specific spending categories. A comparative analysis across different cards is critical in understanding the best value proposition for an individual’s travel spending patterns. A cardholder should meticulously evaluate the details of various programs.

Maximizing Card Value

Strategic approaches can significantly enhance the card’s value. Understanding the redemption process and bonus categories is crucial. For instance, cardholders should consistently track their spending to capitalize on bonus categories and maximize their point accrual. Furthermore, taking advantage of promotional offers and utilizing the travel portal can maximize the value derived from the card.

Travel and Booking Integrations: Bonvoy, Marriott, The Amex

The Bonvoy Marriott Amex card seamlessly integrates with the Marriott Bonvoy program, offering a streamlined approach to booking travel and earning rewards. This integration enhances the overall travel experience by providing exclusive benefits and simplified reward management. The card’s booking features are designed to save time and maximize value for cardholders.

Marriott Bonvoy Program Integration

The Bonvoy Marriott Amex card is deeply integrated with the Marriott Bonvoy program. This allows cardholders to leverage their existing Bonvoy account for managing points, booking hotels, and tracking rewards. This direct connection simplifies the process of accumulating and redeeming points, making it easier to plan and execute travel plans.

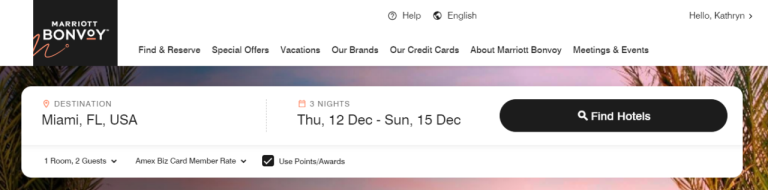

Simplified Booking Process

The card simplifies booking travel and hotel stays by offering a range of options. This includes direct booking through the Marriott Bonvoy website or app, as well as through participating travel agents. The card’s digital features and dedicated support channels provide an enhanced user experience.

Compatible Booking Platforms

| Platform | Description |

|---|---|

| Marriott Bonvoy Website/App | Direct access to Marriott’s extensive portfolio of hotels and resorts. Cardholders can leverage their Bonvoy account for seamless booking and point management. |

| Online Travel Agencies (OTAs) | Participating OTAs often allow for Bonvoy point redemption and booking through the Bonvoy program. Cardholders can benefit from both loyalty program points and potential discounts offered by the OTA. |

| Travel Agents | Partner travel agents can facilitate bookings through the Bonvoy program, often providing personalized service and expertise in navigating complex itineraries. |

Flight Bookings

The Bonvoy Marriott Amex card facilitates flight bookings through partnerships with various airlines. This can help maximize rewards by enabling the use of points or earning bonus points for flight purchases. While not all airlines are directly integrated, many partners exist to utilize the program’s flexibility. Examples include Delta, United, and other airlines participating in the Marriott Bonvoy program.

Earning Points on Travel Activities

Cardholders can earn points on a variety of travel activities using the Bonvoy Marriott Amex card. This includes booking flights and hotels, as well as utilizing the card for everyday expenses like gas, dining, and shopping. The specific earning rates vary based on the activity and the partner merchant. Earning points on eligible purchases is a core component of the card’s value proposition. For example, a purchase made using the card at a participating airline or hotel will contribute to the user’s Bonvoy points balance.

Specific Use Cases and Scenarios

The Bonvoy Marriott Amex card, with its multifaceted benefits, caters to diverse travel preferences and spending habits. Understanding its strengths and limitations across various use cases is crucial for maximizing its value. This section explores the card’s suitability for frequent travelers, business professionals, luxury seekers, and individuals with specific travel styles.

Frequent Travelers

Frequent travelers can leverage the card’s extensive earning potential and loyalty program integration to maximize rewards. The program’s points can be redeemed for flights, hotels, and other travel experiences, making it ideal for those seeking to minimize costs and optimize their travel budgets. The card’s benefits extend beyond earning; it can also offer valuable perks, such as priority airport access, that can significantly enhance the travel experience.

Business Travel and Expense Management

For business travelers, the card’s potential for expense management is a key consideration. The card’s straightforward reporting features and clear transaction categorization can significantly streamline the expense reimbursement process, making it a valuable tool for both travelers and their companies. It offers the opportunity to accumulate points quickly while simultaneously tracking and managing business expenses.

Luxury Travel

The card’s status benefits can open doors to exclusive experiences and amenities, such as premium airport lounges and prioritized check-in. This can translate into a more refined and comfortable travel experience, especially for those seeking luxury accommodations and exclusive services. Moreover, the card’s points can be redeemed for high-end travel experiences, enabling access to premier hotels and exclusive travel packages.

Scenarios Where the Card Might Not Be Optimal

While the Bonvoy Marriott Amex card offers numerous advantages, certain scenarios might not make it the most suitable choice. For example, travelers with limited travel frequency might not fully realize the value proposition of the card. Similarly, travelers prioritizing budget-friendly options might find the card’s rewards less compelling than alternatives offering more immediate cash-back.

Benefits and Limitations for Specific Travel Styles

The card’s value proposition is highly dependent on individual travel styles. For example, those with a preference for budget-friendly accommodations and transportation might find the card’s value proposition less appealing than cards emphasizing cash-back or discounts. Conversely, luxury travelers might find the card’s status benefits and access to exclusive experiences to be highly valuable. A traveler who prioritizes frequent stays at Marriott properties and business travelers who travel extensively would find the Bonvoy Marriott Amex card to be particularly advantageous.

Alternatives and Comparisons

Choosing the right travel credit card depends on individual needs and priorities. This section examines alternative travel cards, focusing on those that offer similar benefits to the Bonvoy Marriott Amex, and highlighting cards designed for specific travel preferences. Understanding the strengths and weaknesses of various options empowers informed decisions.

Alternative Hotel-Focused Cards

Several cards prioritize hotel stays, offering valuable perks for frequent travelers. The Bonvoy Marriott Amex card excels in its Marriott Bonvoy benefits, but other options might provide better value depending on your travel patterns and hotel preferences. Consider cards linked to specific hotel chains or those with broader travel rewards programs.

- IHG Rewards Premier Credit Card: This card offers substantial benefits for IHG Rewards Club members, including bonus points on stays and other IHG properties. Its value proposition centers around frequent IHG hotel stays.

- Hilton Honors American Express Card: A strong contender for Hilton Honors members, this card rewards Hilton stays and provides valuable benefits for frequent Hilton guests. Points earned can be redeemed for stays or other Hilton offerings.

- World of Hyatt Credit Card: Ideal for Hyatt loyalists, this card provides exclusive benefits for Hyatt stays. It allows for maximizing rewards for travelers prioritizing Hyatt hotels.

Comparison of Key Features

A comprehensive comparison aids in evaluating various cards. The table below highlights key features and benefits of several alternative cards, providing a quick overview.

| Card | Hotel Chain Focus | Annual Fee | Welcome Bonus | Points Earnings Rate | Redemption Flexibility |

|---|---|---|---|---|---|

| Bonvoy Marriott Amex | Marriott Bonvoy | $95 | Up to 100,000 bonus points | Varying based on spending | Wide range of redemption options |

| IHG Rewards Premier Credit Card | IHG Rewards Club | $0 | Up to 60,000 bonus points | Varying based on spending | Wide range of redemption options |

| Hilton Honors American Express Card | Hilton Honors | $0 | Up to 60,000 bonus points | Varying based on spending | Wide range of redemption options |

| World of Hyatt Credit Card | Hyatt | $0 | Up to 60,000 bonus points | Varying based on spending | Wide range of redemption options |

Cards Targeting Specific Needs

Certain cards cater to specific travel needs or preferences, such as budget travelers or those prioritizing flexibility. These cards offer different benefits to address individual requirements.

- Cards with flexible redemption options: These cards often allow points to be redeemed for various travel purchases, providing flexibility for diverse travel styles.

- Cards with no annual fee: These cards offer an attractive option for budget-conscious travelers who still desire travel rewards.

- Cards with high bonus points: These cards offer substantial rewards for new cardholders and can be beneficial for those planning significant travel expenses.

Pros and Cons of Similar Cards

A balanced perspective on each card is essential. While the Bonvoy Marriott Amex offers a strong Marriott Bonvoy focus, other cards may excel in different areas.

Understanding the specific benefits and drawbacks of each card is crucial for choosing the optimal option.

Cardholder Profiles and Target Audience

The Bonvoy Marriott Amex card targets a specific segment of travelers seeking enhanced rewards and benefits within the Marriott Bonvoy program. This segment values the seamless integration of travel planning and booking with their rewards accumulation and redemption. Understanding the cardholder profile and motivations is crucial for effective marketing and product development.

Typical Cardholder Profile

The typical Bonvoy Marriott Amex cardholder is a frequent traveler who values luxury and convenience. They are likely to be relatively affluent, with a demonstrated spending history that aligns with the rewards and benefits offered. Their travel habits often include both leisure and business trips, with a preference for Marriott hotels and the Bonvoy program’s flexibility. They prioritize seamless travel experiences and value the potential for significant rewards accumulation.

Motivations for Choosing the Card

Cardholders are drawn to the Bonvoy Marriott Amex card for several reasons, including the ability to earn substantial points on Marriott stays, flights, and other purchases. The flexibility of using these points for various travel experiences, like hotel stays, flights, or even merchandise, is a key motivator. Furthermore, the potential for earning elite status within the Bonvoy program, with its associated perks, is another compelling incentive.

Categorization of Cardholders by Travel Frequency and Spending Habits

| Category | Travel Frequency | Spending Habits | Profile Characteristics |

|---|---|---|---|

| Frequent Traveler (Gold) | More than 10 nights per year at Marriott properties | High spending on travel and related expenses. | Highly engaged in travel planning, booking, and reward redemption. |

| Occasional Traveler (Silver) | 2-5 nights per year at Marriott properties | Moderate spending on travel and related expenses. | Value convenience and reward programs, looking for value in rewards and perks. |

| Aspiring Traveler (Bronze) | Less than 2 nights per year at Marriott properties | Lower spending on travel, but interested in exploring travel rewards. | Drawn to the potential for travel rewards and the ease of booking. |

Demographic Trends

Data suggests a growing trend among millennials and Gen Z travelers toward prioritizing experiences over material possessions. This demographic is increasingly interested in travel rewards programs that offer flexibility and personalized experiences. The Bonvoy Marriott Amex card’s alignment with these values contributes to its appeal among this cohort. Additionally, a notable increase in the use of mobile-based travel planning and booking platforms is observed, which underscores the card’s emphasis on digital convenience.

Target Audience Needs

The target audience for the Bonvoy Marriott Amex card comprises individuals who value convenience, flexibility, and personalized travel experiences. They seek a reward program that allows for strategic point accumulation and redemption for maximum value. Furthermore, the target audience desires a platform that seamlessly integrates with their existing travel plans and preferences.

Future Trends and Potential Enhancements

Source: businesstraveller.com

The Bonvoy Marriott Amex card’s future success hinges on its ability to adapt to evolving travel preferences and rewards program dynamics. Predicting precise changes is challenging, but examining current trends offers valuable insights into potential enhancements and adaptations. The card could leverage emerging technologies and user expectations to maintain its competitive edge.

Potential Updates to Rewards Structure

The card’s rewards program could incorporate more dynamic elements. For example, tiered reward levels could be tied to spending habits, allowing for higher earning rates on specific categories or destinations based on frequent use. Further, offering more flexible redemption options, such as direct booking credits or discounted experiences, would enhance the card’s appeal. Furthermore, dynamic pricing for rewards could be implemented, adjusting the value based on demand and seasonal factors.

Innovations in Travel Booking and Integrations

Travel booking integrations are a key area for potential improvements. The card could enhance its existing integrations by allowing users to book flights or other travel services directly through the card’s platform. Moreover, incorporating real-time price tracking and alerts based on the user’s preferred travel dates and destinations could be valuable.

Emerging Trends in Travel and Their Adaptation, Bonvoy, Marriott, Amex

The rise of sustainable and experiential travel is significant. The card could introduce partnerships with eco-conscious hotels and tour operators, offering exclusive discounts or experiences for environmentally responsible travel choices. Further, incorporating options for unique and immersive experiences, such as cultural tours or local cooking classes, would cater to the evolving travel desires of cardholders.

Examples of Innovative Features

The card could integrate with other travel-related apps or services, offering seamless booking and itinerary management. Furthermore, a feature allowing cardholders to earn rewards for using sustainable travel options, such as public transportation or electric vehicle rentals, would appeal to environmentally conscious consumers. Additionally, offering personalized recommendations based on travel history and preferences could enhance the overall user experience.

Future Changes in Value Proposition

The card’s value proposition could be strengthened by offering exclusive benefits, such as priority boarding, lounge access, or early bird booking opportunities, for Marriott Bonvoy members. Furthermore, partnerships with other travel companies or brands could provide broader travel options and rewards. In addition, an increase in the value of points or miles earned for each dollar spent could potentially enhance the card’s overall value.

Last Point

Source: businessinsider. in

In conclusion, the Bonvoy Marriott Amex card presents a compelling travel credit card option. Its integration with Marriott Bonvoy, diverse redemption options, and potential for maximizing value through strategic spending make it a worthwhile consideration for frequent travelers and those seeking a premium travel experience. While the annual fee is a factor, the potential return on investment and associated benefits may outweigh this cost for many users. Ultimately, understanding the card’s strengths and weaknesses, as well as alternative options, is crucial for making an informed decision.