Amex Bonvoy Business Your Business Travel Hub

Amex Bonvoy Business sets the stage for a comprehensive exploration of its benefits and features. This program offers a nuanced approach to business travel, rewards, and expense management, making it a compelling choice for various business needs.

The Amex Bonvoy Business card program provides a wide array of perks, from travel benefits and rewards to tools for managing business expenses. This detailed overview will cover the program’s key features, comparing it to alternatives, and highlighting the membership levels, earning structure, and redemption options. It also discusses the practical application of the card, the steps involved in applying, and customer service support.

Overview of Amex Bonvoy Business

The Amex Bonvoy Business card program is designed to offer comprehensive rewards and benefits tailored to the needs of business travelers and entrepreneurs. It provides a platform for accumulating points that can be redeemed for various travel experiences, merchandise, and other perks. This program offers a flexible and robust structure that can cater to the diverse travel requirements of businesses and professionals.

The program’s core philosophy revolves around offering substantial value for business spending. It leverages a sophisticated points system to incentivize business transactions, encouraging the use of the card for various business-related activities. Amex Bonvoy Business aims to simplify the complexities of business travel and rewards, creating a more rewarding experience for cardholders.

Key Benefits and Features

The Amex Bonvoy Business card program boasts a wide array of benefits. These include access to exclusive airport lounges, enhanced travel insurance, and flexible redemption options. Furthermore, the program often features special offers and promotions for cardholders, making it a valuable tool for both business travelers and entrepreneurs.

- Enhanced Travel Experiences: The program often includes access to exclusive airport lounges, premium seating, and priority boarding, allowing for a more comfortable and efficient travel experience.

- Comprehensive Travel Insurance: Many Amex Bonvoy Business cards include travel insurance coverage that protects cardholders against unforeseen circumstances, such as trip cancellations or medical emergencies.

- Flexible Redemption Options: Points earned can be redeemed for various travel-related expenses, including flights, hotels, and rental cars. Redemption options also extend to merchandise, allowing for a wider range of choices.

Comparison with Other Business Credit Cards

Compared to other business credit cards in the market, Amex Bonvoy Business stands out for its comprehensive rewards structure and extensive travel benefits. While other cards may offer specific benefits, Amex Bonvoy Business often provides a broader range of choices and redemption options. This flexibility and depth of rewards distinguish it from competitors.

- Comprehensive Rewards: Amex Bonvoy Business often outperforms other business credit cards in terms of reward points and flexibility in redemption options.

- Travel-focused Benefits: Unlike some cards that emphasize cash back or other specific benefits, Amex Bonvoy Business directly caters to travel needs, with a focus on points-based rewards that can be exchanged for various travel-related expenses.

Membership Levels and Tiers

Amex Bonvoy Business card programs typically do not have clearly defined membership levels or tiers. Instead, benefits and reward structures vary based on the specific card chosen. Different cards offer varying reward rates and annual fees. The card selection process should consider individual needs and spending habits.

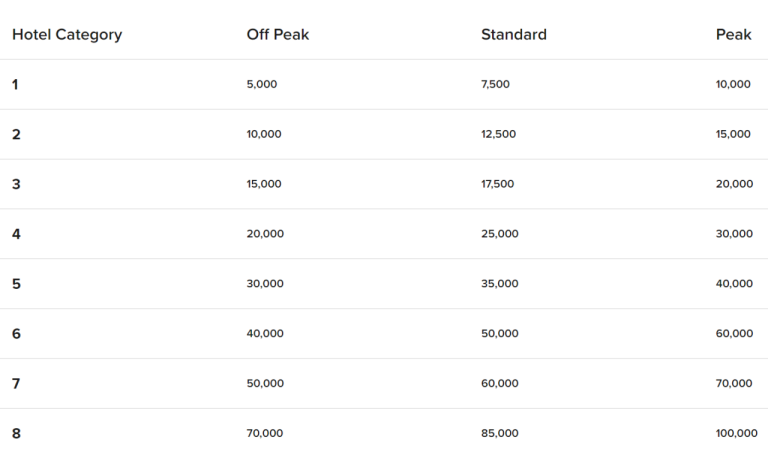

Earning Structure and Redemption Options

The earning structure for Amex Bonvoy Business cards is typically tied to spending amounts. Higher spending usually translates to increased rewards and more points. Redemption options are diverse, allowing cardholders to exchange points for flights, hotels, and other travel-related expenses.

Amex Bonvoy Business Card Options

The following table Artikels some potential Amex Bonvoy Business card options, highlighting key features. Note that specific features and rates can vary, and it’s essential to check the most current details from the official Amex website.

| Card Name | Annual Fee | Rewards Rate | Key Benefits |

|---|---|---|---|

| Amex Bonvoy Business Gold | $95-$195 | 1.5x-2x points on eligible purchases | Airport lounge access, enhanced travel insurance, and priority boarding |

| Amex Bonvoy Business Platinum | $250-$450 | 2x-3x points on eligible purchases | Exclusive airport lounge access, premium travel insurance, and concierge services |

| Amex Bonvoy Business Preferred | $0 | 1x points on eligible purchases | Basic travel rewards, no annual fee |

Travel and Rewards Programs

The Amex Bonvoy Business program offers a comprehensive suite of travel benefits designed to enhance business trips. These benefits, combined with rewards redemption options, provide significant value for frequent business travelers. By integrating seamlessly with travel arrangements, the program aims to optimize both the experience and the financial aspects of business journeys.

Integration with Travel

The Amex Bonvoy Business program integrates with various travel aspects. It provides a unified platform for managing travel bookings, earning rewards, and redeeming points for various travel experiences. This seamless integration simplifies the process of booking flights, hotels, and rental cars, often through dedicated travel partners.

Travel Benefits

The program offers a range of travel benefits to enhance the business travel experience. These benefits are designed to provide tangible value for frequent travelers.

- Airport Lounge Access: Many programs offer access to a network of airport lounges, allowing travelers to relax and work in comfortable environments before or during flights.

- Travel Insurance: Certain levels of membership include travel insurance coverage for unexpected events, providing peace of mind during business trips.

- Booking Assistance: Dedicated travel support often assists with booking flights, hotels, and other travel arrangements.

- Priority Service: Some programs provide priority service for check-in, baggage handling, and other airport processes.

Reward Redemption Options

Amex Bonvoy Business offers flexible redemption options for earned rewards. These options allow travelers to tailor their redemption choices to their specific needs and preferences.

- Points for Flights: Earned points can be redeemed for flights on various airlines, often at competitive rates compared to direct booking.

- Points for Hotels: Redemption options extend to hotels worldwide, offering flexibility in accommodation choices.

- Points for Car Rentals: Points can be redeemed for rental cars, providing convenient transportation during business trips.

- Points for Experiences: Some programs allow the redemption of points for curated experiences, offering a unique element beyond traditional travel.

Types of Travel Experiences Covered

The rewards program covers a wide spectrum of travel experiences, catering to diverse business needs.

- Flights: Domestic and international flights are typically covered, providing options for various destinations.

- Hotels: A broad selection of hotels worldwide is available for redemption, ranging from budget-friendly options to luxury accommodations.

- Rental Cars: Car rentals at various locations are often included in the program, facilitating convenient transportation for business travelers.

- Tours and Activities: Some programs allow the redemption of points for tours and activities, offering a richer travel experience beyond standard accommodations.

Comparison with Other Business Travel Programs

Comparing Amex Bonvoy Business with other business travel programs reveals varying levels of benefits and redemption options. While specifics vary, Amex Bonvoy often provides a robust range of travel perks.

- Loyalty Programs: Some programs offer points accumulation and redemption options for various travel components, including flights, hotels, and car rentals.

- Airline Partnerships: The strength of airline partnerships significantly impacts the available flight redemption options.

- Hotel Affiliations: The breadth and quality of hotel affiliations are key factors to consider when evaluating different business travel programs.

Rewards Redemption Table

The following table lists various redemption options and their associated conditions:

| Reward Category | Redemption Conditions |

|---|---|

| Flights | Points required vary based on flight distance, class, and airline; availability may be affected by demand. |

| Hotels | Points required depend on the hotel’s category and location; availability may be restricted. |

| Car Rentals | Points required differ by rental duration and vehicle type; availability may be limited. |

| Experiences | Points required and available experiences vary; specific terms and conditions apply. |

Business Spending and Expense Management

The Amex Bonvoy Business card streamlines business spending, offering tools for efficient expense tracking and reporting. This simplifies the often-complex process of managing business finances, allowing business owners and employees to focus on core operations. By consolidating transactions and providing comprehensive reporting, the card significantly reduces administrative burdens.

The Amex Bonvoy Business card is designed to simplify business spending, providing features that streamline expense management. This allows for a more efficient use of time and resources, which are crucial in any business environment. The card’s features are designed to match the needs of various business types and sizes, from small startups to large corporations.

Expense Tracking and Reporting Features

The card’s robust expense tracking and reporting features are a significant advantage. These features empower businesses to manage their finances effectively, ensuring accurate records and streamlined accounting processes. By automating much of the expense tracking process, the card reduces the risk of errors and ensures compliance with financial regulations.

Amex Bonvoy Business provides a detailed transaction history, allowing for easy identification of expenses. This helps in maintaining accurate records of business-related expenditures. The card also allows for categorization of expenses, simplifying the reporting process. This can be further enhanced with features such as automatic categorization, which can be very helpful for companies with many transactions.

Advantages of Using the Card for Business Transactions

Using the Amex Bonvoy Business card for business transactions offers several advantages. These advantages extend beyond simply accumulating rewards, impacting the efficiency and profitability of businesses. The card can significantly simplify accounting and reporting procedures, saving time and resources. The card’s features promote transparency and accountability, which are essential for maintaining good financial health.

One key advantage is the ability to track and categorize expenses automatically. This reduces manual effort and the potential for human error. Furthermore, the card often comes with robust reporting tools, allowing businesses to generate detailed financial reports for analysis and decision-making. This analysis can lead to a better understanding of business spending patterns and optimizing business strategies.

Options for Managing Business Expenses

The Amex Bonvoy Business card provides various options for managing business expenses. These options are tailored to accommodate the diverse needs of different businesses. The features cater to a wide range of business types, from solopreneurs to established enterprises. This ensures a seamless and efficient experience for all users.

Amex Bonvoy Business cards often offer features such as mobile expense tracking apps and online portals. These tools allow for real-time expense tracking, detailed reports, and secure data management. Some cards also provide integration with accounting software, which can further simplify expense reconciliation and reporting. These features facilitate quick access to financial information and streamline the reporting process.

Business Expense Categories and Rewards

This table displays the diverse expense categories covered by the Amex Bonvoy Business card, along with the associated rewards.

| Expense Category | Reward Details |

|---|---|

| Travel (Flights, Hotels, Car Rentals) | Earn points based on spending amount, often with bonus points for specific bookings. |

| Dining | Points earned on eligible restaurant purchases, potentially with bonus points on certain days or times. |

| Gas | Points earned on eligible gas station purchases. |

| Office Supplies | Points earned on eligible office supply purchases. |

| Marketing and Advertising | Points earned on eligible marketing and advertising expenses. |

| Software and Subscriptions | Points earned on eligible software and subscription purchases. |

| Entertainment | Points earned on eligible entertainment expenses. |

The rewards structure and specific categories might vary based on the particular Amex Bonvoy Business card offered. It’s recommended to review the card’s terms and conditions for the most up-to-date information.

Membership and Enrollment Process

Gaining access to the Amex Bonvoy Business benefits begins with a straightforward application process. Understanding the requirements and the approval process empowers you to confidently navigate this step. This section details the crucial steps, prerequisites, and considerations associated with securing an Amex Bonvoy Business card.

Application Process Overview

The application for an Amex Bonvoy Business card typically involves submitting an online application. Amex often utilizes a secure online portal, allowing you to furnish the necessary information. This process is designed to be efficient and user-friendly. The application collects pertinent details about the applicant, including business information, financial history, and personal details.

Eligibility Requirements

Amex Bonvoy Business card eligibility often hinges on specific criteria. Applicants typically need to demonstrate a certain level of business activity and financial stability. These factors may include, but are not limited to, the applicant’s business revenue, credit history, and business structure. For example, sole proprietorships, partnerships, or corporations may have different eligibility requirements.

Approval Process and Factors

Amex’s approval process evaluates applicants based on a combination of factors. The application thoroughly scrutinizes the applicant’s financial history, including creditworthiness and payment habits. The applicant’s business history, such as revenue, length of operation, and financial stability, also heavily influences the approval decision. The applicant’s personal credit history also plays a significant role in the approval process.

Cardholder Responsibilities

Cardholders assume certain responsibilities once approved for an Amex Bonvoy Business card. These responsibilities include adhering to the terms and conditions Artikeld in the cardholder agreement. Maintaining accurate business records and timely reporting are crucial to ensuring the smooth operation of the account. Properly managing expenses and adhering to spending limits in the agreement are vital responsibilities.

Terms and Conditions

The Amex Bonvoy Business program operates under a comprehensive set of terms and conditions. These conditions govern the cardholder’s rights, responsibilities, and privileges. Cardholders must carefully review and understand these terms and conditions to avoid any unforeseen issues. Reviewing the fine print and the associated fees is crucial for effective management.

Application Process and Required Documents

Understanding the application process and required documents is key to a seamless application. The following table provides a summary of the process and the necessary documents.

| Step | Description | Required Documents |

|---|---|---|

| 1. Application Initiation | Initiate the application process online via Amex’s secure portal. | No specific documents needed at this stage, but general business information will be required. |

| 2. Information Provision | Provide accurate details about the applicant and their business. | Business license, tax identification number (TIN), and financial statements (depending on the card type and the specific business structure). |

| 3. Document Submission | Submit the required supporting documents to support the application. | Proof of business operation, bank statements, and personal financial documents, if required. |

| 4. Approval or Denial | Amex reviews the application and issues a decision. | None; this is an internal review process. |

Customer Service and Support

Amex Bonvoy Business cardholders benefit from a range of support options designed to address their needs efficiently. Whether it’s a question about rewards, managing expenses, or resolving a problem, the available channels and resources provide comprehensive assistance.

Support Channels

Amex Bonvoy Business provides multiple avenues for contacting customer service, ensuring accessibility and convenience for cardholders. These channels cater to various preferences and situations, from quick inquiries to more complex issues.

Amex prioritizes providing effective and timely support to maintain customer satisfaction.

- Phone Support: A dedicated phone line offers direct interaction with a customer service representative. This is ideal for complex issues requiring immediate clarification or assistance with specific transactions. Amex’s phone support is typically available during standard business hours, providing prompt access to expert assistance.

- Email Support: Email allows cardholders to submit inquiries and requests, providing a written record for reference. This is often the preferred method for straightforward questions or for submitting documents, and it facilitates communication when an immediate response is not crucial.

- Online Chat: An online chat feature provides immediate text-based communication. This is suitable for simple questions and quick solutions, and is typically available during specific hours, ensuring prompt responses for cardholders.

Response Times and Resolution Procedures

Amex strives to provide efficient resolution times for customer inquiries and concerns. Typical response times vary based on the nature of the issue and the chosen support channel. For example, simple inquiries through online chat may be resolved within minutes, while more complex issues involving expense reports or disputes might take a few business days.

Amex follows a standardized resolution procedure to ensure every case is addressed effectively.

- Resolution Procedures: Amex employs a multi-step process to resolve issues. This often involves verifying details, gathering necessary information, and providing appropriate solutions. The specific steps may vary depending on the nature of the issue.

Dispute Resolution

Amex has established clear procedures for resolving disputes and complaints. Cardholders should refer to the cardholder agreement for detailed information on dispute resolution processes. Amex’s dedicated dispute resolution team reviews each case meticulously to ensure fairness and compliance with regulations.

Amex emphasizes fair and impartial dispute resolution to address customer concerns effectively.

- Dispute Resolution Resources: Cardholders can find resources and contact information for dispute resolution on the Amex Bonvoy Business website. This typically includes FAQs, contact forms, and links to relevant policies.

Customer Service Examples

Amex Bonvoy Business cardholders often report positive experiences with customer service. These experiences include efficient resolution of billing discrepancies, prompt assistance with expense reports, and clear explanations regarding rewards programs.

- Example 1: A cardholder experienced a problem with a recent expense report. By utilizing the online chat feature, they received prompt assistance from a customer service representative who guided them through the resolution process, ensuring the report was corrected quickly and efficiently.

- Example 2: A cardholder had a question regarding the Bonvoy Business program’s redemption process. Through email, the cardholder received a detailed response outlining the applicable rules and procedures, along with useful links to relevant FAQs. This enabled the cardholder to understand the redemption process easily.

Potential Risks and Considerations

Source: 10xtravel.com

While the Amex Bonvoy Business card offers valuable rewards and benefits, understanding potential drawbacks and proactively managing expenses is crucial for maximizing its value and avoiding pitfalls. Careful consideration of the terms and conditions, including fees and interest rates, is essential for responsible use.

Responsible financial management is paramount when utilizing any credit card, especially one with potentially high rewards. Understanding the associated risks and employing effective mitigation strategies is key to a positive experience.

Potential Drawbacks of the Amex Bonvoy Business Card

The Amex Bonvoy Business card, like any credit card, comes with potential drawbacks. Uncontrolled spending habits can lead to accumulating debt, exceeding available credit limits, and accruing interest charges. Lack of proper expense tracking and management can obscure the true value of the card’s rewards.

Pitfalls to Avoid When Using the Card

To avoid potential pitfalls, diligently track all business expenses, categorize them appropriately, and maintain accurate records. Regularly review your spending and ensure adherence to company policies for expense reimbursements. This practice prevents misclassifications and potential issues with reimbursement procedures.

Importance of Responsible Spending and Expense Management

Responsible spending and expense management are paramount when using the Amex Bonvoy Business card. Understanding the card’s terms and conditions, including any potential fees or interest rates, is crucial. This knowledge empowers informed decisions and allows for proactive management of financial obligations. Failing to monitor spending habits and manage expenses carefully can lead to unexpected financial burdens.

Terms and Conditions of the Card

The terms and conditions of the Amex Bonvoy Business card article the specific fees, interest rates, and reward program rules. These terms are critical to understanding the financial implications of using the card. Carefully reviewing the fine print, especially the section detailing potential interest rates, is essential.

Examples of Mitigating Risks

Implementing a budget and adhering to it is a key mitigation strategy. Utilize expense tracking software to monitor spending and categorize transactions. Establishing a system for expense reports and reimbursements, aligning with company policies, helps avoid potential issues. Maintaining a good credit history is also vital for securing favorable credit terms in the future.

Table of Potential Risks and Mitigation Strategies

| Potential Risk | Recommended Mitigation Strategy |

|---|---|

| Uncontrolled spending leading to debt accumulation | Establish a budget and stick to it. Track expenses meticulously and categorize transactions. |

| Exceeding credit limits | Monitor credit card balances regularly. Set spending limits and avoid exceeding them. |

| Accruing high-interest charges | Pay your credit card balance in full each month to avoid interest charges. |

| Difficulty tracking and managing expenses | Utilize expense tracking software or a dedicated system to organize and categorize business expenses. |

| Misclassifications in expense reports | Maintain meticulous records of business expenses. Ensure proper categorization and adherence to company expense reimbursement policies. |

| Failure to meet spending requirements for rewards | Understand the specific spending requirements for achieving rewards and ensure expenses are appropriately categorized to qualify. |

Amex Bonvoy Business Card Alternatives

Exploring alternatives to the Amex Bonvoy Business card allows businesses to find the optimal solution, aligning with their specific spending patterns and reward priorities. Understanding the strengths and weaknesses of competing options can help businesses make informed decisions about their financial strategy.

Alternative Cards to Consider

Various credit cards offer attractive features for business travelers and spenders. A thorough evaluation of these options can lead to a more suitable solution than the Amex Bonvoy Business card. Understanding the nuances of each alternative’s benefits and drawbacks is essential.

- Chase Ink Business Preferred: This card excels in its generous travel rewards, particularly for frequent business travelers. It provides a strong value proposition with its high earning rates on travel and business spending. However, the sign-up bonus may not always be as compelling as some competitors.

- Capital One Venture X: Known for its substantial travel rewards, the Venture X offers a robust selection of bonus categories and a strong emphasis on travel perks. Its rewards program is flexible, enabling various travel arrangements. However, it might not be the most suitable option for businesses with substantial spending in non-travel categories.

- American Express Gold Business Card: While not exclusively a travel card, the Amex Gold Business Card offers substantial rewards on dining, streaming, and other categories. It provides valuable perks for business expenses outside of travel. However, its travel rewards may not match the comprehensive offerings of dedicated travel cards.

- Discover it Business Cash Back: A strong choice for businesses prioritizing cash back rewards, the Discover it Business Cash Back card provides a straightforward approach to accumulating rewards. Its flexibility to earn on various spending categories makes it appealing. However, the rewards structure might not be as attractive for businesses focused heavily on travel or other specific expense categories.

Key Feature Comparison

Evaluating the key features of each card is crucial for choosing the most appropriate alternative. This analysis aids in selecting the card that best aligns with individual business needs.

| Card | Travel Rewards | Cash Back/Points | Business Spending Categories | Perks/Benefits | Strengths | Weaknesses |

|---|---|---|---|---|---|---|

| Amex Bonvoy Business | Excellent | Good | Broad | Airport lounge access, travel insurance | Strong travel focus, comprehensive benefits | Potentially higher annual fee |

| Chase Ink Business Preferred | Excellent | Good | Broad | Travel credits, concierge services | High earning rates on travel, robust benefits | Sign-up bonus variability |

| Capital One Venture X | Excellent | Good | Broad | Travel credits, bonus categories | Strong travel rewards, flexible program | Might not be optimal for non-travel spending |

| American Express Gold Business Card | Good | Excellent | Specific (dining, streaming) | Dining credits, other category benefits | Attractive rewards in specific categories | Travel rewards are less comprehensive |

| Discover it Business Cash Back | Limited | Excellent | Broad | No specific perks | Straightforward cash back rewards | Less emphasis on travel benefits |

Factors to Consider When Choosing

Several factors influence the optimal choice of an alternative card. These factors ensure that the selected card effectively addresses business needs.

- Business Travel Frequency: Frequent business travelers might prioritize cards with robust travel reward programs.

- Spending Patterns: Businesses with specific spending categories should select cards aligned with those categories.

- Desired Rewards: Understanding the preferred rewards structure is crucial in selecting the optimal card.

- Annual Fees: Annual fees should be considered alongside the rewards value to avoid unnecessary costs.

Suitability for Different Business Needs, Amex Bonvoy Business

The suitability of each card varies depending on the nature of the business. This section provides insight into how different card alternatives can support specific business requirements.

- Consulting Firms: Cards offering robust travel and business spending benefits would be beneficial.

- E-commerce Businesses: Cards offering cash back or points on online purchases would be relevant.

- Hospitality Companies: Cards with perks aligned with the industry would be appropriate.

Final Wrap-Up: Amex Bonvoy Business

In conclusion, the Amex Bonvoy Business card presents a compelling option for businesses seeking a streamlined travel and expense management solution. The program’s diverse benefits, from travel rewards to expense tracking, cater to various business needs. However, understanding the potential risks and exploring alternatives is crucial for making an informed decision. This guide offers a comprehensive overview, equipping you with the knowledge to decide if this program is the right fit for your business.