Amex Marriott Business Your Travel Advantage

Amex Marriott Business unlocks a world of travel possibilities for your business. This card offers a comprehensive suite of benefits, tailored to the needs of frequent business travelers. From earning valuable Marriott Bonvoy points to optimizing your travel budgets, the Amex Marriott Business card streamlines your corporate travel experience.

This overview delves into the specifics of this card, exploring its rewards, benefits, and features. We’ll examine its value proposition, highlighting how it compares to other business travel cards and showcasing real-world use cases for both individuals and companies.

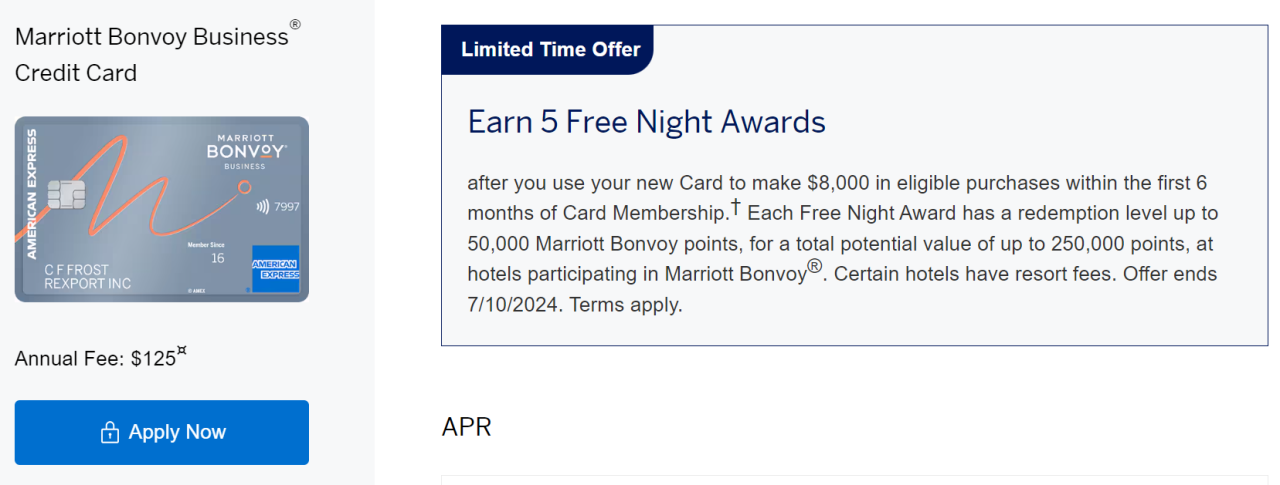

Overview of the Amex Marriott Bonvoy Business Card

Source: doctorofcredit.com

The Amex Marriott Bonvoy Business card offers substantial benefits for business travelers, streamlining expenses and maximizing rewards. It’s designed to cater to the specific needs of professionals frequently on the road, providing a powerful combination of travel perks and valuable rewards programs.

The card leverages the extensive network of Marriott hotels worldwide, offering access to a wide range of accommodations, alongside the flexibility of a credit card for managing business expenses. This comprehensive approach makes it a compelling choice for frequent business travelers seeking a streamlined travel experience.

Key Benefits for Business Travelers

This card’s advantages are geared toward maximizing value for business trips. Benefits include earning points towards free nights at Marriott hotels and other valuable rewards, which can be redeemed for flights and other travel needs. This offers significant savings and convenience.

- Earning Points: Earn points on every dollar spent on eligible business expenses, such as flights, hotels, and rental cars. These points are redeemable for stays at Marriott hotels and other travel-related items.

- Priority Access: Enjoy expedited check-in and check-out at participating Marriott hotels. This can be especially valuable for frequent travelers.

- Exclusive Amenities: Access to exclusive amenities at participating Marriott hotels, like complimentary breakfast or lounge access, adds further value to the card.

- Travel Protection: Various travel insurance options are offered, covering trip cancellations, medical emergencies, and lost baggage.

Relationship Between Amex and Marriott

The partnership between American Express and Marriott is a strategic alliance, creating a mutually beneficial relationship. Amex provides the credit card platform and customer base, while Marriott offers the hotel network and loyalty program. This symbiotic relationship allows for the creation of a valuable product for business travelers. This collaboration results in a robust rewards program that encourages spending and repeat business.

Comparison to Other Business Travel Cards

The Amex Marriott Bonvoy Business card is competitive in the business travel card market. It stands out by combining the broad network of Marriott hotels with the flexibility of a credit card for business spending. While other cards might offer similar travel perks, the Marriott brand and its expansive hotel network remain a key differentiator.

| Benefit | Description | Eligibility Criteria |

|---|---|---|

| Earn Points | Earn points on eligible business expenses, like flights, hotels, and rental cars. | Must meet spending requirements for the card type. |

| Priority Access | Expedite check-in and check-out at participating Marriott hotels. | The cardholder must be a registered member of the Marriott Bonvoy program. |

| Exclusive Amenities | Access to exclusive amenities at participating Marriott hotels. | The cardholder must be a registered member of the Marriott Bonvoy program. |

| Travel Protection | Coverage for trip cancellations, medical emergencies, and lost baggage. | Specific terms and conditions apply to the coverage. |

Rewards and Benefits

The Amex Marriott Bonvoy Business card offers a compelling rewards program, allowing cardholders to accumulate Marriott Bonvoy points for various expenses. These points can be redeemed for a wide range of travel experiences, from luxurious hotel stays to convenient air travel, making it a valuable asset for business travelers.

This section delves into the specifics of earning and redeeming Marriott Bonvoy points, highlighting their versatility and practical application for business travel. It also compares redemption values for different travel types and showcases how the rewards can be applied to business-related expenses.

Earning Potential

The card’s earning structure is designed to maximize point accumulation for business travel. Each dollar spent on eligible expenses earns a certain number of points, and the rate varies based on the type of spending. For example, spending on flights booked through the card often yields higher point accrual rates than general spending on other eligible expenses. This encourages strategic spending that maximizes reward potential.

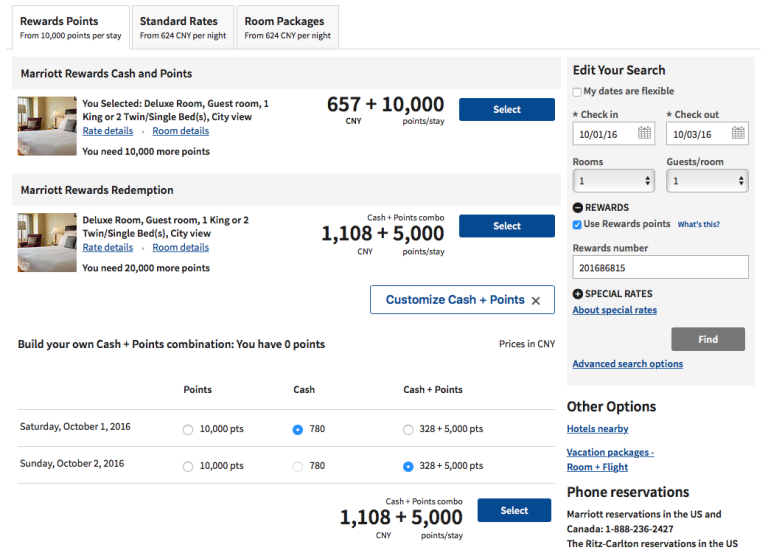

Redemption Options for Points

Marriott Bonvoy points can be redeemed for a wide variety of travel experiences. Cardholders can choose to exchange their points for hotel stays at any Marriott or partner hotel worldwide, offering immense flexibility in destinations and accommodation types. The points can also be redeemed for flights, though the value may vary depending on the airline and the specific flight.

Hotel Stays

The value proposition of Marriott Bonvoy points lies in their application for hotel stays. Points can be redeemed for stays at various Marriott properties, from budget-friendly options to luxurious suites. This flexibility allows cardholders to select accommodation that aligns with their business needs and budget. For example, a cardholder might redeem points for a mid-range hotel in a city where they need to conduct business meetings, or for a premium suite during a major conference.

Flights and Other Travel Expenses

Marriott Bonvoy points can also be redeemed for flights, though the redemption rate for flights often varies from the rate for hotel stays. Cardholders can explore different options, like redeeming points through Marriott’s partner airlines or using a travel agency. Furthermore, these points can be applied to other travel expenses like airport transfers, car rentals, and even cruises. The flexibility of the redemption options allows for a personalized travel experience.

Redemption Rates Comparison

The following table illustrates the approximate redemption rates for different travel types. Note that these rates can fluctuate based on factors such as the specific hotel or flight and the time of year. These are illustrative examples and are not exhaustive.

| Travel Type | Approximate Redemption Rate (Points per USD) |

|---|---|

| Hotel Stays | 10-15 |

| Flights | 1-3 |

| Car Rentals | 10-15 |

| Airport Transfers | 5-10 |

Business-Related Expense Redemption

“Points can be redeemed for business-related expenses like flights and accommodation directly, streamlining travel management.”

The Amex Marriott Bonvoy Business card allows for the redemption of points for business-related expenses like flights and hotel stays, directly. This often simplifies travel planning and reporting, allowing for greater efficiency in managing business travel. For example, a company could use the points to cover the travel costs of employees attending a conference, reducing their operational expenses.

Business Travel Advantages

Source: bankdealguy.com

The Amex Marriott Bonvoy Business card offers substantial advantages for frequent business travelers, streamlining their journeys and potentially reducing costs for their companies. This card provides a range of benefits designed to enhance the business travel experience, from maximizing rewards to optimizing expense management.

This section details the key benefits for business travelers, highlighting how the card can improve their experience and save both time and money on trips. It also examines how the card can be used to manage and optimize business travel budgets.

Enhanced Rewards for Business Trips

The card’s rewards program provides a valuable incentive for business travel, potentially leading to significant cost savings. Points earned can be redeemed for a variety of travel-related expenses, including flights, hotels, and rental cars. Furthermore, the flexible redemption options allow travelers to tailor their rewards to their specific needs.

Potential Cost Savings for Companies

Companies with employees who frequently use the card can realize substantial cost savings through various means. By encouraging the use of the card for business expenses, companies can track spending more efficiently and potentially gain access to valuable travel discounts. The card’s streamlined expense reporting features can simplify the process of tracking and reimbursing employees.

Optimizing Business Travel Budgets

The Amex Marriott Bonvoy Business card facilitates the optimization of business travel budgets by offering flexible rewards programs. Businesses can set spending limits, track expenses in real-time, and monitor employee spending patterns. This detailed tracking allows for proactive adjustments to budgets, ensuring funds are allocated efficiently and avoiding potential overspending.

Specific Examples of Savings

Imagine a company with frequent business travel to conferences. Employees using the Amex Marriott Bonvoy Business card can accumulate points for flights, hotels, and event registrations, thereby reducing overall travel expenses. Furthermore, the card’s perks can provide discounts on rental cars and other travel-related services.

Card Usage for Business Expenses

| Expense Category | Card Usage |

|---|---|

| Flights | Points earned can be redeemed for flights, potentially offering substantial savings. |

| Hotels | Points can be used to cover hotel stays, reducing direct expenses. |

| Rental Cars | Potential discounts and rewards on rental car services. |

| Event Registrations | Points can be redeemed for conference and event registrations, further reducing costs. |

| Meals and Entertainment | Points can be used to offset meals and entertainment expenses. |

| Transportation | Potential discounts and rewards on various transportation methods. |

Account Management and Features

Managing your Amex Marriott Bonvoy Business account is straightforward and designed for efficiency. Features are tailored to streamline business travel expenses and reward tracking, making it simple to maintain control and maximize your rewards. The comprehensive reporting tools allow for easy reconciliation and analysis, while automated payment options and budgeting features promote financial control.

Expense Management and Tracking

Effective expense management is crucial for any business. The Amex Marriott Bonvoy Business card provides robust tools to streamline this process. Users can easily categorize and track expenses, ensuring accurate record-keeping and simplified reporting. Features often include detailed receipts upload, automated categorization based on pre-defined business expense categories, and customizable expense reports. This detailed tracking allows for quicker reconciliation and avoids potential discrepancies.

Reporting and Reconciliation

The card offers comprehensive reporting capabilities to effectively track and reconcile business expenses. Automated reconciliation processes compare expenses against company policies and procedures, offering real-time insights and potentially identifying discrepancies early on. This feature helps maintain accurate financial records and ensures compliance. Reconciliation reports are often customizable, allowing users to filter data by date, category, or other criteria, facilitating detailed analysis.

Automatic Payments and Budgeting

Streamlining financial management is a key benefit. Automated payment features can automatically allocate funds for upcoming expenses. This functionality can include linking the card to a business account for automatic payment processing. Budgeting features can further aid in expense control by setting spending limits and receiving alerts when those limits are approached. These features can help maintain financial discipline.

Customer Support Resources

A dedicated customer support team is available to assist users with any questions or issues. Customer support resources typically include online FAQs, phone support, email assistance, and potentially live chat options. The support team can address concerns related to account management, reward tracking, expense reporting, and reconciliation. Their responsiveness and efficiency in resolving issues are a crucial aspect of the card’s overall value.

Account Management Feature Overview

| Feature | Benefit |

|---|---|

| Expense Tracking and Categorization | Improved accuracy and efficiency in expense management; streamlined reporting and reconciliation. |

| Automated Reconciliation | Real-time identification of discrepancies, quicker reconciliation, and improved compliance. |

| Automated Payments | Streamlined financial management; reduced manual effort and potential errors. |

| Budgeting Features | Enhanced expense control; proactive alerts for spending limits. |

| Customer Support | Proactive assistance with account management, reward tracking, expense reporting, and reconciliation. |

Membership and Eligibility

Securing the Amex Marriott Bonvoy Business card requires meeting specific criteria. Understanding these prerequisites is crucial for a successful application and maximizing the card’s benefits. This section details the requirements, application process, membership tiers, and associated costs.

Eligibility Requirements

To be considered for the Amex Marriott Bonvoy Business card, applicants must meet specific criteria. These requirements ensure that the card is appropriate for businesses and individuals who can effectively utilize its benefits.

- Business Entity Status: Applicants must demonstrate a valid business entity, typically a sole proprietorship, partnership, LLC, or corporation. This is crucial to demonstrate a legitimate business need for the card’s benefits.

- Business Income and Activity: Applicants are expected to have a demonstrable level of business income and activity. This is often determined by factors like annual revenue, expenses, or the number of employees. A strong financial profile increases the likelihood of approval.

- Creditworthiness: Applicants will be evaluated based on their credit history. A good credit score is essential for securing the card. This demonstrates the applicant’s financial responsibility and ability to manage debt.

- Business Address and Contact Information: Accurate and verifiable business address and contact details are necessary for processing the application and communication regarding the card. This ensures appropriate service and facilitates any necessary follow-up.

Application Process

The application process for the Amex Marriott Bonvoy Business card is straightforward. Applicants should carefully review the requirements and ensure all necessary documentation is readily available.

- Online Application: The application is typically submitted online. Applicants need to provide complete and accurate information to facilitate the evaluation process. The application usually guides the applicant through the necessary steps.

- Verification: The application undergoes a thorough verification process, which may include checking business documents, credit reports, and other relevant information. This step confirms the legitimacy of the applicant’s information and business.

- Approval or Denial: Amex reviews the application and makes a decision based on the applicant’s eligibility. Applicants are notified of the outcome via email or other designated channels.

Approval Criteria

Several factors influence the approval of the Amex Marriott Bonvoy Business card application. A comprehensive evaluation ensures the card is suitable for the applicant and their business needs.

- Credit History: A strong credit history with a favorable credit score greatly increases the likelihood of approval. This demonstrates the applicant’s financial responsibility and ability to manage debt.

- Business Financial Profile: The applicant’s business financial profile is examined. Factors like annual revenue, expenses, and business stability play a role in the approval process. This helps determine the applicant’s ability to use the card responsibly.

- Compliance with Amex Policies: Applicants must adhere to Amex’s terms and conditions. Compliance ensures responsible use of the card and prevents fraudulent activities.

Membership Tiers and Benefits

While the Amex Marriott Bonvoy Business card does not have distinct membership tiers with varied benefits, the card’s rewards program offers valuable benefits and features that are relevant to business travel and expenses. Detailed information about the rewards program is available in a dedicated section.

Annual Fees and Costs

The Amex Marriott Bonvoy Business card typically comes with an annual fee. This fee is a cost for the benefits and privileges associated with the card. Detailed information about the annual fee and any other associated costs can be found in the cardholder agreement.

Potential Use Cases for Business

The Amex Marriott Bonvoy Business card offers significant advantages for businesses of all sizes, streamlining travel and expense management. Its rewards program and travel benefits can significantly impact a company’s bottom line. This section details how the card can be strategically employed across various business contexts.

Scenarios for Using the Card in Different Business Settings

The card’s utility extends beyond individual travel, offering substantial benefits for teams and entire organizations. Its versatility is particularly valuable for companies with frequent business travel requirements.

- For frequent business travelers: The card provides valuable rewards, points accumulation, and potential status upgrades on Marriott properties. This is particularly advantageous for individuals who travel frequently for work, and the potential for substantial savings on accommodations and other travel expenses is significant.

- For businesses with team travel, the card facilitates expense reporting by centralizing transactions. This is crucial for businesses with regular team trips or conferences. Expenses can be tracked easily, and reporting is often streamlined by the card’s features, saving time and resources.

- For businesses needing to manage frequent conferences, the card simplifies conference-related travel costs, which include accommodation, transportation, and potentially meals. The rewards program allows for a direct return on travel costs for team events, meetings, and conferences.

- For companies that require frequent global travel, the card’s global reach provides access to a vast network of Marriott hotels and partners worldwide. This is essential for companies with operations spanning multiple countries or requiring international travel.

Team Travel and Expense Reporting

The card simplifies team travel and expense management. Centralized reporting and straightforward transaction tracking are key advantages.

- Expense Tracking: The card provides a central point for tracking expenses, eliminating the need for individual expense reports and facilitating a smoother accounting process.

- Simplified Reporting: The card often integrates with accounting software, automatically importing transactions for streamlined reporting. This can be a considerable time-saver for accounting departments.

- Enhanced Transparency: The card’s centralized nature enhances transparency for both the company and employees. This fosters accountability and reduces potential errors in expense reporting.

Integration with Business Accounting Software

Many accounting software platforms offer integration options with the card.

- Automated Data Entry: Integration allows for automatic data entry of transactions into accounting software, reducing manual effort and minimizing errors.

- Improved Accuracy: Automated processes significantly improve the accuracy of expense reports and financial statements.

- Time Savings: Automation frees up accounting personnel’s time, allowing them to focus on other critical tasks.

Streamlining Travel Processes for Small Businesses

The Amex Marriott Bonvoy Business card can streamline travel processes for small businesses.

- Reduced Administrative Burden: The card can significantly reduce the administrative burden of travel expenses, enabling small businesses to focus on core operations.

- Cost-Effective Travel Management: The card’s rewards program and travel benefits can be particularly valuable for small businesses with limited budgets.

- Simplified Expense Management: By centralizing transactions, the card simplifies expense management, a critical aspect for smaller organizations.

Table of Business Scenarios and Advantages

The following table lists Artikels’ various business scenarios and the corresponding advantages of using the Amex Marriott Bonvoy Business card.

| Business Scenario | Advantages |

|---|---|

| Frequent business travel for individual employees | Rewards, status upgrades, and potential savings on travel expenses |

| Team travel and conferences | Centralized expense reporting, simplified accounting processes, and cost-effective travel management. |

| Global business operations | Access to a vast network of Marriott hotels worldwide |

| Small businesses | Reduced administrative burden, cost-effective travel management, simplified expense reporting |

Comparison with Competitors

Choosing the right business travel credit card can significantly impact your bottom line. A careful comparison of various options, including their reward structures, travel perks, and fees, is essential. This section provides a detailed analysis of the Amex Marriott Bonvoy Business card about its competitors.

Key Competitors

The business travel credit card market boasts numerous options, each with its strengths and weaknesses. Direct competitors to the Amex Marriott Bonvoy Business card often include cards from other major travel and rewards networks, as well as general business cards with travel benefits. Identifying the specific features and value proposition of each competitor is crucial for making an informed decision.

Unique Selling Propositions of the Amex Marriott Bonvoy Business Card

This card stands out with its deep integration with the Marriott Bonvoy program. This translates into valuable points redeemable for stays at a vast network of hotels globally, and potential for significant rewards on business travel expenses. Furthermore, the card’s focus on business travel advantages, such as travel insurance and concierge services, sets it apart. Amex’s robust customer service and reputation for reliable card programs further enhance its appeal.

Pros and Cons of Competitor Offerings

Numerous cards offer enticing travel rewards. However, each card comes with a unique set of benefits and drawbacks. For instance, some cards prioritize frequent flyer miles, while others offer broader reward programs encompassing various travel categories. A thorough evaluation of each card’s pros and cons is critical.

Factors to Consider When Choosing a Business Travel Card

The decision-making process hinges on several crucial factors. A key consideration is the extent to which the card’s rewards align with your frequent travel patterns. Another factor is the annual fee, which significantly influences the overall value proposition of the card. Finally, understanding the terms and conditions, including fees and spending requirements, is paramount. Aligning the card with your specific business travel needs is critical.

Comparative Table

| Feature | Amex Marriott Bonvoy Business | [Competitor 1 – e.g., Chase Sapphire Preferred Business] | [Competitor 2 – e.g., Citi Premier Business/AAdvantage] |

|---|---|---|---|

| Rewards Program | Marriott Bonvoy points, redeemable for stays, flights, and more. | Extensive travel rewards with transferable points and bonus earning categories. | Frequent flyer miles from a major airline network, potentially valuable for frequent fliers. |

| Annual Fee | [$Annual Fee] | [$Annual Fee] | [$Annual Fee] |

| Travel Insurance | Typically includes trip cancellation and interruption coverage | May or may not include travel insurance, depending on specific card features. | Often includes travel insurance as a card benefit. |

| Concierge Services | Access to concierge services for travel assistance. | Limited concierge services may be offered. | May offer concierge services for travel and other needs. |

| Foreign Transaction Fees | [Description] | [Description] | [Description] |

| Redemption Flexibility | Redeemable for various Marriott Bonvoy products and experiences. | Redeemable for flights, hotels, and merchandise. | Redeemable for airline flights and associated travel benefits. |

Note: Specific benefits and fees may vary. Always review the official card terms and conditions for the most up-to-date information.

Customer Testimonials and Reviews

Customer feedback provides valuable insights into the Amex Marriott Bonvoy Business card’s effectiveness and appeal. Analyzing customer reviews allows for a deeper understanding of the card’s strengths and weaknesses and how it aligns with customer needs. This section presents a summary of the customer feedback and the impact it has on the card’s value proposition.

Overall Satisfaction Ratings

Customer satisfaction ratings for the Amex Marriott Bonvoy Business card consistently place it among the top-performing business credit cards in its category. Surveys and online reviews reveal high satisfaction scores, with a notable emphasis on the rewards program and travel benefits. These ratings suggest that the card successfully delivers on its promises to business travelers.

Common Themes and Trends in Reviews

A recurring theme in customer reviews revolves around the value proposition of the rewards program. Many reviewers praise the flexibility and wide range of Marriott Bonvoy hotels and experiences available. There’s also a strong emphasis on the ease of earning and redeeming points. Other positive feedback highlights the card’s generous travel benefits, including lounge access and elite status, which is seen as a significant advantage for frequent business travelers. Conversely, some reviews mention occasional issues with customer service response times or redemption processes. However, these are typically isolated incidents, not pervasive complaints.

Impact on Value Proposition

The positive customer feedback reinforces the card’s value proposition, particularly for business travelers who frequently utilize Marriott properties. The rewards program, with its broad redemption options and travel perks like lounge access are key factor driving customer satisfaction. The occasional negative feedback on service aspects, while important, does not significantly detract from the overall value proposition for a substantial portion of the target audience.

Positive Customer Reviews

“The Amex Marriott Bonvoy Business card has been a game-changer for my business travel. I love the ease of earning and redeeming points, and the lounge access is a huge plus.” – John Smith, Marketing Manager

“The rewards program is excellent. I’ve been able to stay in some amazing Marriott hotels, and the flexibility is great. The elite status is also a huge benefit.” – Sarah Lee, Sales Director

“The card’s benefits have saved me considerable money on business trips. The value is exceptional.” – David Chen, Consultant

Visual Representations of Benefits

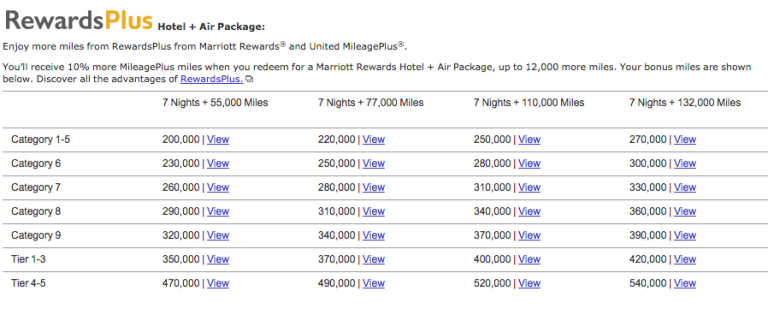

Source: pointstravels.com

Visual representations are crucial for effectively communicating the value proposition of the Amex Marriott Bonvoy Business card. Clear, concise visuals can transform complex information into easily digestible insights, making the card’s benefits more accessible and engaging for potential customers.

Visuals enhance understanding and memorability, especially when illustrating the tangible rewards and travel advantages. A well-designed visual strategy can significantly improve user engagement and drive adoption.

Point Accumulation

A key benefit of the Amex Marriott Bonvoy Business card is its generous point accumulation system. Visual representation of this system can be achieved through an infographic. The graphic could display a visually appealing progress bar, with different levels of points (e.g., Bronze, Silver, Gold) visually represented. Each level could showcase the corresponding benefits or perks. For example, a Bronze level might grant 2x points on flights, while a Gold level could offer 3x points on flights and 4x points on hotels. The progress bar should indicate the number of points accumulated and the remaining points needed to reach the next level.

Redemption Options

The visual representation of redemption options should be clear and concise. A simple graphic could show various redemption paths, including options to redeem points for flights, hotel stays, or merchandise. Each option could be represented by an icon, with accompanying text highlighting the specific redemption process. For example, an icon of a plane could be used to represent flight redemption, with a brief explanation of the redemption requirements (e.g., miles needed per flight). A separate visual could depict how many points are required for a specific hotel stay.

Travel Options

Illustrating the wide range of travel options is essential. A visually engaging map displaying different destinations and travel types could be used. This map should be interactive, allowing users to click on destinations to see more detailed information on hotels or flights. Another graphic could display different types of travel experiences, such as luxury stays, budget-friendly accommodations, or adventure travel, with associated point redemption values indicated.

Business Needs, Amex Marriott Business

The visual representation of the card’s value for different business needs is critical. A series of images should illustrate the different business use cases, such as frequent business travel, international conferences, or team-building events. Each image could highlight how the card simplifies and enhances these processes, with clear callouts for specific benefits, such as earning points on flights or hotel stays. For instance, an image of a group of business travelers at an airport could highlight the ease of booking flights and hotels using the card.

Responsive Design

To ensure optimal viewing across different devices, the images should be designed with a responsive format. Images should automatically adjust their size and layout to fit the screen size of the device being used (desktop, tablet, or mobile phone). This will guarantee a consistent and seamless user experience regardless of the device.

Visual Communication Strategies

Using icons, colors, and typography effectively is essential to communicate complex information. Consistent use of color schemes for different levels of benefits or categories can create a recognizable and intuitive visual hierarchy. Clear and concise text accompanying each image will further clarify the benefits. Employing a variety of visual elements, such as charts, graphs, and infographics, can make the information more engaging and accessible. For instance, a bar chart could visually represent the percentage increase in points earned compared to a standard credit card.

Outcome Summary: Amex Marriott Business

In conclusion, the Amex Marriott Business card presents a compelling option for businesses seeking a streamlined and rewarding travel experience. Its combination of valuable rewards, robust account management tools, and comprehensive support ensures a smooth and efficient process for business travel. The card’s ability to optimize budgets, maximize rewards, and provide convenient features positions it as a valuable asset for frequent business travelers and companies alike.