Marriott Cash and Points Maximizing Value

Marriott’s cash and points offer a powerful way to unlock incredible travel deals. Understanding the system’s intricacies and strategic redemption techniques is key to maximizing your rewards. This guide delves into the world of Marriott Bonvoy, exploring different redemption strategies, membership benefits, and practical applications.

From earning points through stays and activities to strategic cash-and-points combinations, this exploration covers various aspects of optimizing your Marriott travel experience. We’ll examine how to navigate the program effectively, maximize value, and unlock elite status benefits. Whether you’re a seasoned traveler or just starting to explore the world of rewards programs, this guide offers actionable insights to help you make the most of your Marriott Bonvoy membership.

Introduction to Marriott Cash and Points

Marriott Bonvoy’s cash and points system offers a flexible and rewarding way to earn and redeem travel benefits. This system allows members to accumulate points through various activities and then leverage those points for stays at Marriott hotels worldwide, flights, and other valuable perks. Understanding the nuances of this system is key to maximizing its potential.

The Marriott Bonvoy program is a comprehensive loyalty program that rewards travel. It encompasses a wide range of benefits beyond simply earning points, including exclusive access to amenities, personalized services, and opportunities to earn bonus points for specific activities.

Types of Marriott Points and Earning Methods

Marriott Bonvoy offers various ways to earn points. Members can accrue points through stays at participating hotels, through airline partners, and by utilizing co-branded credit cards. The program provides a variety of earning avenues to cater to diverse travel habits and preferences.

- Hotel Stays: A primary method for earning points is through direct stays at Marriott hotels. The number of points earned typically correlates with the length and type of stay, the room category, and potentially, any special promotions in effect.

- Airline Partnerships: Marriott has partnerships with numerous airlines. Members can earn points by flying on these partner airlines. The number of points earned often depends on the distance traveled, the class of service, and the specific airline involved.

- Credit Card Rewards: Many co-branded credit cards offer opportunities to earn Marriott Bonvoy points. The terms and conditions of these cards, including the specific earning rate and any bonus offers, vary depending on the issuing bank and the card chosen.

Redeeming Marriott Points

Marriott Bonvoy points can be redeemed for a diverse range of travel experiences. Members can use their points for hotel stays, flights, and other valuable benefits. The value of redeemed points can vary significantly based on factors such as demand, location, and time of year.

- Hotel Stays: Points can be directly redeemed for stays at Marriott hotels worldwide. The redemption rate typically translates points into a dollar value that can be used to offset the cost of a stay.

- Flights: Points can also be redeemed for flights on partner airlines. The process often involves exchanging points for a specific amount of flight credits that can be applied towards a future flight.

- Other Benefits: Marriott Bonvoy points can be exchanged for a variety of other perks. This might include upgrades, experiences, and other valuable services.

Value Proposition of Cash and Points

Using cash and points for Marriott stays provides a compelling value proposition. Members can potentially save money by strategically combining cash and points to achieve the desired travel experience.

- Flexibility: The system allows members to tailor their travel plans by combining cash and points to maximize the value received. This offers a considerable amount of flexibility in terms of timing, location, and the type of hotel or experience desired.

- Savings Potential: Redeeming points strategically can significantly reduce the overall cost of a stay. By leveraging points for portions of the stay or other components like upgrades, members can save substantial money.

- Enhanced Rewards: Members can combine cash and points to access exclusive amenities and upgrades, adding an extra layer of luxury and value to their travel experience.

Redemption Strategies

Maximizing the value of Marriott Bonvoy points requires a strategic approach. Understanding the nuances of redemption options and the factors influencing point value is crucial for securing the best possible travel experiences. This section delves into various strategies for optimal point utilization.

Effective redemption strategies are paramount for maximizing the value of Marriott Bonvoy points. Consideration of factors such as hotel location, dates, and demand is essential for achieving the most advantageous exchange.

Strategies for Last-Minute Bookings

Last-minute travel often presents a challenge, but strategic point redemption can unlock favorable deals. Leveraging real-time availability and flexible booking windows can help secure discounted rates or even complimentary upgrades. For example, checking availability in popular destinations during periods of lower demand can reveal opportunities to obtain attractive redemption rates.

Strategies for Family Trips

Planning family vacations often requires careful budgeting and consideration of multiple factors. Using points strategically can significantly reduce the cost of a family trip. Utilizing family room discounts and combining points with cash payments can result in cost-effective solutions for large families. Points can also be redeemed for desirable amenities and activities during the trip, making it more memorable and enjoyable for everyone.

Redemption Value Comparison, Marriott cash and points

The value of redeeming points versus paying with cash varies depending on the specific hotel, travel dates, and redemption method. Factors like demand, seasonality, and hotel category influence the relative value of points. For example, during peak season, cash might offer a more competitive rate for popular hotels, whereas off-season travel might make point redemption more advantageous. A comparative analysis of rates for specific hotels and dates is recommended to make informed decisions.

Utilizing Points for Upgrades and Elite Benefits

Points can be leveraged to secure upgrades and access elite member benefits, enhancing the overall travel experience. Loyalty programs often offer opportunities for complimentary upgrades, expedited check-in/check-out, and priority airport services. Careful planning and strategic allocation of points can ensure that these valuable perks are utilized optimally. Consider the value of potential upgrades against the cost of directly purchasing them.

Points and Cash Combinations

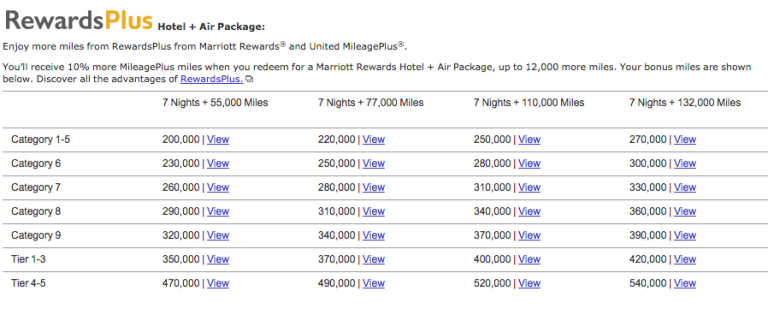

Source: nerdwallet.com

Combining Marriott points with cash offers a flexible approach to hotel stays, allowing you to customize your travel experience and potentially save money. This method allows for a tailored approach, balancing the value of points with the cost of a stay. Understanding the interplay between cash and points is crucial for maximizing your Marriott rewards.

Strategic combinations of cash and points can significantly impact the overall cost of your stay. Leveraging point multipliers, understanding redemption rates, and assessing various scenarios are key factors in making informed decisions.

Point Multiplier Impact

Point multipliers, often offered during promotions or specific periods, increase the value of your points. These multipliers can significantly influence the effectiveness of a cash-and-points combination. For example, a 2x multiplier on Marriott points during a promotional period doubles the value of your points, effectively reducing the cost of your stay. A multiplier will enhance the value of your points, making your cash-and-points combination even more cost-effective.

Calculating Optimal Combinations

Determining the best combination of cash and points for a specific stay requires careful calculation. Consider the following factors: the price of the hotel, the number of points required for the stay, and the potential value of the points based on current multipliers. A simple formula for calculating the best combination is:

(Hotel cost – (points needed * point value))

This formula helps determine the net cost savings when combining cash and points. For example, if a hotel costs $500, requires 50,000 points, and points are worth $0.01 each, the formula yields a cash cost of $450.

Factors to Consider

Several factors influence the decision to use cash, points, or a combination. The current value of your points, the hotel’s price, and any potential point multipliers are essential considerations. Availability of rooms and flexibility in dates also impact the decision-making process. Also, consider the overall value proposition: Are you getting a significantly better rate by combining cash and points compared to using only cash?

Example Scenarios

Consider a scenario where a hotel room costs $300. Using only cash would require paying the full amount. However, if 25,000 points are required and each point is worth $0.02, using a combination could be more economical. Using only cash, the cost would be $300. Using 25,000 points (valued at $50) would leave a cash cost of $250. This demonstrates the potential savings when combining points and cash. Another scenario might involve a hotel with a high cash price but a limited number of available points, potentially rendering a combined approach less beneficial. Always evaluate the specific circumstances.

Marriott Bonvoy Membership Levels: Marriott Cash And Points

Understanding your Marriott Bonvoy membership level is crucial for maximizing the value of your points and cash. Different tiers offer varying benefits, directly impacting your redemption options and overall travel experience. This section delves into the intricacies of each level, explaining how they affect your cash and points strategy.

Membership Tier Benefits

Marriott Bonvoy membership levels, ranging from base to elite status, offer a spectrum of benefits. These benefits often translate to enhanced cash and points redemption options. The higher your tier, the more favorable the redemption conditions and perks become.

Marriott Bonvoy Membership Levels and Benefits Table

| Membership Level | Points Earning Rate | Elite Night Credits | Elite Qualifying Nights | Breakfast Benefit | Lounge Access | Other Benefits |

|---|---|---|---|---|---|---|

| Base Member | Standard rate | 0 | N/A | No | No | None |

| Silver Elite | Standard rate | 25% bonus | 25 nights | 1 breakfast per stay | No | Early check-in/late check-out |

| Gold Elite | Standard rate | 50% bonus | 50 nights | 2 breakfasts per stay | Access to select lounges | Priority waitlist, free Wi-Fi |

| Platinum Elite | Standard rate | 75% bonus | 75 nights | 3 breakfasts per stay | Access to select lounges | Free room upgrades, guaranteed rooms |

| Titanium Elite | Standard rate | 100% bonus | 100 nights | 4 breakfasts per stay | Access to select lounges | VIP service, dedicated concierge |

Impact on Cash and Points Redemptions

The membership level directly influences the value of your cash and points. Higher tiers often unlock preferential treatment in redemption processes. For example, a Platinum member might be able to redeem points for a higher-category room or receive priority access to desirable dates. Elite members may also benefit from more generous point-to-cash conversion rates.

Examples of Elite Status Benefits

Elite status significantly enhances the value of cash and points. Imagine a Gold member redeeming points for a stay during peak season. The member might find that the higher status allows them to select a more desirable room category or a more favorable booking date compared to a base member. Furthermore, elite members often enjoy expedited check-in and check-out procedures, further streamlining their travel experience. Platinum members might be offered the opportunity to receive an upgrade to a suite, significantly improving the value of their points redemption.

Comparing Marriott Bonvoy Membership Levels

The table below offers a concise comparison of Marriott Bonvoy membership levels, highlighting the nuances in cash and points benefits. The specific benefits may vary slightly based on the property and location.

| Membership Level | Redemption Options | Cash Value Enhancement | Overall Value |

|---|---|---|---|

| Base Member | Standard redemption options | Limited | Lower |

| Silver Elite | Standard redemption options with minor advantages | Moderate | Moderate |

| Gold Elite | Enhanced redemption options, potential for better room choices | Significant | High |

| Platinum Elite | Exceptional redemption options, priority access, and potential upgrades | Very Significant | Very High |

| Titanium Elite | VIP treatment, tailored service, guaranteed upgrades | Maximum | Maximum |

Flexibility and Value

The Marriott Bonvoy program offers a significant degree of flexibility, allowing travelers to tailor their experiences to their specific needs and preferences. This flexibility extends to booking windows, travel dates, and the combination of points and cash, offering a variety of options for maximizing value. Understanding these aspects is crucial for travelers seeking the best possible return on their Marriott Bonvoy points.

The program’s flexibility enables strategic planning and adjustment to evolving travel plans. This adaptability is a key differentiator when compared to other hotel loyalty programs. Savvy travelers can leverage this flexibility to secure attractive deals, especially when combining cash and points to optimize their travel budgets.

Booking Windows and Travel Dates

Marriott Bonvoy frequently features special offers and promotions, often tied to specific booking windows and travel dates. These opportunities can significantly impact the value of your points and cash, enabling substantial savings. Understanding the program’s promotional calendar and booking patterns is vital for securing the most favorable rates.

Identifying the Best Deals with Cash and Points

A systematic approach to combining cash and points can significantly improve the value of your travel arrangements. Utilizing online tools and resources, travelers can compare the cost of a stay using solely cash versus combining cash and points. Examining the balance between cash and points redemption, based on the specific travel dates and destination, is paramount. Real-world examples of successful cash-and-points combinations, such as booking a weekend getaway during a mid-week promotional period, demonstrate the potential for significant savings.

Tracking Points and Rewards

Regularly monitoring your Marriott Bonvoy account is crucial for maximizing the value of your points and rewards. The Marriott Bonvoy app or website provides detailed information on your accumulated points, enabling you to track progress towards redemption goals. Using this data, you can make informed decisions regarding your travel plans and potentially identify additional earning opportunities.

Comparison with Other Hotel Loyalty Programs

While Marriott Bonvoy offers considerable flexibility, other hotel loyalty programs may also feature similar or alternative benefits. Comparing the point redemption rates, bonus opportunities, and available booking windows of different programs can help travelers choose the program that best suits their individual needs and travel patterns. This comparative analysis ensures that you select the program that aligns with your travel preferences and goals.

Practical Application

Putting your Marriott Bonvoy points to good use requires a strategic approach. This section details the practical steps for booking stays, managing your points, and understanding potential limitations. Maximizing the value of your points often involves careful planning and consideration of various factors.

Booking a Marriott Stay with Cash and Points

Booking a Marriott stay using a combination of cash and points requires navigating the platform’s options. The process generally involves selecting your desired dates, location, and room type, then specifying the amount of cash and points you wish to use. Marriott’s system will calculate the total cost and the points required to reach your desired payment.

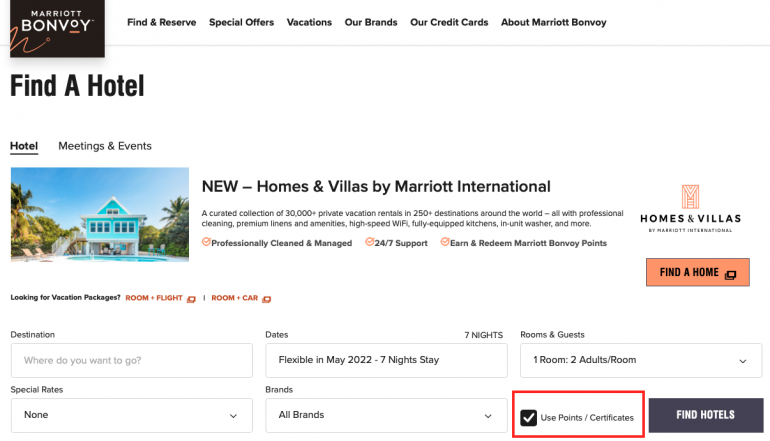

- Step 1: Access the Marriott website or app. Navigate to the booking section and input your desired travel dates, destination, and room preferences.

- Step 2: Review the available room options. Identify the specific room and rate that best suit your needs and preferences. The platform will typically display the total cost, including any taxes or fees.

- Step 3: Select your preferred payment method. Specify the amount you want to pay in cash and the amount you wish to redeem in points. The platform will show the remaining balance and the required points.

- Step 4: Review and confirm the booking. Carefully examine the booking summary, ensuring accuracy in dates, room type, and payment details. Confirm your booking once satisfied.

Tracking and Managing Marriott Points

Efficiently managing your Marriott Bonvoy points is crucial for maximizing their value. Utilizing online tools and resources is essential for keeping track of your points balance and activity.

- Utilizing the Marriott Bonvoy app or website: The Marriott Bonvoy platform provides a comprehensive overview of your account, including your points balance, recent activity, and upcoming reservations.

- Setting up automatic point tracking: This can help ensure that you stay informed about your points balance and avoid any unexpected discrepancies.

- Creating a points redemption strategy: Developing a plan for using your points allows you to prioritize destinations and maximize their value. This can involve considering the value of points per dollar spent.

Limitations of Cash and Points for Stays

Certain types of stays may not be as easily or optimally booked with a cash and points combination. Specific properties or packages might have restrictions on point redemption.

- Specific hotel packages: Some special packages or promotions might not be redeemable with points.

- High-demand periods: During peak seasons, availability might be limited, even with a combination of cash and points. This could make it challenging to secure a desired stay.

- Specific property policies: Certain properties may have unique policies regarding cash and points redemptions. These policies could restrict the usage of points in specific situations.

Strategic Use of Cash and Points

Using cash and points strategically can significantly enhance your travel experience.

- Targeting high-value rewards: Consider redeeming points for stays at premium hotels or resorts that align with your travel preferences.

- Combining with promotions: Look for opportunities to combine your points usage with Marriott promotions to further enhance the value of your rewards.

- Prioritizing preferred destinations: Consider targeting destinations where you can leverage your points to maximize the value of your travel. For example, booking a stay at a popular destination with a Marriott hotel during peak season.

Alternatives and Considerations

Maximizing your Marriott rewards often involves exploring diverse strategies. Beyond leveraging cash and points, alternative approaches can significantly impact your overall savings and travel experience. Understanding these options and their potential drawbacks is crucial for making informed decisions.

While Marriott Bonvoy’s cash and points system offers flexibility, other avenues exist to save money on hotel stays. This section delves into these alternatives, outlining potential risks and limitations, and providing situations where using solely cash might be more advantageous.

Alternative Savings Strategies

Utilizing travel credit cards can be a powerful tool for earning travel rewards, including hotel stays. Many cards offer generous sign-up bonuses, points accrual rates, and potential discounts on Marriott properties. Careful evaluation of card benefits, fees, and redemption policies is vital. Understanding the terms and conditions of these programs can significantly impact your bottom line.

Potential Risks and Limitations of Cash and Points

Employing a cash and points redemption strategy necessitates careful planning and consideration. Fluctuations in exchange rates between points and cash can impact the ultimate value of your rewards. Redemption rates for points can vary based on demand, location, and the time of year. Unforeseen circumstances like unexpected travel cancellations or changes in plans can lead to wasted points. Furthermore, the value of points can depreciate if not used within a reasonable timeframe.

Situations Favoring Cash-Only Stays

While cash and points offer flexibility, certain circumstances may render a purely cash-based approach more suitable. For example, if you require immediate booking confirmations or prefer flexibility in cancellation policies, using cash might be a more straightforward solution. In scenarios where point availability is limited or the value proposition of redeeming points is significantly diminished, a cash-only option can be more practical. For instance, if a particular hotel offers a discounted cash rate that surpasses the value of redeeming points, opting for cash could be more economical.

Cash vs. Points: A Comparative Analysis

| Factor | Cash | Cash & Points |

|---|---|---|

| Flexibility | High – Immediate booking, often more cancellation flexibility | Moderate – Dependent on redemption policies and availability |

| Potential Savings | Dependent on available discounts | Potentially higher, dependent on point value and redemption rates |

| Risk of Points Expiration | Zero | High Points can expire if not used within a timeframe |

| Transaction Fees | Generally none | Potentially some fees associated with point redemptions |

| Redemption Complexity | Simple – Direct payment | Moderate – Requires understanding of point value and redemption process |

| Suitable for… | Immediate needs, situations where flexibility is crucial | Long-term planning, maximizing value on stays with favorable redemption rates |

Future Trends

Marriott’s Cash and Points program, a cornerstone of the Bonvoy loyalty program, is likely to evolve in response to changing market dynamics and customer preferences. Understanding potential future directions will be crucial for maximizing the value of your points and maximizing rewards.

Potential Enhancements in Redemption Options

The future may see Marriott expanding its redemption options beyond traditional hotel stays. This could involve incorporating experiences, such as dining credits at partner restaurants, or access to premium airport lounge services. A greater focus on personalized offers tailored to individual customer preferences is also probable. For example, frequent travelers might receive prioritized access to exclusive deals or promotions.

Increased Integration with Partner Programs

Marriott’s strategic partnerships are likely to become even more intertwined with its cash and points program. This integration could lead to a wider range of redemption options across partner brands. For example, a customer might redeem points for flights on a specific airline or merchandise from a particular retailer. This could potentially offer a more comprehensive travel and lifestyle rewards ecosystem.

Emphasis on Sustainability and Social Impact

In line with global trends, Marriott may place a stronger emphasis on sustainable and socially responsible travel. This could manifest in awarding points for eco-friendly travel choices, such as staying in hotels with specific sustainability certifications or supporting local communities through initiatives tied to the program.

Dynamic Pricing and Tiered Benefits

Market fluctuations and increasing demand might lead to more dynamic pricing for cash and points redemption. Higher tiers of Marriott Bonvoy membership could provide greater flexibility in redemption options and potentially exclusive perks. This is a common practice in other loyalty programs, reflecting a trend of rewarding high-value members with preferential treatment.

Possible Future Directions of Marriott’s Cash and Points Program

| Potential Trend | Description | Example |

|---|---|---|

| Expanded Redemption Options | Points redeemable for experiences, such as dining or activities. | Redeeming points for a cooking class at a partner restaurant or a guided tour. |

| Enhanced Partner Integration | Wider redemption options across various partner brands. | Redeeming points for a rental car or a flight ticket from a partner airline. |

| Sustainability Focus | Awarding points for eco-friendly travel choices. | Points are awarded for staying in hotels with LEED certifications or supporting local conservation efforts. |

| Dynamic Pricing | Adjusting redemption values based on market demand. | Higher point requirements for popular destinations during peak season. |

| Tiered Benefits | Exclusive perks and flexibility for higher-tier members. | Gold-tier members have access to expedited check-in or lounge access. |

Conclusion

Source: pinimg.com

In conclusion, leveraging Marriott’s cash and points effectively requires a nuanced understanding of the program’s intricacies. We’ve covered a wide range of strategies, from maximizing point value to combining cash and points for optimal savings. By exploring membership levels, comparing the value proposition to other programs, and understanding potential limitations, you can tailor your approach to your individual travel needs and preferences. The future of Marriott’s cash and points system remains an exciting prospect, and the insights provided here equip you to adapt to any potential changes and continue maximizing your travel rewards.