Marriott Amex Business Your Travel Advantage

Marriott Amex Business cards offer a compelling suite of benefits for savvy business travelers. This in-depth exploration dives into the intricacies of the card, from its core perks to the potential pitfalls. We’ll dissect the Marriott Bonvoy rewards program and compare it with other business travel cards, providing a comprehensive understanding of how to maximize your travel and rewards potential.

The card’s various tiers and rewards, along with the annual fee structure, are detailed. We’ll show you how to strategically use the card to optimize your business travel expenses, maximizing your earning potential for flights, hotels, and rental cars. We’ll also cover the crucial aspect of understanding the redemption process and navigating the Marriott Bonvoy program.

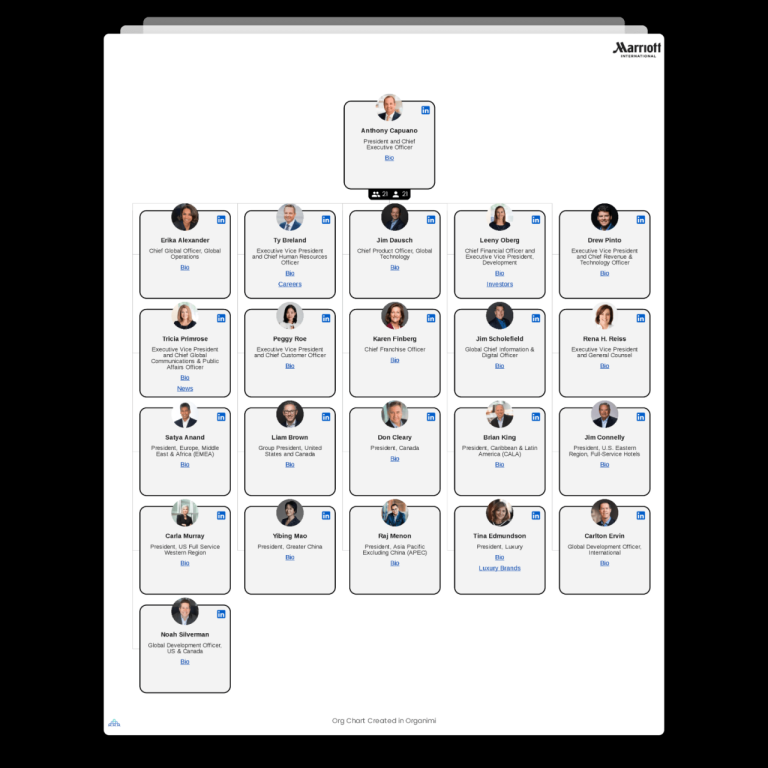

Overview of the Marriott Amex Business Card

The Marriott Bonvoy Business American Express card offers a compelling suite of benefits designed to cater to the needs of frequent business travelers. Understanding its features and rewards structure is crucial for maximizing its value. This overview will detail the key perks, tiered rewards, and annual fees, enabling informed decision-making.

The card rewards loyalty to Marriott Bonvoy hotels and resorts, while also providing valuable business-centric perks, such as travel credits, elevated service, and exclusive access to programs. It aims to provide a streamlined travel experience for professionals.

Key Perks and Advantages for Business Travelers

This card provides various benefits tailored for business travelers, encompassing perks like priority check-in and check-out at participating hotels, complimentary airport lounge access, and expedited baggage handling. These amenities contribute to a more efficient and comfortable travel experience, saving time and minimizing stress. Additionally, the card often includes travel insurance, offering protection against unexpected events, ensuring peace of mind.

Different Tiers and Associated Rewards

The Marriott Bonvoy Business American Express card typically offers tiered rewards programs. These tiers often correlate with spending levels, with higher tiers yielding greater rewards, such as faster earning of points for future travel. For example, a higher spending tier might offer a more significant bonus on each stay. This allows cardholders to accumulate points at a faster rate, making future travel more affordable or rewarding.

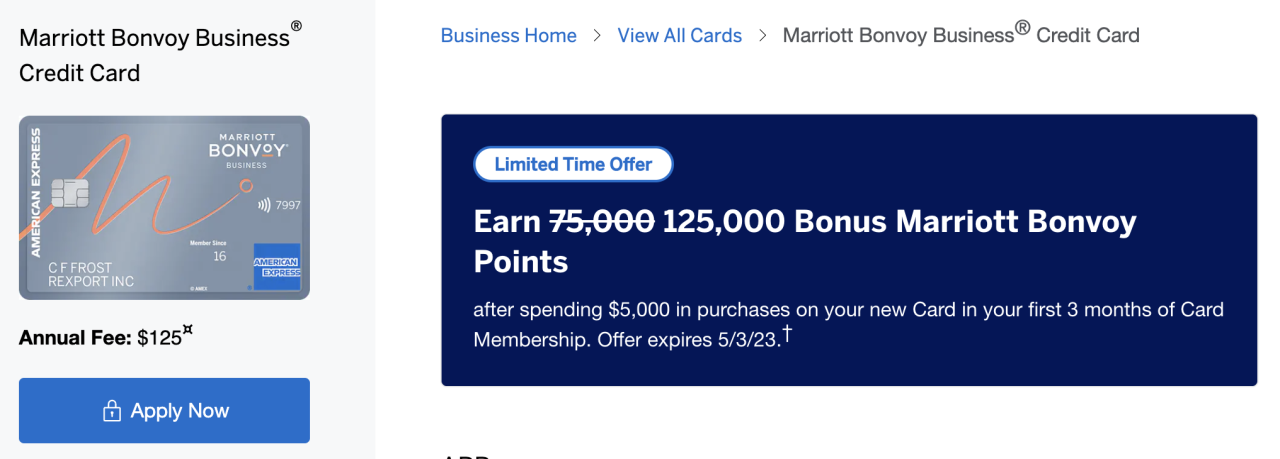

Annual Fee Structure and Implications

The annual fee associated with the Marriott Bonvoy Business American Express card varies depending on the specific card offered. Understanding the fee structure is essential. The fee represents the cost of membership in the program and should be considered alongside the value of the benefits offered. For example, if the benefits are expected to offset the annual fee through savings on travel or other advantages, the card may be a valuable investment. It is important to calculate the potential savings against the annual cost to determine the financial viability of the card. The annual fee should not be the sole factor in decision-making; rather, it should be evaluated in conjunction with the expected value derived from the card’s benefits.

Benefits for Business Travel

The Marriott Bonvoy Business American Express card offers significant advantages for business travelers seeking to optimize their expenses and maximize rewards. By understanding the card’s features, you can leverage its benefits to streamline your business trips and potentially save money.

This card, with its focus on travel, provides an effective way to manage business expenses while simultaneously earning valuable points redeemable for flights, hotels, and rental cars. This detailed overview will highlight how the card can streamline your travel planning and reward program participation.

Optimizing Business Travel Expenses, Marriott Amex Business

The card’s benefits extend beyond simply earning points. Features like automatic expense tracking and reporting capabilities can significantly streamline the process of managing travel-related costs. This automated approach minimizes the potential for errors and allows for more efficient reconciliation with company records. Furthermore, the card’s travel insurance coverage can provide peace of mind, protecting against unexpected events and reducing the financial impact of unforeseen circumstances.

Earning Points for Flights, Hotels, and Rental Cars

The card’s reward structure is deeply integrated with the Marriott Bonvoy program, offering substantial earning potential on flights, hotels, and rental cars. Members can earn points for eligible purchases, including flights booked directly through the airline or on a travel agency website, hotel stays, and car rentals from participating providers. This versatility allows for a wide range of travel arrangements to be eligible for reward accumulation.

Maximizing Rewards for Business Trips

Maximizing rewards involves strategic planning and understanding the program’s intricacies. Members can accumulate points faster by booking flights, hotels, and rentals directly through Marriott Bonvoy partners. Careful planning and pre-booking can lead to better rates and maximize rewards, ensuring you get the most out of your travel spending.

Value Proposition Relative to Other Business Travel Credit Cards

The Marriott Bonvoy Business card’s value proposition is contingent on individual travel patterns and spending habits. Comparing it to other business travel cards, consider the value of Marriott Bonvoy points in relation to other loyalty programs. The value of points can vary significantly based on redemption options and current market conditions.

Potential Drawbacks or Limitations of the Card for Business Travel

A key consideration is the potential for a limited reward redemption value in specific situations. While the card offers substantial benefits, it might not be optimal for travelers who primarily utilize non-Marriott affiliated partners for their flights, hotels, or rentals. Another potential drawback involves maintaining a consistent spending history to retain eligibility for specific benefits or to reach certain reward thresholds. Finally, consider the necessity for a balance between earning points and incurring expenses that may exceed the value of the rewards received.

Rewards Program and Redemption

The Marriott Bonvoy program, integrated with the Marriott Amex Business Card, offers substantial rewards for business travelers. This program allows you to accumulate points based on your spending and activity, which can then be redeemed for a wide array of travel, merchandise, and experience options.

The Marriott Bonvoy program functions as a loyalty platform for members, enabling them to earn and redeem points across various Marriott properties and partners. These points can be accumulated by spending on eligible purchases made using the Marriott Amex Business Card, and then applied towards fulfilling travel and other needs.

Earning Marriott Bonvoy Points

Accumulating Marriott Bonvoy points is straightforward. Points are awarded based on your spending on the Marriott Amex Business Card. The rate at which you earn points varies depending on the specific spending category and the type of transaction. Understanding the earning structure is crucial for maximizing the benefits of the card.

Redemption Process

Redeeming your Marriott Bonvoy points is a straightforward process. Points can be redeemed for various travel experiences, including flights, hotels, and rental cars, as well as merchandise and experiences. You can log in to your Marriott Bonvoy account online to manage your points balance and initiate redemption requests.

Redemption Options

A wide range of options exists for redeeming Marriott Bonvoy points. The flexibility allows you to choose experiences tailored to your needs.

| Redemption Category | Description |

|---|---|

| Flights | Points can be redeemed for flights on various airlines, both directly and through partner airlines. The availability of specific flights and associated costs will vary based on the number of points and the specific redemption options. |

| Hotels | Points can be used to book stays at Marriott hotels worldwide, as well as partner hotels. Points redemption often involves a combination of points and cash to cover the complete stay. |

| Merchandise | Points can be redeemed for a wide variety of merchandise, from travel accessories to gift cards. The specific options and associated point values will vary based on the merchant. |

| Experiences | Points can be used to book various experiences, including tours, activities, and other offerings. These experiences are typically linked to specific locations and can be combined with hotel stays or other travel options. |

Example Redemption Scenarios

Consider a business traveler who earns 25,000 points through spending on the Marriott Amex Business Card. They could redeem these points for a flight to a conference, a hotel stay in a major city, or a combination of both. This flexibility allows for customization to fit the traveler’s unique needs and preferences.

Practical Application and Usage

Maximizing the value of your Marriott Bonvoy Business American Express card hinges on understanding its features and applying them strategically. This section details how to use the card effectively for business travel, highlighting ways to maximize rewards and efficiently track your progress.

Using the card for everyday business expenses, combined with strategic travel bookings, significantly boosts reward-earning potential. This approach transforms the card from a simple credit card into a valuable tool for managing and accumulating travel rewards.

Step-by-Step Guide for Business Travel

Understanding the nuances of booking travel and using the card for related expenses is crucial for optimizing rewards. A meticulous approach to booking and spending ensures you’re earning points effectively.

- Booking Flights and Hotels: Look for partner hotels and airlines within the Marriott Bonvoy program. This direct booking often yields higher reward accrual compared to booking through third-party platforms. Leverage the Marriott Bonvoy website or app to secure these bookings.

- Using the Card for Expenses: Utilize the card for all eligible business expenses, such as flights, accommodation, and ground transportation. This approach allows you to accumulate points for your business travel.

- Maintaining Detailed Records: Accurate record-keeping is essential for tracking your spending and earned rewards. This includes noting the transaction date, amount, and the category to which it applies.

- Reviewing Statements Regularly: Regularly review your statements to ensure accuracy and identify any potential errors. This proactive approach helps maintain a clear picture of your point balance and avoid any discrepancies.

Maximizing Earning Potential

Strategic spending patterns can significantly amplify your reward-earning potential. By understanding the categories that earn the most points, you can tailor your spending habits accordingly.

- Prioritize Eligible Categories: Concentrate spending in categories that yield higher points per dollar, such as flights, hotels, and restaurants.

- Utilize Bonus Offers: Actively seek out bonus offers and promotions related to the card. These can greatly increase your reward earnings.

- Combine with Other Rewards Programs: Combining this card with other loyalty programs or travel rewards cards can amplify your overall earnings, maximizing the value of each dollar spent.

Tracking Points and Rewards

A clear system for tracking your points is essential for maximizing the value of your card. Understanding the reward structure and the various redemption options available is crucial for optimizing your travel plans.

- Utilizing the Marriott Bonvoy App: The Marriott Bonvoy app provides a convenient platform for tracking your points and viewing your redemption options. It offers real-time updates and detailed information.

- Maintaining a Spreadsheet: A dedicated spreadsheet can help organize your points accrual, tracking the date and amount of points earned. This helps with planning future travel.

- Understanding Redemption Options: Thoroughly research the redemption options available, understanding the value of each point and potential associated fees.

Spending Scenarios and Potential Rewards

The following table illustrates potential reward earnings based on different spending scenarios. These examples are intended to provide a general understanding of reward structures and do not represent exhaustive possibilities.

| Spending Scenario | Estimated Rewards (Points) |

|---|---|

| Business Trip (Flights, Hotels, and Meals) – $5,000 | Estimated 5,000-10,000 points |

| Frequent Travel for Conferences – $2,000 | Estimated 2,000-4,000 points |

| Business Lunches and Meetings – $1,000 | Estimated 1,000-2,000 points |

Comparison with Other Business Cards

Source: azureedge.net

Choosing the right business travel credit card hinges on individual needs and priorities. A comprehensive comparison with competing cards illuminates the strengths and weaknesses of each, enabling informed decision-making. This section delves into various options, highlighting their value propositions and key differentiators.

Competitive Landscape Overview

The business travel credit card market is robust, with numerous options vying for consumer attention. Understanding the offerings of key competitors provides a crucial context for evaluating the Marriott Amex Business card’s position. Major players often focus on different aspects of business travel, from rewards programs to travel perks.

Key Considerations for Selection

Several factors influence the optimal choice of a business travel credit card. These include the frequency and nature of business trips, desired reward redemption flexibility, and the relative importance of travel perks versus other benefits. For example, a frequent flyer who prioritizes miles accumulation might favor a card focused on airline partnerships.

Value Proposition Comparison

Different business travel cards cater to diverse needs. The Marriott Amex Business card, for example, offers a strong Marriott Bonvoy rewards integration, emphasizing hotel stays. Competitor cards might prioritize airline miles, flexible spending accounts, or other benefits, reflecting their distinct value propositions. The Marriott card’s value lies in its comprehensive hotel rewards system.

Criteria for Selecting the Best Card

Selecting the best business travel credit card requires a careful assessment of individual needs. A detailed analysis of travel patterns, spending habits, and reward preferences forms the basis for an informed decision. Consider factors like the redemption rate for points or miles, available travel perks, and the annual fee, along with the total benefits of the cost.

Side-by-Side Comparison Table

| Feature | Marriott Amex Business | American Express Business Platinum | Chase Ink Business Preferred |

|---|---|---|---|

| Rewards Program | Marriott Bonvoy points; transferable to other partners | Membership Rewards points; transferable to various partners | Chase Ultimate Rewards points; transferable to airlines and hotels |

| Annual Fee | USD 95 (or varying depending on card version) | USD 695 | USD 95 |

| Airline Partnerships | Limited direct airline partnerships, but strong hotel focus | Broader airline partnerships | Strong airline and hotel partnerships |

| Travel Perks | Free nights at Marriott hotels, complimentary airport lounge access | Priority boarding, airport lounge access, and travel insurance | Global Entry/TSA PreCheck, airport lounge access |

| Spending Thresholds | No explicit spending threshold required | No explicit spending threshold required | No explicit spending threshold required |

This table provides a snapshot of key features, but a deeper evaluation requires considering individual travel habits and preferences. Each card possesses its strengths and weaknesses.

Potential Pitfalls and Considerations

Source: googleusercontent.com

While the Marriott Bonvoy Business American Express card offers numerous benefits, understanding potential pitfalls and considerations is crucial for responsible use. Carefully evaluating the associated costs, rewards program limitations, and potential risks can help maximize the card’s value and avoid unforeseen expenses.

Understanding the nuances of annual fees, spending thresholds, and redemption policies can prevent disappointment and ensure the card aligns with your specific business travel needs. Responsible card use, including adhering to terms and conditions, is paramount to avoiding potential issues.

Annual Fees and Spending Thresholds

Annual fees can significantly impact the card’s overall value. Understanding these costs about your expected business travel volume and spending patterns is vital. Some cards may have higher annual fees but offer potentially more significant rewards for higher spending levels. Analyzing your business travel expenses and the card’s reward structure will help you determine if the benefits justify the annual fee.

Potential Risks and Limitations of the Rewards Program

The Marriott Bonvoy Business rewards program, while valuable, does have inherent limitations. Redemption options may not always align with your specific travel needs, and availability can be influenced by demand and time of year. Furthermore, points expire after a certain period, and the redemption value can fluctuate based on factors like hotel category, location, and booking time. It’s crucial to be aware of these potential risks and limitations to avoid wasted rewards.

Hidden Costs and Fees

Beyond the annual fee, certain fees, such as foreign transaction fees, balance transfer fees, or cash advance fees, may be applied. Reviewing the terms and conditions for these fees is essential to avoid unexpected charges. A lack of awareness regarding these fees can lead to substantial expenses, reducing the overall value of the card.

Importance of Responsible Use and Understanding Terms and Conditions

A thorough understanding of the card’s terms and conditions is essential for responsible use. Reviewing the fine print, including redemption policies, spending requirements, and any potential restrictions, ensures you fully comprehend the associated obligations and potential limitations. Failure to adhere to the terms and conditions may lead to penalties or limitations on benefits.

Table of Potential Downsides

| Potential Pitfall | Explanation | Mitigation Strategy |

|---|---|---|

| High Annual Fee | Annual fees can be substantial, especially for cards with higher rewards. | Assess if the rewards justify the fee based on your spending habits. |

| Limited Redemption Options | Rewards may not always match desired travel dates, locations, or hotel categories. | Plan and be flexible with your travel dates and preferences. |

| Point Expiration | Unused points may expire after a certain period. | Utilize points before the expiration date or explore options for extending expiration. |

| Foreign Transaction Fees | Fees may apply when using the card in foreign countries. | Use alternative payment methods when possible, or compare exchange rates. |

| Hidden Fees | Unforeseen fees (balance transfers, cash advances) can reduce benefits. | Review terms and conditions meticulously before using these features. |

Illustrative Scenarios: Marriott Amex Business

Source: cloudinary.com

The Marriott Bonvoy Business American Express card offers a wealth of opportunities to optimize business travel expenses and maximize rewards. Understanding how to apply the card strategically across various situations can significantly enhance its value. These scenarios highlight practical applications and demonstrate how the card can save money and earn valuable rewards.

Scenario 1: Frequent Business Traveler

A frequent business traveler, Sarah, uses the Marriott Bonvoy Business card extensively for flights and accommodations. She books flights and hotels directly through the Marriott platform, and her card provides significant rewards on these purchases. She also takes advantage of the travel insurance and perks available to cardholders. This scenario highlights the potential for substantial savings and reward accumulation for frequent business travelers.

Scenario 2: International Business Trip

Consider a business trip to Europe. John, a business owner, uses the Marriott Bonvoy Business card for flights, airport transfers, and local transportation. He also takes advantage of the global network of Marriott hotels and the ability to redeem points for airport lounge access, which enhances his business travel experience.

Scenario 3: Short Business Trip to a Nearby City

For a short business trip to a nearby city, Mark uses the Marriott Bonvoy Business card for a local hotel. He books a rental car directly through the card portal, taking advantage of potential discounts. He also utilizes the card for meals and incidental expenses, accumulating points on every transaction.

Scenario 4: Group Business Trip

A company planning a group business trip to a conference can utilize the Marriott Bonvoy Business card for booking group accommodations. The card offers discounts on various services, and it can be used for meals and transportation for the entire group.

Scenario 5: Maximizing Rewards

This scenario showcases a strategic approach to maximizing rewards. By carefully planning trips and bookings through the Marriott platform, customers can accumulate significant points and miles. Using the points for upgrades or additional travel perks further enhances the value of the card.

Rewards Table

| Scenario | Travel Type | Reward Category | Potential Rewards (Example) |

|---|---|---|---|

| Frequent Business Traveler | Flights & Hotels | Points, Upgrades, Complimentary Amenities | Free night stay, flight upgrades, airport lounge access |

| International Business Trip | Flights, Accommodation, Local Transportation | Points, Discounts, Travel Insurance | Discounted airport transfers, significant point accrual, and insurance coverage |

| Short Business Trip | Local Hotels, Rental Cars | Points, Discounts | Hotel points, rental car discounts, and local meal savings |

| Group Business Trip | Group Accommodation, Meals, Transportation | Group Discounts, Points, Travel Perks | Group room discounts, complimentary breakfast, and travel insurance |

| Maximizing Rewards | Strategic Booking, Point Redemption | Points, Upgrades, Additional Perks | Free flights, upgrades, and early check-in privileges |

Additional Information and Resources

Staying informed and connected is crucial for maximizing the benefits of your Marriott Bonvoy Amex Business Card. This section provides essential resources for accessing support, understanding the program, and leveraging your card to its fullest potential.

Official Websites

Accessing the official websites of Marriott Bonvoy and American Express is vital for up-to-date information, policy changes, and program details. These sites offer comprehensive details about the card, rewards, and associated terms and conditions.

- Marriott Bonvoy: Provides information on the broader Marriott Bonvoy program, including hotels, points, and travel benefits.

- American Express: Offers details specific to the Marriott Bonvoy Amex Business Card, including terms and conditions, benefits, and contact information.

Customer Support and FAQs

For assistance and clarification on various aspects of the card, dedicated resources such as FAQs are available. These readily available resources can address common questions, saving you time and effort.

- Accessing FAQs: Both the Marriott Bonvoy and American Express websites feature extensive FAQs addressing common queries regarding the card, rewards redemption, and other related topics.

- Searching for answers: Utilize the search functionality on both websites to find answers to specific questions quickly. This will save you time and allow you to focus on using the card efficiently.

Contacting Customer Service

Knowing how to reach customer service is crucial for addressing specific issues or questions. Direct and prompt communication can expedite the resolution of any problems.

- Phone support: Contacting customer service via phone is a common method for personalized support. Details on phone numbers and hours of operation can be found on the respective websites.

- Email support: Email is an alternative channel for contacting customer service. This allows for written communication, documentation, and potentially faster responses depending on the volume of inquiries.

- Online chat support: Some websites offer online chat support for immediate assistance. This is particularly helpful for resolving immediate issues or receiving clarifications quickly.

Maximizing Card Benefits

Several tips can help you optimize your use of the Marriott Bonvoy Amex Business Card and maximize your rewards.

- Track your points: Regularly check your account balance to monitor your progress toward desired rewards or redemptions.

- Enroll in email alerts: Subscribe to email alerts for important updates, promotions, and special offers related to the card.

- Review terms and conditions: Understand the fine print to avoid unexpected charges or restrictions. Carefully review terms and conditions to ensure you are using the card within its limits.

Key Contact Information

The following table summarizes key contact information for customer support. This provides quick access to essential details for resolving issues.

| Website | Phone Support | Email Support |

|---|---|---|

| Marriott Bonvoy | (Phone number – varies by region) | (Email address – varies by region) |

| American Express | (Phone number – varies by region) | (Email address – varies by region) |

Note: Specific contact information is subject to change and should be verified on the respective websites.

Final Wrap-Up

In conclusion, the Marriott Amex Business card presents a compelling option for business travelers seeking a robust rewards program. By understanding the benefits, potential drawbacks, and strategies for maximizing rewards, you can make informed decisions about whether this card aligns with your individual travel and spending habits. Remember to carefully consider the annual fee, redemption options, and compare them to other business travel cards to ensure optimal value.