Marriott Bonvoy Business AMEX Card Your Business Travel Advantage

The Marriott Bonvoy Business American Express card offers a compelling package for business travelers. It combines substantial travel benefits with a comprehensive rewards program, making it a valuable tool for frequent fliers and those seeking exceptional perks. Understanding its features, fees, and alternatives is crucial for maximizing its potential and making an informed decision.

This review dives deep into the Marriott Bonvoy Business American Express card, exploring its benefits, associated fees, and comparisons to similar business credit cards. We’ll examine everything from earning potential and redemption options to the annual fee and creditworthiness requirements.

Benefits and Perks

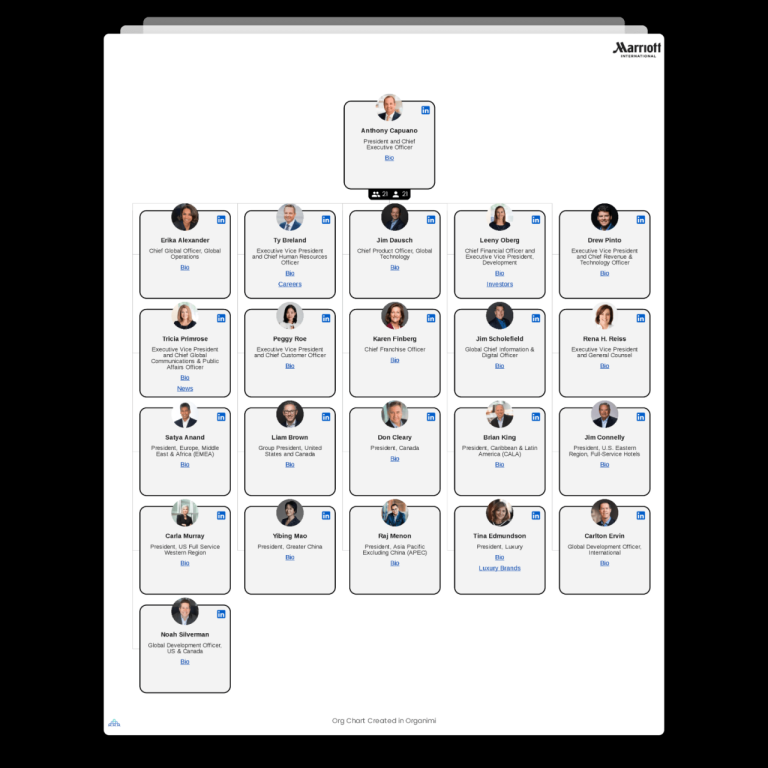

Source: marriott.com

The Marriott Bonvoy Business American Express card offers a comprehensive suite of benefits designed to enhance business travel and financial management. These perks extend beyond basic rewards, providing tangible value to cardholders. Understanding these benefits can help you make informed decisions about your business spending and travel arrangements.

Travel Benefits

The card provides a range of travel advantages. These benefits often contribute to a more seamless and enjoyable travel experience.

- Free Checked Baggage: Many business cards do not offer free checked baggage. This benefit is particularly useful for frequent travelers, saving money and streamlining the travel process. The exact allowance varies by airline and booking circumstances.

- Lounge Access: Access to airport lounges provides a comfortable and productive environment before or after flights. This is particularly valuable for extended layovers or when you need a quiet space to conduct business. Lounge access varies depending on the lounge and the Marriott Bonvoy program.

- Priority Boarding: Priority boarding can save valuable time and stress. This benefit allows cardholders to board flights ahead of the general public, reducing wait times and allowing for more efficient travel arrangements.

Financial Benefits

The card also provides several financial advantages, streamlining business expenses and providing additional value.

- Purchase Protection: Protection against purchase issues, such as lost or stolen items, can offer peace of mind for business-related purchases. This benefit safeguards investments and ensures that cardholders are covered against certain losses.

- Zero Foreign Transaction Fees: Eliminating foreign transaction fees can significantly reduce the cost of international business travel and expenses. This is crucial for businesses operating across borders.

- Enhanced Customer Service: Dedicated customer service for business cardholders can streamline support and address any issues promptly. This feature is particularly helpful when dealing with complex transactions or travel arrangements.

Earning and Redemption Potential

The card offers flexible options for earning and redeeming points. This flexibility is a key consideration for maximizing the value of the card.

- Earning Points: Points are earned based on spending, providing a direct link between business spending and reward accumulation. Specific earning rates are Artikeld in the cardholder agreement. For example, spending $1000 on eligible purchases may yield 1000 points.

- Redemption Options: Points can be redeemed for travel through Marriott Bonvoy, offering flexibility in choosing hotels, flights, and other travel experiences. The specific redemption rate varies depending on the type of redemption.

Comparison to Other Business Cards

The Marriott Bonvoy Business American Express card competes in a market with numerous similar offerings. Key factors to consider include earning rates, travel benefits, and redemption options. While specific earning rates and benefits may vary between cards, the Marriott Bonvoy card offers a substantial value proposition, particularly for frequent travelers.

Key Benefits Summary

| Benefit | Description | Value Proposition |

|---|---|---|

| Free Checked Baggage | Complimentary checked baggage allowance for eligible travel | Reduces travel costs and simplifies the travel process |

| Lounge Access | Access to select airport lounges | Provides a comfortable and productive environment for business travelers |

| Priority Boarding | Faster boarding on select flights | Saves time and enhances travel efficiency |

| Purchase Protection | Protection against eligible purchases | Provides peace of mind and reduces financial risk |

| Zero Foreign Transaction Fees | No fees on international transactions | Cost-effective international travel and business transactions |

| Enhanced Customer Service | Dedicated customer service for business cardholders | Streamlines support and ensures prompt issue resolution |

Fees and Requirements

The Marriott Bonvoy Business American Express card, while offering attractive benefits, comes with associated fees and requirements. Understanding these aspects is crucial for evaluating the card’s suitability for your business needs. Careful consideration of these factors will help you make an informed decision.

This section details the annual fee, other associated costs, spending requirements, creditworthiness criteria, and potential hidden charges to assist in your assessment. We’ll also compare the card’s fees to those of comparable business credit cards.

Annual Fee and Associated Costs

The annual fee for the Marriott Bonvoy Business American Express card varies depending on the specific terms and conditions of the card. It is important to carefully review the terms of the offer and card details for precise fee amounts. Other associated costs, such as foreign transaction fees or late payment penalties, are also possible, though these are often contingent on individual usage patterns.

Spending Requirements

The card issuer typically sets minimum spending requirements for maintaining the card. These requirements often differ based on the card’s specific offering, so always consult the card issuer’s terms and conditions for detailed information. While these spending requirements can vary, they often align with the card issuer’s risk assessment criteria.

Creditworthiness Criteria

The Marriott Bonvoy Business American Express card, like other credit cards, requires meeting specific creditworthiness criteria. Factors such as credit history, income, and debt-to-income ratio play a role in determining eligibility. A strong credit history generally increases the likelihood of approval.

Hidden Costs and Fees

Hidden costs may not always be immediately apparent in the card’s initial offering. Always review the fine print and the terms and conditions thoroughly to ensure awareness of all fees, including any transaction fees or interest rates. These costs can often be overlooked during initial card consideration.

Comparison to Other Business Cards

Comparing the Marriott Bonvoy Business American Express card to similar business credit cards is essential for making an informed decision. Consider factors like annual fees, rewards programs, and the range of benefits offered. Conducting thorough research into other business credit cards will help assess the value proposition of this particular card.

Fees Summary Table

| Fee Type | Description | Amount |

|---|---|---|

| Annual Fee | Recurring annual fee for card maintenance. | (Variable, consult the specific card offer) |

| Foreign Transaction Fee | Potential fee for transactions made in foreign currencies. | (Variable, consult the specific card offer) |

| Late Payment Fee | Fee for late payment of card balances. | (Variable, consult the specific card offer) |

| Interest Rate | Rate applied to outstanding balances. | (Variable, consult the specific card offer) |

Alternatives and Comparisons: Marriott Bonvoy Business American Express Card

Choosing the right business credit card can significantly impact your travel and financial management. Understanding the landscape of competitor cards allows you to make an informed decision tailored to your specific business needs. This section explores alternative premium business credit cards, highlighting their features and value propositions in comparison to the Marriott Bonvoy Business American Express card.

Comparative Analysis of Premium Business Cards

Various premium business credit cards from competitors offer compelling travel benefits and rewards programs. These cards often cater to different business travel preferences and spending patterns. A thorough comparison considering annual fees, travel perks, and point earning rates is crucial for a strategic choice.

Alternative Cards Targeting Business Travelers

Several alternative cards directly target business travelers, offering unique rewards structures and travel benefits. These cards frequently prioritize specific travel preferences, such as frequent flyer programs or hotel loyalty programs.

Features, Benefits, and Value Proposition of Alternative Cards, Marriott Bonvoy Business American Express Card

Alternative cards often emphasize specific areas like frequent flyer miles, hotel loyalty points, or broader spending categories. Understanding the card’s value proposition in terms of your business’s specific travel and spending habits is key. For example, a card focused on frequent flyer miles might be ideal for businesses that rely heavily on air travel. Conversely, a card emphasizing hotel points could be better for businesses with extensive hotel stays. The card’s benefits and features need to align with your business travel requirements to maximize value.

Pros and Cons of Alternative Cards Based on Specific Business Needs

The suitability of a card depends heavily on the specific travel and spending patterns of your business. Consider factors like flight frequency, hotel stays, and overall spending habits. A card with high travel benefits might not be as valuable if your business rarely utilizes air travel or hotel accommodations. Conversely, a card with broader spending category rewards could prove advantageous if your business has diverse expenses.

Comparative Table of Business Credit Cards

This table compares the Marriott Bonvoy Business American Express card with three other premium business credit cards, focusing on travel rewards, fees, and annual income requirements.

| Card Name | Annual Fee | Travel Benefits | Points Earning Rate |

|---|---|---|---|

| Marriott Bonvoy Business American Express | $95 | Marriott Bonvoy points, complimentary airport lounge access | Up to 3x points on Marriott stays and dining |

| Chase Sapphire Preferred Business Card | $95 | Travel credits, global entry, or TSA PreCheck, Chase Ultimate Rewards points | 3x points on travel, dining, and streaming services |

| American Express Business Platinum Card | $695 | Extensive travel benefits, including airport lounge access and global entry credits | 2x points on travel and dining, and 1x on all other purchases |

| Citi Prestige Business Card | $450 | Global entry, travel insurance, and hotel credits | 2x points on travel and dining, and 1x on all other purchases |

Last Recap

In conclusion, the Marriott Bonvoy Business American Express card presents a compelling proposition for business travelers seeking a comprehensive rewards program and travel perks. While the annual fee and specific requirements should be carefully considered, the substantial travel benefits and potential for significant point accumulation make it a noteworthy option. Weighing the benefits against the fees and comparing them to alternative business credit cards will ultimately determine their suitability for your specific travel and spending habits.