Amex Marriott Business Maximizing Rewards

Amex Marriott Business cards offer a compelling way for businesses to maximize travel rewards. This comprehensive guide explores the benefits of this card, outlining strategies for optimizing business travel expenses and analyzing the program’s value proposition within the broader context of business travel loyalty programs. Understanding the intricacies of earning and redeeming points, alongside detailed comparisons to other similar cards, empowers businesses to make informed decisions.

From detailed descriptions of the Amex Marriott Bonvoy Business card’s benefits and earning potential, to practical strategies for expense management and insightful comparisons to other loyalty programs, this exploration provides a complete overview of the Amex Marriott Business solution. Learn how to leverage the card for optimal rewards, manage travel expenses effectively, and analyze the program’s overall value for your business.

Amex Marriott Bonvoy Business Card Benefits

The Amex Marriott Bonvoy Business card offers a compelling suite of benefits tailored for business travelers. It provides valuable rewards for frequent business travel and expense management, potentially saving significant amounts of money over time.

This card goes beyond simply offering points; it provides a comprehensive travel and expense management solution for professionals. Its structure allows for flexibility in earning and redeeming rewards, making it a worthwhile consideration for business travelers.

Earning Potential

The card’s earning potential hinges on the volume of business travel and expenses. For every dollar spent on eligible purchases, you earn points that can be redeemed for flights, hotels, and other travel experiences. Points accumulate quickly with frequent use.

- Base Points Earned: A certain number of points are earned for every dollar spent on eligible purchases, usually varying depending on the specific card and spending category. For example, you might earn 3 points per dollar on eligible Marriott hotel stays and 1 point per dollar on other eligible business spending.

- Bonus Points: Depending on the card, there are often bonus opportunities for additional points, particularly during specific periods or for specific spending categories. This can significantly boost the overall earning potential.

- Tiered Earning Potential: Some cards may offer increased earning rates based on spending levels, which can significantly improve the overall return on investment for cardholders with high business expenses.

Redemption Options

Points earned on the Amex Marriott Bonvoy Business card can be redeemed in a variety of ways. The flexibility in redemption options is a key aspect of the card’s value.

- Direct Redemption: Points can be directly exchanged for Marriott Bonvoy points, allowing for flexibility in travel choices across the Marriott portfolio and other partners.

- Partner Programs: The Marriott Bonvoy program often partners with airlines and other travel providers. This opens up redemption opportunities for flights, car rentals, and other travel-related expenses.

- Transferring to Other Programs: Certain Marriott Bonvoy cards may allow you to transfer points to other airline or hotel programs. This allows for a diverse range of redemption options.

Business Travel and Expense Management

The Amex Marriott Bonvoy Business card can streamline business travel and expense management. By using the card for eligible expenses, you’re able to track transactions and expenses easily.

- Expense Tracking: The card’s features often include robust expense tracking capabilities, allowing for detailed record-keeping of business trips and expenses.

- Simplified Expense Reports: This simplified process for expense reports can save considerable time and effort, especially when traveling frequently for business.

- Potential Savings: The potential for savings comes from maximizing rewards on business travel, effectively reducing the cost of business trips over time.

Comparison to Other Business Travel Cards

| Feature | Amex Marriott Bonvoy Business | [Competitor 1] | [Competitor 2] |

|---|---|---|---|

| Hotel Focus | High, specifically Marriott Bonvoy | General travel rewards | Airline-focused rewards |

| Earning Rate (example) | 3 points per $1 on Marriott stays | 2 points per $1 on various spending | 1 point per $1 on eligible purchases |

| Redemption Flexibility | Wide, including Marriott and partners | Limited, often focused on partner airlines | Narrow, primarily focused on flights |

| Annual Fee | [Insert annual fee] | [Insert annual fee] | [Insert annual fee] |

Note: The above table is a simplified example. Specific details vary based on the card and its terms and conditions. Always consult the official card issuer for precise information.

Business Travel & Expense Management with Amex Marriott: Amex Marriott Business

Leveraging the Amex Marriott Bonvoy Business Card for business travel expenses can significantly enhance your return on investment. This card offers numerous benefits beyond the standard rewards program, providing streamlined expense management and potential cost savings. Maximizing these advantages requires a strategic approach to tracking, categorizing, and submitting expenses.

Effective expense management with the Amex Marriott Bonvoy Business Card goes beyond simply accumulating points. It’s about optimizing your travel and expense processes for efficiency and maximizing the rewards. By meticulously tracking and categorizing your spending, you can ensure accurate reimbursements and maximize your rewards potential. This approach also contributes to a more organized and efficient business operation.

Strategies for Maximizing Card Value for Business Travel Expenses

Careful planning and execution are key to maximizing the value of the Amex Marriott Bonvoy Business Card for business travel expenses. Understanding the card’s benefits and applying them strategically is crucial for optimal returns. This includes selecting the right travel options and adhering to expense policies.

- Optimize Booking Channels: Utilizing the card’s travel portal or partner websites can provide exclusive offers and discounts. This can translate to substantial savings compared to independent searches.

- Prioritize Preferred Hotels: Actively using the card’s benefits for accommodations at Marriott Bonvoy properties can enhance reward-earning potential and potential discounts.

- Utilize Travel Insurance: The card’s potential travel insurance coverage should be evaluated to ensure that it aligns with your specific travel needs. This can offer peace of mind and protection in unforeseen circumstances.

Tracking and Categorizing Business Spending for Optimal Rewards

Accurate tracking and proper categorization of business expenses are vital for accurate reimbursement and maximizing reward potential. This process also aids in better financial management and reporting.

- Establish a Consistent System: Implementing a detailed system for recording expenses, including dates, locations, descriptions, and amounts, ensures accurate tracking.

- Utilize Expense Tracking Software: Leveraging expense management software can automate the categorization process, reducing manual effort and increasing accuracy. Examples include Expensify, Concur, and others.

- Categorize Expenses Precisely: Categorizing expenses accurately based on predefined business guidelines and company policies ensures efficient reimbursement and adherence to company policies.

Step-by-Step Guide to Effectively Manage Business Travel and Expenses with the Card

This detailed guide articulates the process of effectively managing business travel and expenses using the Amex Marriott Bonvoy Business Card.

- Record all Expenses Immediately: Documenting each expense promptly, including details like date, vendor, description, and amount, is essential for accurate reporting.

- Organize Receipts and Documentation: Maintaining organized records of receipts and supporting documentation is crucial for the reimbursement process. This includes storing copies digitally for ease of access.

- Submit Receipts and Documentation for Reimbursement: Complying with your company’s specific reimbursement procedures is critical. This often involves using a designated form or system for submission.

Submitting Receipts and Documentation for Reimbursement

A well-defined process for submitting receipts and documentation is critical for smooth reimbursement and avoids delays. This process ensures that expenses are properly validated and reimbursed promptly.

- Adhere to Company Policy: Following your company’s specific reimbursement guidelines is crucial. These guidelines will articulate the required documentation and submission procedures.

- Ensure Accuracy: Double-checking all information for accuracy is essential to avoid issues during the reimbursement process. This includes verifying dates, amounts, and descriptions.

- Maintain Copies: Retain copies of submitted receipts and documentation for your records. This is important for reference and in case of any discrepancies.

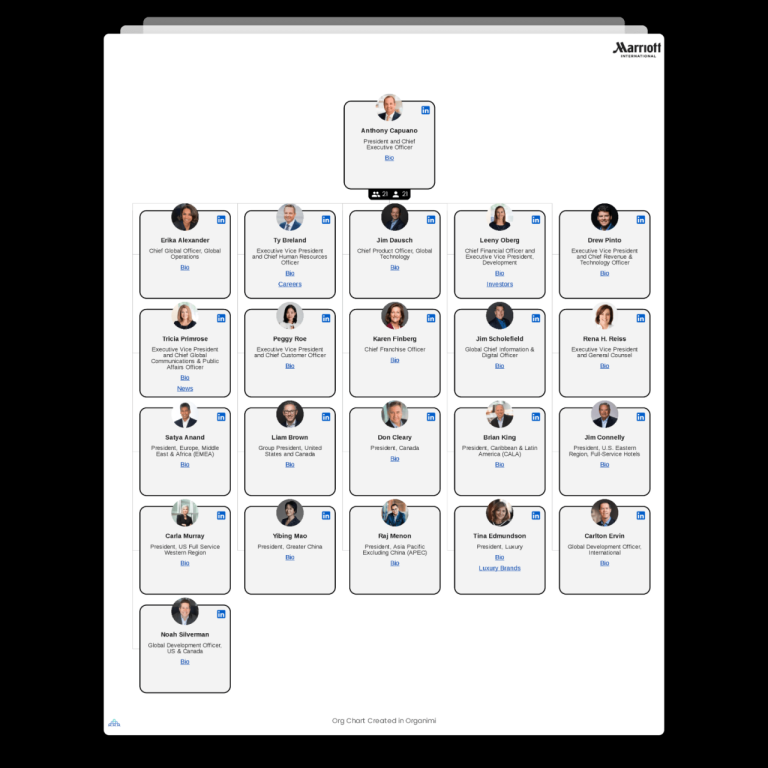

Analyzing the Marriott Bonvoy Business Program

Source: bankdealguy.com

The Marriott Bonvoy Business program is designed to cater to the specific needs of business travelers. Understanding how it stacks up against other loyalty programs and its inherent strengths and weaknesses is crucial for evaluating its suitability. This analysis will explore its features, potential alternatives, and its hotel categorization system.

The Marriott Bonvoy Business program, while focusing on business travelers, aims to provide benefits that extend beyond simple rewards. By examining its unique characteristics, including the tiered hotel categories and associated perks, we can gain a more comprehensive understanding of its potential value proposition compared to other business travel programs.

Comparison to Other Business Travel Loyalty Programs

Various business travel loyalty programs exist, each with its own set of benefits and drawbacks. A key aspect in comparing programs is examining the breadth and depth of the rewards offered. Some programs might prioritize elite status benefits like airport lounge access, while others emphasize earning points quickly on flights or hotel stays. Each program has a different approach, and travelers should consider their travel patterns and preferences when evaluating them. For example, a frequent domestic business flyer might find a program emphasizing domestic flight miles more attractive than one focused on international hotel stays.

Pros and Cons of the Marriott Bonvoy Business Program

- Pros: The Marriott Bonvoy Business program offers a wide network of Marriott hotels globally, providing options for diverse business travel needs. Its status-matching feature allows for quick accumulation of benefits. Furthermore, the program often includes perks like complimentary breakfast and room upgrades, which can be substantial savings for frequent business travelers. Early check-in and late check-out are also common benefits for elite members.

- Cons: Like any program, the Marriott Bonvoy Business program has its limitations. The earning rate for points might not always be competitive compared to other programs that offer bonus points on specific spending categories. The value of the perks can also fluctuate based on the specific hotel and location. Potential downsides could also be seen in limited flexibility in redeeming points for flights outside the Marriott network, which is something to consider.

Potential Alternatives to the Amex Marriott Bonvoy Business Card

Choosing an alternative to the Amex Marriott Bonvoy Business Card depends on individual travel patterns and spending habits. Consider the following:

- Other Co-branded Cards: Other credit card companies often offer co-branded cards tied to specific hotel chains or airlines. These cards may offer comparable or even superior benefits in terms of earning rates, especially if a traveler frequently uses a particular airline or hotel chain.

- Points-Based Programs: Points-based programs that reward general spending or activities might provide a wider array of redemption options. This could be a valuable alternative if a traveler’s spending or travel preferences aren’t perfectly aligned with the Marriott Bonvoy program.

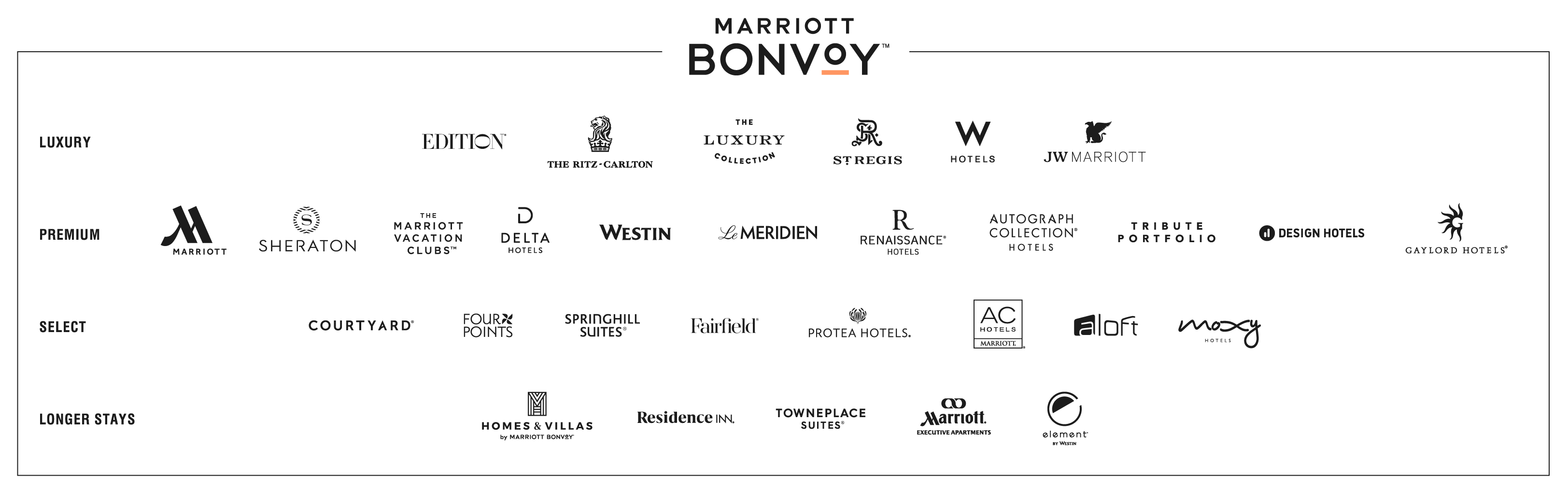

Hotel Categories and Tiers within the Marriott Bonvoy Program

The Marriott Bonvoy program categorizes hotels into different tiers, reflecting the quality and amenities offered. Understanding these tiers is vital for maximizing rewards and benefits. A higher tier generally translates to better amenities and potential for higher status benefits.

| Hotel Category | Description |

|---|---|

| Luxury | High-end hotels with premium amenities and services. |

| Boutique | Smaller, independent hotels often with a unique character. |

| Select | A wide variety of hotels catering to different needs and preferences. |

The tiers within each category reflect the specific quality of the hotel. Higher tiers generally mean more perks and benefits for loyalty members.

Potential Use Cases & Value Proposition

Source: miles-and-more.com

The Amex Marriott Bonvoy Business card offers a compelling value proposition for businesses of all sizes. By leveraging its extensive rewards program and travel benefits, companies can optimize their expense management and enhance employee travel experiences. This section delves into diverse use cases and demonstrates how the card can significantly impact a business’s bottom line.

Diverse Business Applications

The Amex Marriott Bonvoy Business card isn’t just for large corporations; it caters to a wide spectrum of businesses. From small startups to established enterprises, the card’s flexible benefits can streamline travel and reward loyalty. Businesses can utilize the card for a variety of needs, including company meetings, employee conferences, and business trips for sales representatives or executives. The card’s flexibility is a key factor in its appeal.

Scenarios of High Value Proposition

This card shines in scenarios where travel is a significant component of the business operation. For example, a marketing firm hosting a large conference for clients would benefit from the card’s extensive hotel network and rewards program. Similarly, a software company sending its sales team on a cross-country roadshow would find the card’s travel and expense management tools invaluable. The card’s comprehensive benefits make it an attractive option for businesses with substantial travel budgets.

Rewards Tier Structure, Amex Marriott Business

The Amex Marriott Bonvoy Business card offers tiered rewards, reflecting varying levels of spending and loyalty. This tiered structure incentivizes higher spending and ensures that users receive rewards commensurate with their travel volume.

| Rewards Tier | Annual Spending Threshold | Benefits |

|---|---|---|

| Bronze | $10,000 – $20,000 | Earn points on eligible purchases, basic travel perks, and potential early bird discounts. |

| Silver | $20,000 – $40,000 | Increased earning rates on points, priority boarding on flights, and elevated hotel benefits, such as premium room upgrades. |

| Gold | $40,000+ | Exclusive access to elite airport lounges, expedited check-in and check-out, and a dedicated travel concierge for personalized travel assistance. |

Case Study: “InnovateTech Solutions”

InnovateTech Solutions, a mid-sized technology consulting firm, utilized the Amex Marriott Bonvoy Business card to manage its travel expenses and reward employee loyalty. The company’s annual travel budget is approximately $50,000, and its employees frequently attend industry conferences and client meetings. By leveraging the card’s rewards program, InnovateTech was able to accumulate points for stays at Marriott hotels, leading to substantial savings on future trips. The card’s integrated expense management tools streamlined the expense reporting process, saving the company valuable time and resources. Moreover, the increased loyalty points enabled the firm to book better-class accommodations for important client meetings. This resulted in a more positive client experience and a perceived elevation of the company’s brand image.

Last Word

Source: 10xtravel.com

In conclusion, the Amex Marriott Business card presents a powerful tool for businesses seeking to streamline travel expenses and maximize rewards. By understanding the benefits, implementing effective expense management strategies, and comparing the program to alternatives, businesses can optimize their travel spending and gain valuable insights into the potential returns. This guide provides the essential knowledge to make informed decisions about incorporating this card into your company’s travel strategy.