Amex Marriott Bonvoy Business Your Travel Toolkit

Amex Marriott Bonvoy Business unlocks a world of travel rewards and expense management tools. This card offers a powerful combination of hotel points, flight miles, and expense tracking features tailored for business travelers. Understanding its benefits, practical applications, and alternatives is key to maximizing your return on travel spend.

This comprehensive guide delves into the specifics of the Amex Marriott Bonvoy Business card, comparing it to other options and highlighting its advantages for optimizing business travel expenses and rewards. Learn how to leverage its features for maximizing points and efficiently managing your business travel budget.

Benefits of Amex Marriott Bonvoy Business

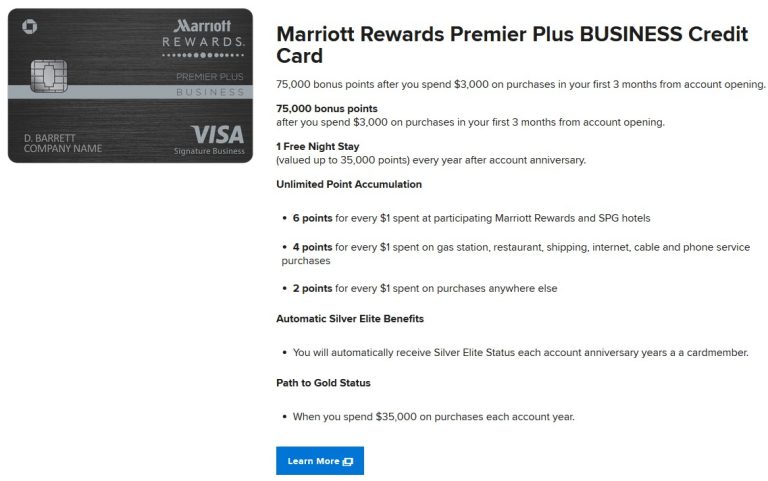

Source: fastly.net

The Amex Marriott Bonvoy Business card offers a compelling proposition for business travelers, combining valuable rewards with practical travel benefits. This card excels in providing substantial value for frequent business journeys, and its rewards structure aligns well with typical business spending patterns. A key differentiator lies in its connection to the Marriott Bonvoy program, which allows for flexibility and rewards across a wide range of travel accommodations.

This card provides a comprehensive suite of benefits, including robust earning rates on various business expenses, access to elite status benefits, and valuable travel protections. It stands out from other business travel cards by emphasizing the Marriott Bonvoy ecosystem, offering a unique rewards structure tailored to frequent travelers. Understanding the detailed benefits, earning rates, and comparisons to other options is essential for making an informed decision.

Rewards Earning Rates

The Amex Marriott Bonvoy Business card boasts flexible earning rates, catering to different spending patterns. A significant advantage is the ability to earn valuable points on various business-related expenses.

| Spending Category | Points Earned per $1 Spent |

|---|---|

| Marriott Hotels & Resorts | 10 points |

| Flights booked through Amex Travel | 3 points |

| Other Travel Purchases (excluding hotels and flights) | 1 point |

| Restaurants and other purchases | 1 point |

This table illustrates the earning structure. While not as high as cards focused exclusively on travel, the card’s broad coverage of business spending is a considerable advantage. Note that earning rates can fluctuate based on promotions and spending activity.

Elite Status Benefits

Achieving and maintaining elite status through the Marriott Bonvoy program provides significant advantages. These benefits extend beyond just the card itself, encompassing perks applicable to all Marriott Bonvoy members. Meeting specific spending criteria or accumulating a certain number of points can unlock various elite status privileges. Examples include expedited check-in and check-out, room upgrades, lounge access, and priority baggage handling. These perks significantly enhance the overall travel experience for frequent business travelers.

Travel Protections

The Amex Marriott Bonvoy Business card comes with travel protections, offering peace of mind for business journeys. This protection encompasses various aspects, including trip interruption insurance, baggage delay coverage, and emergency medical assistance. These protections can provide essential coverage in unforeseen circumstances. A thorough review of the card’s specific terms and conditions is recommended to understand the scope of coverage.

Comparison to Other Business Travel Cards

Comparing the Amex Marriott Bonvoy Business card to other business travel credit cards reveals key distinctions. While cards focused solely on airline miles may offer higher earning rates on flights, the Amex Marriott Bonvoy Business card stands out with its comprehensive rewards structure covering hotels, restaurants, and general business expenses. The breadth of earning categories and the integrated Marriott Bonvoy program are significant advantages. Different cards will have varying earning rates and benefit packages; it is crucial to analyze the specific needs and spending habits of each business traveler.

Practical Uses for Business Travelers

Source: fitsmallbusiness.com

Maximizing rewards and minimizing costs are paramount for business travelers. The Amex Marriott Bonvoy Business card offers a powerful toolkit for achieving these goals. This section details practical strategies for leveraging the card’s benefits, from optimizing point redemptions to streamlining travel processes.

Effective utilization of the Amex Marriott Bonvoy Business card requires a strategic approach to both flight and hotel bookings. Understanding the card’s benefits and implementing smart redemption strategies can significantly reduce travel expenses while maximizing rewards.

Optimizing Point Redemptions for Flights

Strategic point redemption for flights hinges on understanding the program’s structure and various redemption options. A flexible approach, considering factors like availability and redemption rates, is crucial for maximizing value. Different booking platforms might offer varying rates for the same flight. It’s essential to explore multiple avenues to find the most favorable redemption terms.

- Flexibility is Key: Don’t be rigid in your preferred dates or destinations. Exploring alternative dates and locations can often unlock better redemption rates. Flexibility allows you to secure flights that align with your priorities and yield the best value for your points.

- Compare Redemption Platforms: The Amex Marriott Bonvoy program might offer point redemption through various partners. Comparing redemption rates across these platforms can help you secure the best deal for your flights. Thorough research is critical for uncovering optimal options.

- Consider Booking in Advance: Booking flights in advance, especially for high-demand routes or travel periods, can potentially increase your chances of finding favorable redemption rates. This proactive approach allows you to seize opportunities for better value.

Optimizing Point Redemptions for Hotels

Hotel redemption strategies are crucial for maximizing value with the Amex Marriott Bonvoy Business card. The card’s affiliation with the Marriott Bonvoy program unlocks a vast network of hotels globally. A proactive approach to searching for and booking accommodations is essential for optimizing your point usage.

- Prioritize Marriott Bonvoy Hotels: Prioritizing Marriott Bonvoy hotels for redemption can yield significant savings and rewards. The vast network of Marriott hotels offers flexibility and variety in accommodation choices.

- Leverage Flexible Booking Options: Exploring flexible booking options, including dates and room types, can often unlock better redemption rates. Adjusting your parameters allows for greater flexibility in finding the most favorable hotel accommodations.

- Utilize Award Booking Tools: Many online travel agencies or hotel booking platforms offer tools specifically designed for redeeming award points. Utilizing these tools can significantly simplify the process and help you uncover optimal redemption opportunities.

Best Practices for Domestic and International Travel

This section Artikels strategies for utilizing the Amex Marriott Bonvoy Business card effectively for both domestic and international travel. Different factors influence travel costs and rewards in different locations.

- Domestic Travel: The card’s benefits for domestic travel can significantly impact your overall travel experience, offering rewards and savings. Using the card for daily expenses, such as dining and transportation, can accrue points for future travel.

- International Travel: For international travel, the card’s foreign transaction fees and international redemption options are crucial. Understanding the implications of these factors is essential for maximizing rewards and minimizing costs.

Redemption Guide: Flights and Hotel Stays

This section provides a step-by-step guide to redeem points for flights and hotel stays using the Amex Marriott Bonvoy Business card.

- Log in to your Marriott Bonvoy account. Accessing your account provides access to your points balance and redemption options.

- Search for flights or hotels. Utilize the platform’s search functionality to identify available options for redemption.

- Select your desired flights or hotel stay. Review the availability and redemption requirements.

- Apply your points for redemption. Follow the platform’s instructions to redeem your points for the selected flights or hotel stays.

- Confirm and finalize your booking. Complete the booking process, and ensure you receive confirmation of your redemption.

Expense Management and Reporting

Streamlining expense tracking and reporting is crucial for business travelers. The Amex Marriott Bonvoy Business card offers robust tools to simplify this process, enabling accurate and timely expense management. This feature significantly reduces administrative burdens and ensures compliance with company policies.

Effective expense management often hinges on efficient receipt organization and expense categorization. The Amex Marriott Bonvoy Business card simplifies this process through its digital platform, which allows for easy upload and organization of receipts. This automated system is designed to reduce manual effort, thereby optimizing the overall expense reporting workflow.

Receipt Organization and Categorization

Proper receipt organization is fundamental to accurate expense reporting. The card’s online portal provides a dedicated space for uploading receipts, allowing for easy categorization. This structured approach ensures receipts are easily accessible when needed. By using specific tags and descriptions, travelers can quickly sort and retrieve relevant receipts. A common method involves categorizing receipts by expense type (e.g., meals, lodging, transportation) and then further organizing them by date or trip.

Expense Reporting Options

The Amex Marriott Bonvoy Business platform provides multiple expense reporting options to accommodate diverse business needs. This versatility is critical in ensuring compliance with company policies. The card’s online portal facilitates the process of uploading receipts, classifying expenses, and generating reports.

| Expense Reporting Option | Description |

|---|---|

| Automated Expense Tracking | The platform automatically categorizes expenses based on pre-defined rules, streamlining the reporting process. |

| Manual Expense Entry | For expenses that do not fit pre-defined categories, manual entry allows for precise expense details. |

| Customizable Reporting | Users can customize reports to meet specific business needs, tailoring them to individual reporting requirements. This often involves filtering by date range, expense type, or other criteria. |

| Integration with Accounting Software | Many accounting platforms integrate with the Amex Marriott Bonvoy Business platform. This integration streamlines data transfer and ensures expense data is readily available for reconciliation. |

Reconciliation Using the Online Portal

The online portal facilitates expense reconciliation by providing a clear overview of all expenses. This streamlined process ensures that reported expenses align with actual transactions. Users can easily compare uploaded receipts against the reported expenses, quickly identifying discrepancies. Detailed transaction history, along with comprehensive reporting tools, makes the reconciliation process accurate and transparent.

Alternatives and Considerations

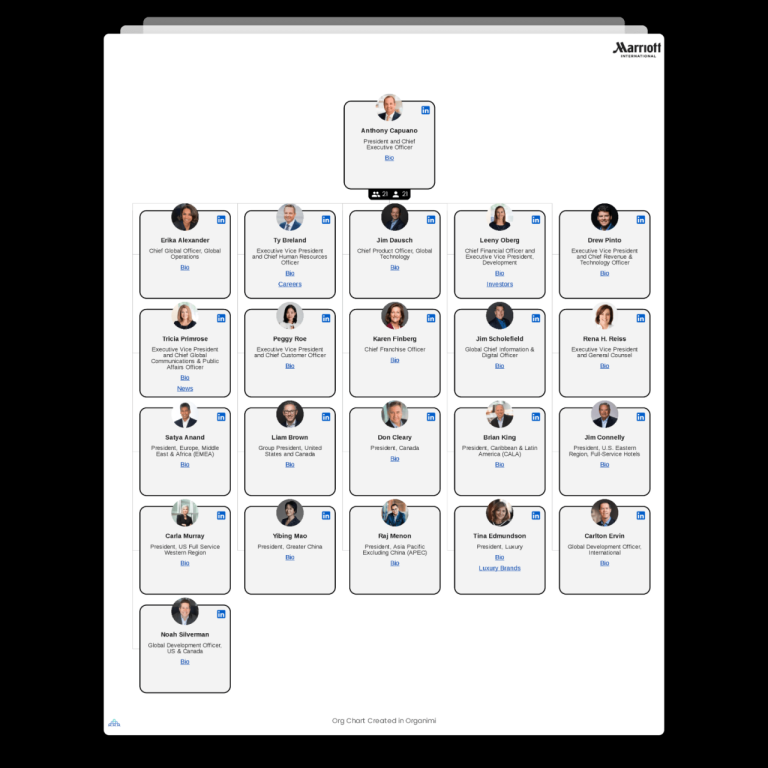

Source: cloudfront.net

While the Amex Marriott Bonvoy Business card offers compelling benefits, exploring alternative options is crucial for aligning with individual business travel needs and priorities. This section examines potential alternatives, highlighting key differences and considerations for selecting the most suitable card.

A multitude of business travel credit cards are available, each with its own unique rewards structure and benefits. Careful evaluation of these options, considering factors like spending habits, travel frequency, and desired rewards, is essential for maximizing value. Understanding the value proposition of different cards is critical for making informed decisions.

Potential Alternatives to the Amex Marriott Bonvoy Business

Various cards cater to different business travel preferences. Alternatives might include cards emphasizing flexible travel points, cash back, or specific airline partnerships, depending on your frequent flyer program and travel routes. Choosing the right alternative hinges on factors such as the volume of business travel and the desired reward structure.

Comparison with Similar Business Travel Cards

Direct comparison of the Amex Marriott Bonvoy Business with other cards is essential for understanding relative value. Factors like earning rates, bonus categories, and redemption options should be scrutinized. Different cards excel in different areas, such as travel rewards, expense management tools, or hotel loyalty programs.

Factors to Consider When Selecting a Business Travel Card

Several factors should guide the selection process. Understanding spending habits and travel frequency provides context for choosing the most advantageous card. A business traveler who frequently utilizes a specific airline or hotel chain might find a card with corresponding partnerships particularly attractive. Furthermore, the ease of expense reporting and redemption options are critical aspects to consider.

Alternative Business Travel Cards, Amex, Marriott, Bonvoy Business

| Card Name | Key Features | Potential Advantages | Potential Disadvantages |

|---|---|---|---|

| Chase Ink Business Preferred | High earning rate on travel and other business expenses; generous welcome bonus; strong travel portal; excellent for frequent travelers. | Excellent earning potential; extensive travel portal. | Potentially higher annual fee compared to some alternatives; rewards may not align perfectly with every traveler’s needs. |

| American Express Platinum Business Card | Extensive benefits, including airport lounge access, concierge services, and premium travel protections; strong global acceptance. | Excellent perks and benefits; wider acceptance internationally. | High annual fee; the earning structure may not be the best for all business travelers. |

| Capital One Venture X Rewards Credit Card | Flexible travel points, transferrable to various partners, and exceptional bonus categories. | Transferable points, broad redemption options. | It may have fewer perks compared to other business travel cards. |

| Citi® / AAdvantage® Executive World Elite Mastercard® | Strong partnership with American Airlines; potentially attractive for frequent American Airlines flyers. | Excellent rewards for frequent American Airlines travelers. | Limited redemption options outside of American Airlines. |

Closure: Amex Marriott Bonvoy Business

In conclusion, the Amex Marriott Bonvoy Business card provides a multifaceted approach to business travel, combining rewards, expense management, and travel protection. By understanding its benefits and strategic applications, business travelers can significantly enhance their travel experiences and optimize their spending. While alternative options exist, this card stands out for its comprehensive features. Whether you’re a frequent flyer or a new business traveler, exploring its potential is worthwhile.