Marriott Biz Card Your Business Travel Companion

Marriott Biz Card sets the stage for a detailed exploration of this valuable business travel credit card. It delves into the benefits, rewards, and application process, making it a helpful guide for anyone considering this option.

This card offers a range of perks specifically designed for business travelers. From earning points toward free nights at Marriott hotels to potential elite status, it promises significant value for frequent travelers. The card’s features are meticulously examined, alongside comparisons with other business travel cards, to provide a comprehensive overview. A clear understanding of the application process, account management, and responsible spending is also included, addressing potential concerns and highlighting the benefits.

Introduction to Marriott Biz Card

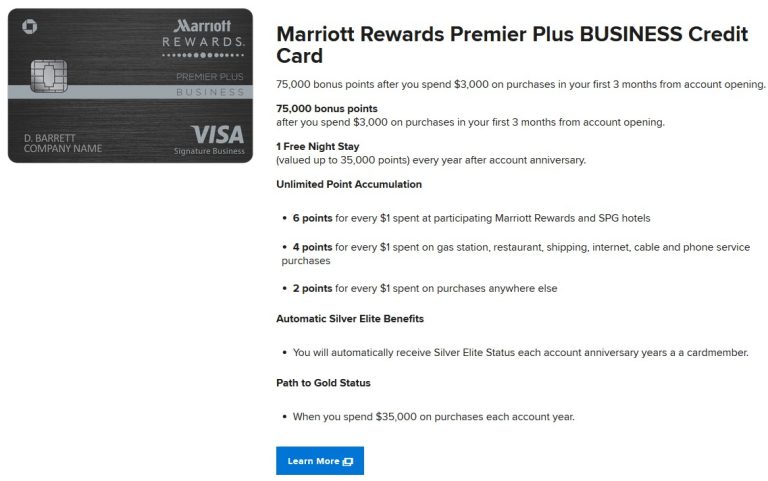

Source: marriott.com

The Marriott Bonvoy Business Credit Card offers a streamlined way for business travelers to earn rewards and maximize their travel spending. This card is designed to cater to the needs of professionals who frequently utilize Marriott properties and other travel services. It provides tangible benefits that can translate into significant savings and valuable perks.

The card’s benefits extend beyond the initial rewards structure, providing access to exclusive experiences and services designed to enhance the overall travel experience for the business professional.

Card Description

The Marriott Bonvoy Business Credit Card is a premium travel credit card that links directly to the Marriott Bonvoy rewards program. This allows cardholders to accumulate points for travel expenses, including hotel stays, flights, and rental cars.

Benefits and Perks

This card provides various perks and benefits tailored to business travelers. These benefits often include complimentary perks such as lounge access, priority boarding, and free checked baggage. Many cards offer enhanced benefits, such as expedited check-in and check-out at Marriott properties, and bonus points on specific travel purchases.

Target Audience

The primary target audience for this card is business travelers, frequent travelers, and professionals who utilize Marriott properties and services. The card is also attractive to those who frequently book flights, hotels, and rental cars.

Key Features and Advantages

- Earning Potential: The card offers substantial earning potential, with points awarded on eligible purchases, including hotel stays, flights, and other travel-related expenses. For instance, you can earn 3x points on Marriott stays and 2x points on flights and other travel expenses. This allows for quick accumulation of rewards, potentially enabling free stays or upgrades in the future.

- Rewards Redemption: Points earned can be redeemed for various travel experiences, including hotel stays, flights, and rental cars. The flexibility of the redemption process allows users to select the most suitable option to meet their needs.

- Business Travel Focus: The card offers features specifically designed for business travel, such as expense reporting tools, which sisimplifyracking and reporting of business-related expenses. The card also provides tools for managing and organizing trips.

- Lounge Access: Some versions of the card include complimentary access to select airport lounges, providing a comfortable and productive environment before or after flights.

Comparison with Other Business Travel Cards

| Feature | Marriott Bonvoy Business Card | American Express Business Platinum | Chase Ink Business Preferred |

|---|---|---|---|

| Annual Fee | Variable | $695 | $95 |

| Hotel Points Earnings | 3x on Marriott stays | Variable | 1x on travel |

| Flight Points Earnings | 2x on flights | Variable | 1x on travel |

| Lounge Access | Potential for complementary access | Complimentary access | No complimentary access |

Note: Specific features and benefits can vary depending on the specific card variant and issuer’s terms and conditions. The table provides a general comparison and may not encompass all features. Detailed information should be reviewed on the issuer’s website.

Benefits and Perks

The Marriott Bonvoy Business Card offers a compelling suite of benefits designed to enhance the travel experience of business professionals. These perks extend beyond simply accumulating points; they provide tangible value in streamlining travel arrangements and maximizing the return on business trips.

The card’s rewards program is intricately linked to the broader Marriott Bonvoy loyalty program, allowing cardholders to leverage their existing loyalty status or build one. Earning and redeeming points is straightforward and offers a flexible approach to travel rewards.

Marriott Bonvoy Rewards Program

The Marriott Bonvoy Rewards program allows cardholders to accumulate points for every dollar spent on eligible travel and dining purchases. This flexible system offers substantial earning potential, and the points can be redeemed for a wide range of travel experiences.

- Earning Potential: Points are accumulated at a rate that varies depending on the specific cardholder’s spending habits and the categories of spending. For example, business travel expenses, such as flights, hotel stays, and meals, can translate directly into significant point accrual.

- Redemption Options: Points can be redeemed for a multitude of travel experiences, including hotel stays, flights, and even experiences within the Marriott Bonvoy portfolio. Flexibility in redemption is key; points can be exchanged for specific hotels, flights, or even combined to create a customized travel package.

Travel Benefits

The Marriott Bonvoy Business Card provides substantial travel benefits that streamline the business trip experience.

- Free Nights: The card offers the potential for earning free nights at participating Marriott hotels, depending on the cardholder’s spending and the chosen redemption program. This is particularly beneficial for frequent business travelers who need to stay at Marriott properties.

- Elite Status: Reaching specific spending thresholds can unlock elite status within the Marriott Bonvoy program. This elite status translates to additional perks, such as priority check-in and check-out, access to exclusive lounges, and more.

- Lounge Access: Depending on the cardholder’s elite status or the specific card type, access to Marriott Bonvoy lounges may be included. This amenity provides a comfortable and productive space for travelers to relax and work during layovers or before and after meetings.

Value Proposition for Business Travelers

The Marriott Bonvoy Business Card offers substantial value for business travelers. The rewards program and travel benefits directly translate to tangible cost savings and improved travel experiences. A business traveler who regularly stays at Marriott hotels, for example, can significantly reduce the overall cost of their travel by earning free nights and enjoying lounge access.

Reward Tiers and Benefits, Marriott biz card

The following table articulates the different reward tiers and their associated benefits:

| Reward Tier | Associated Benefits |

|---|---|

| Bronze | Basic point earning rate, standard benefits. |

| Silver | Enhanced point earning rate, priority check-in/check-out, lounge access in select locations. |

| Gold | Higher point earning rate, priority boarding, and exclusive access to premium lounges. |

| Platinum | Highest point earning rate, dedicated concierge service, enhanced lounge access, and expedited check-in. |

Application and Membership

Applying for the Marriott Bonvoy Business Credit Card involves a straightforward process. Understanding the requirements and eligibility criteria is crucial for a smooth application experience. Potential approval or rejection scenarios can be anticipated by familiarizing yourself with the application process. This section provides a comprehensive guide, outlining the steps, necessary documents, and potential outcomes.

Application Process Overview

The application process for the Marriott Bonvoy Business Credit Card is designed to be efficient and user-friendly. Applicants will need to provide personal and business information, and potentially financial details. Completing the application accurately and thoroughly will increase the chances of approval.

Eligibility Criteria

To be eligible for the Marriott Bonvoy Business Credit Card, applicants typically need to meet certain requirements. These requirements may vary depending on the specific card type and may include factors such as credit history, income, and business structure. Detailed criteria are typically found on the Marriott Bonvoy website or within the application form.

Potential Application Outcomes

Application outcomes can vary. Approval is contingent upon meeting the eligibility criteria and a satisfactory assessment of the applicant’s creditworthiness. Rejection may stem from factors like insufficient credit history, high debt levels, or inconsistent financial information. It is important to understand that these factors are common reasons for rejection, and the applicant should strive to improve their financial profile.

Step-by-Step Application Guide

- Visit the official Marriott Bonvoy website and navigate to the Business Credit Card application page.

- Provide accurate and complete personal and business information. Ensure all details are verified and correct.

- Provide the required financial information. This may include details of business revenue, expenses, and debts.

- Review the application carefully before submitting it to ensure accuracy.

- Apply and await notification. The approval or rejection process may take several business days.

Flowchart of Application Procedure

(A visual flowchart depicting the application process, with boxes representing steps, arrows showing the direction of the process, and decision points indicating approval or rejection based on meeting eligibility criteria. This flowchart is a conceptual representation and not a visual element. It would ideally include steps from the previous section.)

Requirements for Different Card Types

| Card Type | Credit Score Requirement | Annual Revenue Requirement | Business Structure |

|---|---|---|---|

| Marriott Bonvoy Business Premier Card | 650+ | $100,000+ | Sole Proprietorship, Partnership, LLC |

| Marriott Bonvoy Business Select Card | 600+ | $50,000+ | Sole Proprietorship, Partnership, LLC |

| Marriott Bonvoy Business Essential Card | 550+ | $30,000+ | Sole Proprietorship, Partnership, LLC |

Note: The specific requirements may vary, and the table provides illustrative examples. Refer to the official Marriott Bonvoy website for the most up-to-date information.

Account Management

Managing your Marriott Biz Card account efficiently is key to maximizing its benefits and tracking expenses effectively. This section details various methods for account management, including online access and support, and how to check your account balance and transaction history.

Account Access Methods

Various avenues are available for accessing your Marriott Biz Card account. You can access your account information and manage your profile through a secure online portal, which is often the most convenient option. Alternatively, you can contact customer support for assistance. The online portal provides a comprehensive overview of your account, allowing you to view statements, track spending, and make necessary adjustments.

Online Account Access and Support

The online portal provides a user-friendly interface for managing your account. You can log in to view your account balance, transaction history, and upcoming payments. Support is often available via email, chat, or phone for addressing queries or resolving issues. The online portal often provides FAQs and helpful resources to guide you through the account management process.

Checking Account Balances and Transaction History

Checking your account balance and transaction history is straightforward through the online portal. Simply log in and navigate to the relevant sections. Detailed transaction records allow you to monitor your spending, identify expenses, and reconcile your statements. This enables precise tracking of business expenses.

Using Online Tools for Managing Expenses

The online portal often integrates with expense reporting tools. These tools enable you to categorize and track business expenses easily. You can input receipts, categorize expenses, and generate reports for tax purposes or expense reimbursements. This streamlined approach significantly simplifies expense management.

Comparison of Online and Offline Account Management

| Feature | Online Account Management | Offline Account Management |

|---|---|---|

| Accessibility | 24/7 access from anywhere with internet connectivity | Limited to business hours and specific locations |

| Account Overview | Comprehensive view of account balance, transaction history, and statements | Requires contacting customer support or reviewing physical statements |

| Expense Tracking | Integration with expense reporting tools, easier categorization, and tracking | Manual tracking of expenses and receipts |

| Support | Online chat, email, and phone support | Phone support during business hours |

| Efficiency | Highly efficient and convenient for managing expenses on the go | Less efficient and time-consuming compared to online methods |

Responsible Spending and Financial Management

Source: boardingarea.com

Using a business credit card responsibly is crucial for maintaining financial health and maximizing its benefits. Understanding the importance of budgeting, tracking expenses, and managing credit limits is key to avoiding potential financial pitfalls. This section will Artikel strategies for responsible credit card use, ensuring you leverage the card’s advantages while safeguarding your financial well-being.

Importance of Responsible Spending

Responsible spending with a business credit card involves understanding the implications of exceeding credit limits and the potential impact on your credit score. By diligently managing your spending and adhering to a budget, you can avoid incurring unnecessary interest charges and maintain a healthy credit profile.

Budgeting and Expense Tracking

Effective budgeting and expense tracking are essential for responsible financial management. A well-defined budget provides a framework for allocating funds to various business needs, helping you avoid overspending and maintain financial control. Using expense tracking software or spreadsheets can help you monitor your spending patterns and identify areas where you can optimize your budget. This process is crucial for understanding your spending habits and making informed decisions about future financial allocations.

Implications of Exceeding Credit Limits

Exceeding your credit limit can negatively impact your creditworthiness. Credit card issuers often assess your creditworthiness based on how you use your credit. If you frequently exceed your credit limit, it can indicate a potential risk to the issuer. This can affect your credit score, potentially making it harder to obtain future credit or secure favorable interest rates. This can hinder your ability to secure loans or other credit facilities, affecting your business’s operational capacity.

Minimizing Interest Charges

Minimizing interest charges is crucial for managing your business finances effectively. Understanding how interest rates work and adhering to payment schedules can save you significant amounts of money over time. Paying your balance in full and on time each month is the most effective way to avoid interest charges. Utilizing a budgeting strategy that allows for full payment is essential for minimizing these charges.

Credit Scores and Responsible Credit Utilization

Maintaining a healthy credit score is vital for your business’s financial well-being. A good credit score can help you secure favorable interest rates and loans, providing your business with the necessary financial tools. Responsible credit utilization, meaning using only a portion of your available credit, is a key indicator of creditworthiness. Avoid overextending yourself and maintain a balance that demonstrates responsible financial management.

Budgeting Methods for Travel Expenses

Properly budgeting travel expenses is vital for business owners. Different budgeting methods can be tailored to suit individual needs and circumstances.

| Budgeting Method | Description | Example |

|---|---|---|

| Zero-Based Budgeting | Allocate every dollar of income to a specific expense or category. | Allocate $10,000 of projected income for travel expenses, then further break this down into specific categories like flights, accommodation, and meals. |

| Percentage-Based Budgeting | Allocate a percentage of income to each expense category. | Allocate 10% of your projected income for travel expenses, then divide that 10% further among various travel categories. |

| Envelope System | Assign a specific amount to each expense category and place it in an envelope. | Place a certain amount of cash in an envelope labeled “flights”, “accommodation”, etc., and only use the money from the respective envelope for each category. |

Customer Service and Support

Maintaining a positive customer experience is paramount to the success of the Marriott Biz Card. This section details the various channels available for support, guiding you through the process of contacting customer service representatives and resolving any issues or disputes efficiently. Understanding these avenues will empower you to promptly address concerns and maximize the benefits of your card.

Available Channels for Support

This section articulates the various channels for reaching out to customer service representatives for assistance. These options are designed to accommodate diverse needs and preferences, ensuring accessibility and prompt resolution of any concerns.

- Phone Support: Direct contact with a customer service representative is often the most efficient method for immediate assistance. Dialing a dedicated support line allows for personalized guidance and immediate resolution of issues.

- Online Support Portal: A dedicated online portal provides access to frequently asked questions (FAQs), self-service tools, and online chat options. This platform offers a convenient alternative for resolving common issues without the need for a phone call.

- Email Support: Email support offers a written record of your inquiry and its resolution. This is particularly helpful for detailed questions or situations requiring a thorough explanation.

- Social Media Support: Some companies utilize social media platforms (like Twitter or Facebook) to address customer inquiries. This can be a valuable resource for quick responses to simple queries or for reporting urgent issues.

Contacting Customer Service Representatives

This section details the process for reaching customer service representatives. Following these steps ensures a smooth interaction and a timely resolution to your concerns.

- Identifying the Issue: Before contacting customer service, clearly identify the issue you are facing. This will help the representative understand your concern and provide a tailored solution.

- Gathering Information: Compile relevant information such as your account number, transaction details, or any other pertinent information to expedite the resolution process. This could include reservation numbers or confirmation codes.

- Selecting the Appropriate Channel: Choose the support channel that best suits your needs and the complexity of the issue. Phone support is ideal for complex issues or those requiring immediate action. The online portal is a great starting point for more common inquiries.

Resolving Issues or Disputes

This section details the process for resolving any issues or disputes that may arise with the Marriott Biz Card. Following these steps ensures a fair and efficient resolution.

- Documentation: Maintain records of all communications, including dates, times, and details of interactions with customer service. This will be vital for tracking the progress of your issue.

- Escalation Procedure: If the initial attempt to resolve the issue is unsuccessful, understand the escalation procedure within the customer service framework. This often involves contacting a supervisor or a dedicated dispute resolution team.

- Following Up: After submitting your request or contacting customer service, follow up with the representative to ensure your issue has been properly addressed. This ensures a complete and satisfactory resolution.

Common Customer Service Inquiries and Resolutions

This section provides examples of common customer service inquiries and their typical resolutions.

- Lost or Stolen Card: Immediately report a lost or stolen card to customer service to prevent unauthorized charges and secure a replacement card. The process typically involves verifying your identity and providing relevant information for a new card to be issued.

- Incorrect Billing: If you notice an incorrect billing statement, contact customer service immediately. The resolution typically involves reviewing the statement and adjusting the billing if the error is verified.

- Technical Issues with Online Portal: If you experience technical difficulties with the online portal, contact customer service. The resolution often involves troubleshooting the issue and providing assistance to resolve the problem.

Contact Information

The following table provides contact information for various customer service channels.

| Channel | Contact Information |

|---|---|

| Phone Support | 1-800-MARRIOTT (1-800-627-7466) |

| Online Support Portal | marriott.com/support |

| Email Support | bizcardsupport@marriott.com |

| Social Media Support | @MarriottBiz on Twitter |

Frequently Asked Questions (FAQ)

This section addresses common inquiries regarding the Marriott Bonvoy Business Credit Card. Understanding the nuances of this card is crucial for maximizing its benefits and avoiding potential pitfalls. Navigating the complexities of business travel rewards programs can be simplified with clear answers to frequently asked questions.

Application Process

The application process for the Marriott Bonvoy Business Credit Card typically involves online submissions. Applicants should carefully review the eligibility criteria to ensure they meet the requirements. A thorough understanding of the application procedures minimizes potential delays and ensures a smooth onboarding experience.

- Eligibility Requirements: Applicants must meet specific criteria, including minimum income thresholds, business-related spending, and credit history. This ensures the card is tailored to businesses with legitimate travel needs.

- Application Timeframe: Processing times for applications can vary, but typically range from a few days to several weeks. Applicants should anticipate this timeframe and allow sufficient time for the process to be completed.

- Supporting Documentation: In some cases, supporting documentation might be required to verify business operations. This ensures the legitimacy of the application and aligns with cardholder agreements.

Rewards and Points

This section details the rewards and points accrual system associated with the card. Understanding how points accumulate and redeem is essential for maximizing the card’s value.

- Point Earning Rate: The Marriott Bonvoy Business Card offers various earning rates based on spending categories. The program typically provides enhanced earning rates on eligible business spending.

- Point Redemption Options: Points can be redeemed for various Marriott Bonvoy rewards, including stays at Marriott hotels, flights, and other experiences. This provides flexibility in how cardholders utilize their accumulated points.

- Point Expiration Policy: Points earned on the Marriott Bonvoy Business Card have specific expiration policies. These policies are articulated to ensure cardholders are aware of the terms and conditions of point validity.

Spending and Financial Management

This section explores the spending habits and financial implications of using the Marriott Bonvoy Business Card. Smart financial management is critical for maximizing the value of the card.

- Annual Fees: The Marriott Bonvoy Business Card typically comes with an annual fee. This fee should be weighed against the potential benefits to determine the value proposition for the cardholder.

- Transaction Limits: The card may have transaction limits that vary based on individual cardholder accounts. Understanding these limits is crucial to avoid exceeding spending caps and potential issues.

- Responsible Spending Practices: Managing expenses responsibly and adhering to company policies is key. This includes meticulous record-keeping and tracking of business-related transactions.

Common Misconceptions

This section addresses common misconceptions surrounding the Marriott Bonvoy Business Card. Understanding these misconceptions helps avoid inaccurate assumptions and ensures informed decision-making.

- Misconception 1: The card is solely for frequent travelers. In reality, the card’s benefits extend to all business owners and individuals who regularly use travel for business purposes.

- Misconception 2: Points are difficult to redeem. In actuality, points can be redeemed for a variety of rewards, including hotel stays, flights, and other experiences.

- Misconception 3: The annual fee outweighs the benefits. Cardholders should carefully evaluate the annual fee against the potential benefits and value proposition to make an informed decision.

Customer Inquiries and Responses

This section showcases examples of customer inquiries and responses to address common questions and concerns.

| Customer Inquiry | Response |

|---|---|

| “How do I redeem my points?” | Points can be redeemed for various Marriott Bonvoy rewards, including hotel stays, flights, and other experiences. Visit the Marriott Bonvoy website for detailed redemption instructions.” |

| “What is the annual fee?” | “The annual fee for the Marriott Bonvoy Business Card is [amount]. This fee should be considered about the potential benefits.” |

| “Can I use the card for personal travel?” | “The Marriott Bonvoy Business Card is designed for business travel. However, some incidental personal travel may be permitted. Consult the terms and conditions for clarification.” |

Comparison with Competitors

A key aspect of choosing a business credit card is understanding its value relative to competitors. Comparing features, benefits, and terms across various cards helps businesses make informed decisions aligned with their specific needs and spending patterns. This section details a comparison of the Marriott Bonvoy Business American Express card with other prominent business credit cards.

Key Differentiators

Several factors set the Marriott Bonvoy Business American Express card apart. These include the robust rewards program tied to Marriott’s extensive hotel network, valuable travel benefits, and potential for substantial savings. However, understanding the nuances of other business credit cards is crucial for evaluating their respective strengths and weaknesses.

Comparison Table

This table presents a comparative overview of the Marriott Bonvoy Business American Express card against other popular business credit cards, highlighting key features and potential benefits.

| Feature | Marriott Bonvoy Business American Express | Chase Ink Business Cash Card | American Express Business Platinum Card | Capital One Spark Business |

|---|---|---|---|---|

| Rewards Program | Points redeemable for Marriott stays, flights, and other travel experiences. | Cash back rewards, with varying categories for earning. | Points earned on purchases, transferable to various travel partners. | Cash back rewards, tiered earning rates for specific merchant categories. |

| Annual Fee | $0 | $0 | $595 | $0 |

| Travel Benefits | Complimentary nights at Marriott hotels, potential for elite status. | Limited travel benefits, often associated with specific spending tiers. | Extensive travel perks, such as lounge access, concierge services. | No direct travel benefits, but potential for earning through cash back. |

| Spending Categories | Focus on travel and hospitality expenses. | Varied spending categories, potentially earning higher cash back in preferred sectors. | Focus on business expenses, offering broader spending categories. | Emphasis on small business expenses and specific merchant categories. |

Value Proposition for Different Businesses

The optimal business credit card depends on the nature of the business and its spending habits. A travel-intensive business might prioritize the Marriott Bonvoy Business American Express card for its travel benefits. A business with significant spending across various sectors might prefer a card like the Chase Ink Business Cash Card, which offers flexible cash back rewards. Businesses with higher budgets and a broad spectrum of business expenses might benefit from the comprehensive benefits of the American Express Business Platinum Card. Small businesses focused on specific categories might find the Capital One Spark Business card appealing due to its simplified structure and tiered rewards.

Pros and Cons of Each Card

A detailed analysis of each card’s advantages and disadvantages is essential for making an informed decision. For instance, the Marriott Bonvoy Business American Express card’s strong travel focus is a significant advantage for frequent travelers, but it may not be as beneficial for businesses with minimal travel needs. Conversely, the Chase Ink Business Cash Card provides flexibility, but the potential for maximizing rewards might be limited. The American Express Business Platinum Card offers substantial benefits but comes with a substantial annual fee.

Future Trends and Developments

The business travel credit card market is constantly evolving, driven by technological advancements, shifting consumer preferences, and evolving industry standards. Understanding these trends is crucial for maintaining a competitive edge and anticipating the needs of corporate travelers. This section explores potential future directions in the market, specifically analyzing the Marriott Biz Card program and the broader landscape of travel rewards and points programs.

Potential Future Trends in the Business Travel Credit Card Market

The market for business travel credit cards is poised for significant transformation. Increased emphasis on sustainability and environmental consciousness is likely to influence card offerings, potentially including rewards tied to eco-friendly travel choices. Furthermore, personalized experiences and seamless digital interactions are becoming increasingly important, with a focus on tailored travel recommendations and automated expense reporting features.

Possible Changes to the Marriott Biz Card Program

The Marriott Biz Card program is likely to adapt to these market trends. Potential enhancements might include integrating sustainable travel options into the reward structure, offering tiered benefits based on spend levels, and expanding partnerships with other travel-related businesses. A rise in mobile-first functionalities, like enhanced mobile check-in and contactless payment options, is also anticipated.

Potential New Features or Benefits

Future Marriott Biz Card benefits might include exclusive access to premium airport lounges or preferential booking rates at Marriott hotels. The program could also potentially partner with other businesses for discounts or perks. Personalized rewards, tailored to the traveler’s frequent destinations or preferred amenities, are another possibility. The introduction of unique rewards, such as early bird check-in or room upgrades, based on card usage, could also be considered.

Insights into the Future of Travel Rewards and Points Programs

Travel rewards programs are expected to continue their evolution toward greater personalization and utility. The emphasis will likely shift from accumulating points for the sake of accumulation to leveraging points for tangible benefits and experiences. Integration with other loyalty programs and payment systems is anticipated, allowing seamless point transfers and redemptions. Furthermore, digital wallets and contactless payment technologies are likely to play a more prominent role in redeeming points.

Summary of Future Trends

- Increased Emphasis on Sustainability: Travel rewards programs may incorporate incentives for eco-friendly travel choices, like carbon offsetting or choosing sustainable transportation options. This trend is driven by growing consumer awareness and corporate social responsibility initiatives.

- Personalized Experiences: Business travel cards will likely feature more tailored benefits and recommendations based on individual traveler preferences and travel patterns.

- Enhanced Digital Interactions: Expect seamless digital tools for expense reporting, booking, and check-in. Mobile-first functionalities are expected to be crucial in streamlining the traveler experience.

- Integration with Other Loyalty Programs: The ability to seamlessly transfer points between different loyalty programs will become more common, allowing travelers to maximize their rewards potential.

- Greater Utility of Points: Travel rewards programs will shift from simply accumulating points to providing tangible benefits, such as exclusive access to premium amenities or personalized travel recommendations. Points will be more valuable when they can be redeemed for practical advantages.

Epilogue: Marriott Biz Card

In conclusion, the Marriott Biz Card provides a compelling proposition for business travelers seeking rewards and convenience. By understanding the benefits, application requirements, and responsible spending practices, users can maximize the value of this card. Comparisons with competitors provide context, and future trends offer insight into potential advancements. This detailed guide empowers users to make informed decisions about their business travel needs.