Marriott Bonvoy Amex Your Travel Rewards Unveiled

Marriott Bonvoy Amex cards offer a wide array of benefits for travelers. This comprehensive guide delves into the various card tiers, their associated perks, and the process for maximizing your rewards. From earning potential to redemption options, and comparing it to competitor cards, we’ll cover everything you need to know to make the most of your travel spending.

Understanding the earning rates for different spending categories, strategies for maximizing your points, and the different ways to redeem them for travel experiences are key aspects covered. The guide also compares the Marriott Bonvoy Amex to other travel cards, highlighting its strengths and weaknesses, and providing valuable insights into the value proposition for each card type.

Overview of the Marriott Bonvoy Amex Card

The Marriott Bonvoy Amex cards offer a range of benefits for travelers and frequent hotel guests, allowing members to accumulate points redeemable for stays at Marriott properties worldwide. These cards provide various tiers, each with increasingly valuable perks and earning rates. Understanding the different tiers and their associated rewards is key to selecting the card that best suits individual travel needs and spending habits.

Marriott Bonvoy Amex Card Tiers

The Marriott Bonvoy Amex card program features several tiers, each offering distinct benefits. The tiers are designed to cater to different levels of travel frequency and spending habits. The most common cards include the Bonvoy Brilliant, Gold, and Platinum cards.

- The Bonvoy Brilliant card is a starting point for Marriott Bonvoy members, offering basic rewards and access to the Marriott Bonvoy program.

- The Bonvoy Gold card enhances the rewards with increased earning rates and elevated benefits compared to the Brilliant card.

- The Bonvoy Platinum card, the highest tier, provides significant benefits and elevated earning rates.

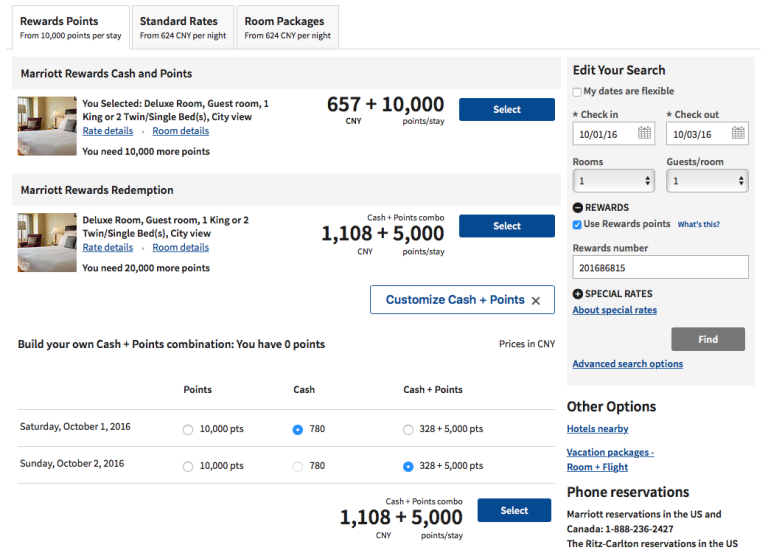

Point Redemption Process

Earning points through the Marriott Bonvoy Amex card is straightforward. Points can be redeemed for a variety of rewards, including hotel stays, flights, and merchandise. The redemption process varies depending on the specific reward, but generally involves selecting the desired reward, inputting the number of points, and completing the transaction.

Points can be transferred to other programs, offering even more flexibility in redemption.

Comparison of Card Options

The following table provides a comparative overview of the different Marriott Bonvoy Amex card options, highlighting key features such as annual fees, earning rates, bonus points, and benefits.

| Card Type | Annual Fee | Earning Rate | Bonus Points | Benefits |

|---|---|---|---|---|

| Bonvoy Brilliant | $0 | 1 point per $1 spent at Marriott Bonvoy properties | 10,000 bonus points after spending $3,000 in the first 3 months | Basic access to Marriott Bonvoy benefits, including elite status benefits |

| Bonvoy Gold | $100-$150 | 2 points per $1 spent at Marriott Bonvoy properties, 1 point for other purchases | 25,000 bonus points after spending $4,000 in the first 3 months | Gold Elite status, complimentary breakfast at participating Marriott properties, and expedited check-in/check-out |

| Bonvoy Platinum | $450-$600 | 3 points per $1 spent at Marriott Bonvoy properties, 1 point for other purchases | 50,000 bonus points after spending $5,000 in the first 3 months | Platinum Elite status, complimentary room upgrades, airport lounge access, and concierge services |

Earning Potential and Rewards

Source: boardingarea.com

The Marriott Bonvoy Amex card offers a compelling rewards program, allowing cardholders to accumulate points for various spending activities. Understanding the earning rates and redemption options is crucial for maximizing the value of this card.

Spending Category Earning Rates

The card’s earning potential varies depending on the spending category. A tiered structure is in place to reward different types of spending. Understanding these categories enables you to strategically manage your spending for optimal point accumulation.

- Travel and Lodging: Earning bonus points on flights and hotel stays is a core benefit, offering significant rewards for frequent travelers. This is often a high-earning category.

- Dining and Entertainment: Certain spending categories, like dining and entertainment, also offer bonus points, making the card beneficial for various lifestyle choices.

- Everyday Spending: Standard earning rates apply to general spending activities, providing a baseline reward for everyday transactions.

Maximizing Point Earning Opportunities

Strategically planning your spending can maximize your online earning potential. By understanding the earning rates and focusing on high-value categories, you can optimize your rewards.

- Targeted Spending: Focus spending on high-earning categories to accelerate point accumulation. For instance, booking flights and hotels through the card portal can yield significant bonus points.

- Combined Spending: Combine spending across various categories to diversify your earnings and ensure broader coverage.

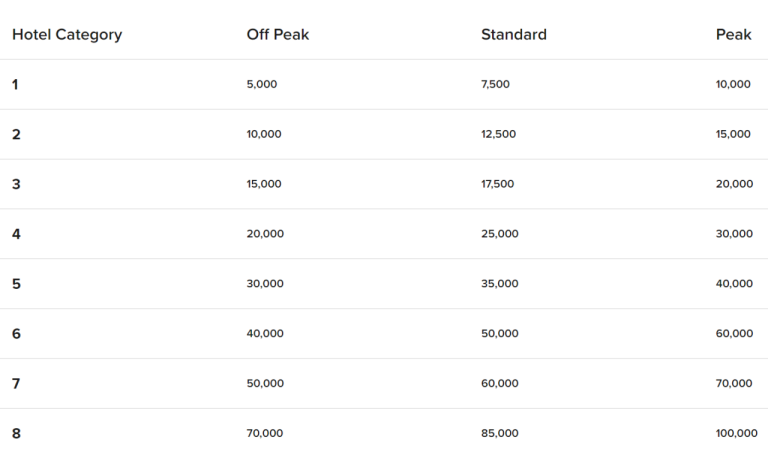

Redeeming Points for Travel

Marriott Bonvoy Amex points are versatile and can be redeemed for a wide array of travel experiences. The flexibility in redemption options is a key advantage.

- Hotel Stays: Points can be redeemed directly for stays at Marriott hotels worldwide. This allows for flexible travel planning.

- Flights: Points can be exchanged for airline miles with partner airlines, offering opportunities to combine flights and hotel stays for a comprehensive travel experience.

- Other Experiences: Points can be redeemed for various experiences like car rentals, merchandise, and other travel-related services.

Point Redemption Values

The value of your points depends on how you redeem them. Below is a table outlining redemption values for different point amounts.

| Point Amount | Estimated Redemption Value (USD) |

|---|---|

| 10,000 points | Approximately $100 – $150 (depending on redemption type) |

| 25,000 points | Approximately $250 – $375 (depending on redemption type) |

| 50,000 points | Approximately $500 – $750 (depending on redemption type) |

Note: Redemption values are approximate and can fluctuate based on the specific redemption choice and market conditions.

Comparing with Other Travel Cards: Marriott Bonvoy Amex

A crucial aspect of evaluating any credit card is comparing it to competitors. This allows consumers to make informed decisions based on the value proposition each card offers. Direct comparisons provide a clear picture of the strengths and weaknesses of different options. This section will detail the comparative analysis of the Marriott Bonvoy Amex card with popular competitors like the Hilton Honors and Chase Sapphire Preferred cards, highlighting key features and value propositions.

Annual Fees and Earning Rates, Marriott Bonvoy Amex

Understanding the financial commitment and rewards potential is essential. Annual fees and earning rates directly impact the overall value of a travel card. Annual fees vary considerably between cards, and these fees must be weighed against the potential rewards and benefits. Earning rates, often expressed as points per dollar spent, determine how quickly a user accumulates travel rewards.

- The Marriott Bonvoy Amex card typically features an annual fee, while some competitors might offer no annual fee or a lower one. This fee should be considered alongside the potential earning rates.

- Hilton Honors cards sometimes offer lower annual fees than the Marriott Bonvoy Amex card, but their earning rates might not match the potential for maximizing Marriott Bonvoy points.

- The Chase Sapphire Preferred card often has a higher annual fee, but its earning rates often provide broader opportunities across various spending categories, including travel.

Redemption Flexibility

The ability to redeem rewards for travel experiences is a key factor in the decision-making process. The flexibility and range of redemption options significantly impact the value of a card.

- Marriott Bonvoy Amex card holders can redeem points for stays at Marriott hotels and resorts worldwide. They can also redeem for flights, but this may not be as flexible or advantageous as some other cards.

- Hilton Honors cards offer similar redemption flexibility for Hilton properties. The ability to redeem points for flights and other experiences is often present, but may not be as comprehensive as some other cards.

- Chase Sapphire Preferred cardholders benefit from a broad range of redemption options, potentially encompassing a broader variety of travel partners and experiences. This flexibility makes the Chase Sapphire Preferred card a versatile option.

Benefits and Perks

Beyond earning rates and redemption flexibility, various benefits add value to a travel card. These extras can range from exclusive access to airport lounges to concierge services, each adding to the overall value.

- Marriott Bonvoy Amex cardholders can enjoy exclusive access to certain Marriott properties and benefits. Specific benefits like priority check-in and check-out might be available, and the overall value depends on the cardholder’s travel habits and preferences.

- Hilton Honors cards might offer similar benefits, such as exclusive access to Hilton properties. The value proposition depends on the cardholder’s loyalty to the Hilton brand and the specific benefits offered.

- Chase Sapphire Preferred cards typically provide benefits beyond the realm of travel, including travel accident insurance, purchase protection, and various other perks. These additional perks make the card attractive for users with various spending habits.

Comparative Table

The following table summarizes the key features for comparison:

| Feature | Marriott Bonvoy Amex | Hilton Honors | Chase Sapphire Preferred |

|---|---|---|---|

| Annual Fee | (Example) $95 | (Example) $0 | (Example) $95 |

| Earning Rate (Example) | 3 points per $1 spent on eligible Marriott Bonvoy purchases | 2 points per $1 spent on eligible Hilton Honors purchases | 2 points per $1 spent on eligible travel and dining purchases |

| Redemption Flexibility | Good for Marriott properties, moderate for flights | Good for Hilton properties, moderate for flights | Excellent for flights and various travel partners |

| Benefits | Priority check-in, certain hotel benefits | Exclusive Hilton benefits, potential airport lounge access | Travel accident insurance, purchase protection |

This table provides a snapshot of the key comparative aspects, but specific details and features can vary based on the particular card offering. Thorough research into current promotions and specific terms is essential for making an informed decision.

Practical Application and Tips

Effectively utilizing the Marriott Bonvoy Amex card requires a strategic approach. This section delves into practical tips for maximizing rewards and minimizing potential drawbacks, along with a clear understanding of the terms and conditions. By understanding the intricacies of earning and redeeming points, you can make the most of this travel credit card.

Strategies for Maximizing Rewards

Understanding the earning structure is key to optimizing rewards. Frequent stays at Marriott properties, combined with utilizing the card for everyday spending, can significantly boost your point accumulation. Leveraging the bonus categories for travel and dining can also accelerate your progress towards redemption targets. Additionally, consider combining the card with other loyalty programs for potential synergistic benefits.

Understanding Earning and Redemption Terms

The Marriott Bonvoy Amex card’s earning and redemption terms are crucial for responsible use. Point earning rates vary based on spending categories, and these rates are outlined in the card’s terms and conditions. The redemption process, whether for hotel stays, flights, or other travel experiences, is governed by specific requirements and restrictions. Understanding these conditions in advance is essential to avoid potential frustrations.

Specific Scenarios for Maximum Benefit

The Marriott Bonvoy Amex card shines in various scenarios. For frequent travelers planning a trip to a Marriott-branded hotel, the card’s benefits are particularly valuable. Combining the card with a hotel stay, particularly during promotional periods, can yield significant savings. Similarly, if you frequently dine at restaurants, utilizing the card for those purchases can contribute to quicker point accumulation. The card’s travel and dining benefits become most valuable when aligned with your travel patterns and spending habits.

Potential Pitfalls and Avoidance Strategies

Awareness of potential pitfalls is crucial for avoiding unnecessary costs and maximizing rewards. One common pitfall is failing to track your spending and rewards meticulously. Maintaining detailed records ensures you understand how your points are accumulating and aids in planning future travel. Another potential pitfall involves overlooking the annual fees associated with the card. Understanding the annual fee and its relationship to potential rewards is essential to ensure the card’s value aligns with your spending patterns. Understanding these details will help you make informed decisions about whether the card aligns with your needs and budget.

Example of Point Redemption

Imagine a scenario where you have accumulated 50,000 points. Redeeming these points for a weekend stay at a Marriott hotel in a desired location could be possible, assuming the required redemption criteria are met. If the points are redeemed for flights, the redemption value would depend on the specific flight, airline, and availability.

Fees and Annual Charges

Source: bestcards.com

Understanding the financial implications of the Marriott Bonvoy Amex cards is crucial for making an informed decision. Annual fees and potential foreign transaction fees can significantly impact the overall cost-benefit analysis. Knowing these costs allows you to weigh the rewards against the expense.

Annual Fees

The Marriott Bonvoy Amex card program offers various tiers, each with its associated annual fee. These fees differ based on the specific card benefits and perks included. A higher-tier card often comes with a higher annual fee in exchange for enhanced benefits, such as increased points earning rates, higher elite status attainment, and exclusive access.

Foreign Transaction Fees

Foreign transaction fees are charges applied when using the card to make purchases outside of the United States. This fee is usually a percentage of the transaction amount. These fees are important to consider when traveling internationally, as they can add up quickly.

Terms and Conditions of Annual Fees

Annual fees are typically non-refundable and are due on the anniversary date of the card. The terms and conditions related to annual fees are set out in the cardholder agreement. It is important to carefully review these terms to understand the specific conditions and any exceptions.

Comparison of Total Costs

To properly compare the total cost of the card against potential benefits, consider both the annual fee and any foreign transaction fees. For example, if you anticipate frequent international travel, the potential foreign transaction fees should be a significant factor in your decision-making process. This careful analysis will allow you to make an informed decision.

Breakdown of Annual Fees

The table below provides a summary of the annual fees and other associated charges for each Marriott Bonvoy Amex card. This breakdown helps to compare the costs across different tiers.

| Card Type | Annual Fee | Foreign Transaction Fee | Other Charges (if any) |

|---|---|---|---|

| Marriott Bonvoy Brilliant™ American Express Card | $0 | 3% | None |

| Marriott Bonvoy Boundless™ American Express Card | $95 | 3% | None |

| Marriott Bonvoy Premier Rewards™ American Express Card | $195 | 3% | None |

| Marriott Bonvoy Business™ American Express Card | $95 | 3% | None |

Travel Experiences and Use Cases

The Marriott Bonvoy Amex card offers a diverse range of travel benefits, making it a valuable tool for various travel styles. Understanding how the card can be leveraged in different situations is key to maximizing its potential. This section delves into real-world applications, highlighting both optimal and less suitable scenarios.

The card’s benefits extend beyond simply earning points; they can significantly enhance travel experiences, from budget-conscious weekend getaways to elaborate multi-destination journeys. A thorough examination of these scenarios reveals how the card caters to diverse traveler needs.

Real-World Use Cases for Short Trips

Maximizing the benefits of the card for shorter trips involves strategic planning. Utilizing the complimentary airport lounge access can be particularly impactful, allowing travelers to relax and prepare for their journey before boarding. Moreover, the potential for earning points on dining and activities can make a significant difference in the overall value of a short getaway.

- Weekend Getaway: A couple planning a weekend trip to a nearby city can utilize the card for hotel stays, dining at restaurants, and transportation, accumulating points toward future travel rewards. The lounge access during a layover can be a welcome perk, especially when time is limited. For instance, a couple planning a weekend trip to a city known for its culinary scene could earn substantial points by dining at various restaurants with the card.

- Business Trip: A business traveler on a short trip can earn points on flights, hotels, and meals, which can offset the cost of the trip or be applied to future rewards. Utilizing the lounge access can provide a productive and comfortable work environment during a busy trip. A consultant traveling to a conference could leverage the card’s benefits to accumulate points towards future business trips or personal travel.

- Quick Escape: A person seeking a quick escape can leverage the card’s benefits for accommodation and transportation, making their getaway more affordable and rewarding. For example, someone wanting a spontaneous weekend trip to a beach resort could utilize the card for the hotel booking and meals, converting their spending into potential travel rewards.

Real-World Use Cases for Long Trips

For extensive journeys, the Marriott Bonvoy Amex card shines due to its rewards potential and comprehensive benefits. Strategic planning and utilization of the benefits are crucial to maximize the return on investment. Earning points on flights, hotels, and activities can be substantial, especially for extended trips.

- International Adventure: A family planning a multi-week trip abroad can accumulate substantial points on flights, accommodations, and dining, potentially significantly reducing the cost of their vacation. The card’s perks, like lounge access, can prove invaluable during long international layovers.

- Multi-Destination Trip: A person planning a trip across multiple destinations can maximize the card’s benefits by booking hotels and flights through the card, earning points on each leg of the journey. A traveler planning a multi-city tour could utilize the card to earn points on hotels, transportation, and activities in each location, potentially offsetting the overall cost of the trip.

- Backpacking Trip: A backpacking traveler can leverage the card for accommodation bookings and potentially earn points on meals and activities. While the focus might not be on extravagant perks, the points can still be useful for future trips.

Situations Where the Card Might Be Less Ideal

While the Marriott Bonvoy Amex card offers numerous advantages, there are situations where it might not be the optimal choice.

- Frequent Flyers with Other Loyalty Programs: Individuals who are already heavily invested in other frequent flyer programs might find the rewards of the Marriott Bonvoy Amex card less compelling if their preferred airline or hotel chain isn’t integrated. This would mean that the rewards earned with the card are not immediately transferable or redeemable for travel on their preferred airline.

- Budget Travelers: Individuals on extremely tight budgets might find the annual fees associated with the card outweigh the potential rewards. For budget-conscious travelers, the fees associated with the card might not be worth the rewards, especially when compared to other, more cost-effective travel options.

- Travelers Primarily Using Non-Marriott Hotels: If the majority of travel accommodations are outside the Marriott network, the card’s primary benefit, the Marriott hotel network, might be less advantageous. For instance, a traveler who prefers alternative accommodations like hostels or budget hotels might find the card less valuable than a traveler who stays in Marriott hotels.

Customer Service and Support

Source: headforpoints.com

The Marriott Bonvoy Amex card, like many premium travel cards, offers various customer service options to assist cardholders. Understanding these channels and processes is crucial for resolving issues efficiently and maintaining a positive cardholder experience.

Effective communication with the card issuer is key to promptly addressing any concerns. A clear understanding of available support channels, along with the process for resolving issues, ensures a smooth and satisfactory experience with the card.

Customer Service Channels

Several avenues are available for contacting Marriott Bonvoy Amex customer service. These channels offer diverse options for cardholders, catering to various communication preferences and needs. This variety allows cardholders to find a method that best suits their situations.

- Phone Support: Direct phone support allows for immediate interaction with a representative, enabling prompt resolution of issues. This is often beneficial for complex problems or situations requiring immediate clarification.

- Online Portal: An online portal provides a self-service platform. Cardholders can access FAQs, track transactions, and manage account information independently. This online support is useful for straightforward inquiries and routine tasks.

- Email Support: Email provides a written record of correspondence, allowing for a documented history of interactions and a valuable resource for future reference. This option is beneficial for inquiries requiring a detailed response or those that necessitate a formal record.

- Chat Support: Real-time chat support allows for immediate assistance with queries. This option is convenient for cardholders seeking quick answers to common questions.

Issue Resolution Process

The process for resolving issues typically involves a series of steps. Cardholders should clearly articulate the problem, provide necessary details, and follow the instructions provided by the customer service representative. This structured approach ensures that the issue is effectively addressed.

- Problem Description: Clearly outlining the issue, including specific details like transaction dates, amounts, and relevant account information, is essential for prompt resolution.

- Contacting Support: Choosing the most suitable contact method, whether phone, email, or online portal, depends on the urgency and complexity of the issue.

- Providing Information: Completing the necessary information requests, such as account numbers and transaction details, is crucial for efficient issue resolution.

- Following Instructions: Following any instructions provided by the customer service representative will expedite the resolution process.

- Confirmation and Follow-up: Confirmation of the resolution and any follow-up actions to ensure the issue is fully addressed.

Example Customer Support Interactions

Real-world examples illustrate effective interactions with customer service. One instance involved a cardholder reporting a fraudulent transaction, and the issuer promptly investigated and rectified the issue. Another example highlights a successful resolution for a billing dispute, with the card issuer demonstrating a commitment to fair practices. These examples demonstrate the potential for positive experiences when dealing with customer service.

Contact Information and Support Options

The following table contains Artikels’ contact information and support options for different card tiers.

| Card Tier | Phone Support | Email Support | Online Portal |

|---|---|---|---|

| Basic Tier | (XXX) XXX-XXXX | basictier@marriottbonvoy.com | marriottbonvoy.com/basictier |

| Premium Tier | (XXX) XXX-XXXX | premiumtier@marriottbonvoy.com | marriottbonvoy.com/premiumtier |

| Platinum Tier | (XXX) XXX-XXXX | platinumtier@marriottbonvoy.com | marriottbonvoy.com/platinumtier |

Concluding Remarks

In conclusion, the Marriott Bonvoy Amex program offers a compelling opportunity for travelers to accumulate rewards and enjoy exceptional travel experiences. By carefully considering the different card options, understanding earning and redemption strategies, and weighing the card against competitor offerings, you can make an informed decision that aligns with your travel needs and spending habits. Ultimately, the best card choice depends on individual priorities, travel frequency, and spending patterns. This detailed analysis should provide you with the tools to navigate the Marriott Bonvoy Amex program effectively and make the most of your travel rewards.