Marriott Bonvoy Amex Business Your Travel Advantage

Marriott Bonvoy Amex Business offers a compelling opportunity to maximize your travel rewards. This card rewards business travel and spending with generous benefits, including hotel points, flight miles, and lounge access. Understanding the tiers of benefits and earning rates is key to unlocking the full potential of this card.

The card’s benefits are thoughtfully structured, catering to diverse spending categories. A detailed comparison with competitor cards helps illuminate its unique strengths and weaknesses. This analysis explores practical applications and use cases, equipping you with the knowledge to leverage the card effectively and avoid potential pitfalls.

Benefits and Perks

Source: fitsmallbusiness.com

The Marriott Bonvoy Amex Business card offers a comprehensive suite of rewards and benefits designed to enhance business travel and spending. These perks cater to various spending habits and travel preferences, offering flexibility and value for cardholders.

This card provides a tiered system of benefits, with enhanced rewards accruing as spending increases. The structure allows cardholders to maximize their rewards based on their individual needs and spending patterns.

Rewards Structure

The Marriott Bonvoy Amex Business card rewards program is structured to incentivize spending across various categories. Different spending tiers unlock varying levels of benefits and rewards, promoting strategic spending habits that align with the cardholder’s needs.

Travel Perks

The card offers substantial travel benefits, encompassing hotel stays, flight accommodations, and lounge access. These perks are designed to make travel more comfortable and rewarding. Earning Marriott Bonvoy points on eligible hotel stays and flight bookings is a primary benefit.

Earning Rates

The card offers different earning rates across various spending categories. This flexible structure allows cardholders to optimize their rewards based on their spending patterns.

Earning Rates by Spending Category

| Spending Category | Earning Rate | Redemption Options | Additional Notes |

|---|---|---|---|

| Travel (flights and hotels booked directly through the card or Marriott Bonvoy) | 3x points | Hotel points, flight miles | Earning points for direct bookings, ensuring maximum reward accrual for travel-related expenditures. Points can be redeemed for stays at Marriott hotels and other participating brands. |

| Purchases made at gas stations | 1x point per $1 spent | Hotel points | A straightforward earning rate, suitable for routine gas purchases. |

| Purchases made at restaurants | 2x points per $1 spent | Hotel points | Encourages dining out, offering a moderate return on eligible restaurant expenses. |

| Other Purchases | 1x point per $1 spent | Hotel points | Provides a basic return on other general expenses. |

Comparison with Competitors: Marriott Bonvoy Amex Business

Comparing the Marriott Bonvoy Amex Business card against similar business travel cards from other hotel chains and credit card issuers reveals a nuanced landscape of rewards and benefits. Understanding the strengths and weaknesses of each card is crucial for discerning the best fit for individual travel and spending patterns. This comparison will delve into earning rates, redemption options, and annual fees, providing a comprehensive overview of available options.

A critical aspect of evaluating business travel cards is their ability to efficiently accumulate rewards and facilitate seamless redemption. Different cards offer varying earning rates, redemption flexibility, and annual fees. Understanding these factors will empower informed decision-making regarding which card aligns most effectively with one’s business travel habits and financial priorities.

Earning Rates and Redemption Options, Marriott Bonvoy Amex Business

The earning rates and redemption options are critical components when comparing business travel cards. Different cards have varying reward structures, making a comparative analysis essential. The Marriott Bonvoy Amex Business card typically offers a certain percentage of bonus points for travel spending, while competitor cards might emphasize different categories of spending. Each card’s redemption options play a vital role in determining how efficiently travelers can convert their rewards into travel.

Annual Fees and Value Proposition

Annual fees are a crucial consideration when choosing a business travel card. The Marriott Bonvoy Amex Business card, like other competitor cards, has an annual fee that must be weighed against the card’s value proposition. This fee is typically a one-time payment, and the card’s benefits, such as potential savings on travel and access to exclusive perks, should be considered about the cost. The annual fee’s value is evaluated by comparing the potential rewards and benefits against the cost.

Detailed Comparison Table

| Feature | Marriott Bonvoy Amex Business | Competitor A | Competitor B |

|---|---|---|---|

| Annual Fee | $150 | $250 | $100 |

| Earning Rate (Travel) | 3% | 2% | 4% |

| Redemption Options | Wide variety of Marriott Bonvoy properties, flexible redemption for flights | Partnerships with select airlines, limited redemption flexibility | Focus on hotel stays, less flexibility for flights |

| Membership Perks | Access to Marriott Bonvoy benefits | Loyalty program benefits, exclusive offers | Exclusive hotel perks, potential lounge access |

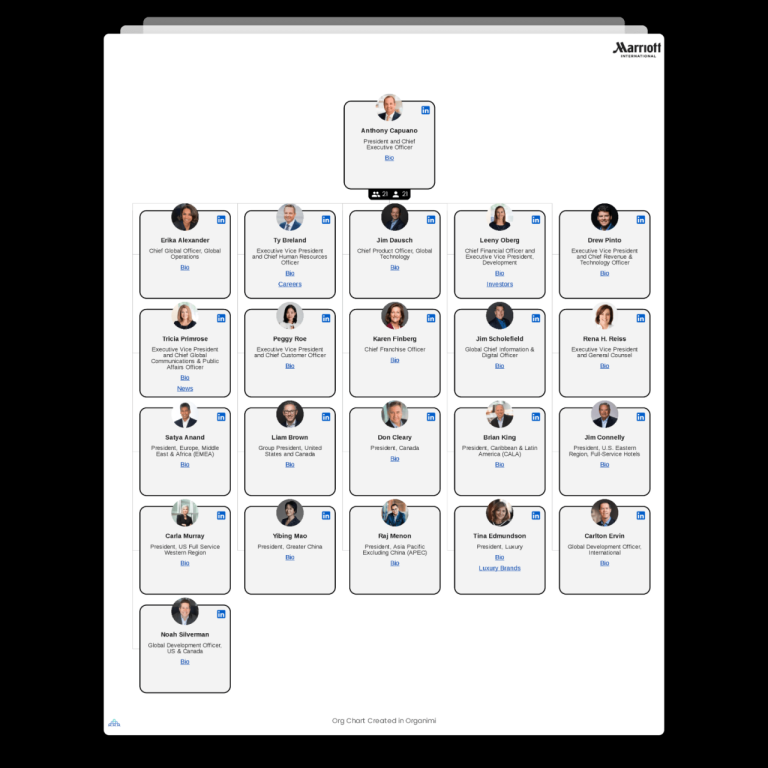

Practical Application and Use Cases

Source: johnnyjet.com

Maximizing the benefits of the Marriott Bonvoy Amex Business card requires a strategic approach. This section details specific scenarios where the card shines, showcasing how to leverage its rewards and benefits to their fullest potential. It also addresses situations where this card might not be the ideal choice for a particular user.

Understanding how to track spending, earn points, and redeem rewards effectively is crucial. This guide provides a step-by-step approach to ensure you’re getting the most out of your card.

Optimizing Rewards and Benefits

The Marriott Bonvoy Amex Business card offers substantial benefits when utilized for business travel and expenses. Strategic use maximizes rewards and minimizes potential drawbacks.

- Frequent Business Travelers: This card excels for frequent business travelers. The substantial travel rewards can quickly accumulate, allowing for upgrades, free nights, and potentially even first-class travel. For instance, a sales representative who travels regularly to conferences can significantly reduce their travel costs and expenses by accumulating points through the card.

- Corporate Events and Meetings: The card can be beneficial for business-related conferences and meetings. The ability to earn points on all expenses associated with these events can translate to free stays or upgrades in hotels affiliated with the Marriott Bonvoy program.

- Frequent Hotel Stays: If your business often requires stays in Marriott hotels, the card is a powerful tool. It allows for increased earning potential through points, which can be redeemed for free nights or upgrades.

Potential Limitations

While the Marriott Bonvoy Amex Business card is generally advantageous, certain situations might render it less optimal.

- Limited Travel Needs: For individuals with infrequent business travel, the card’s rewards may not offer a significant return on investment compared to other cards that cater to different spending habits. If the user is not a frequent traveler, another card with different rewards might offer a more suitable value.

- High Spending Limits: Users with limited spending habits or those who don’t plan to exceed a certain spending threshold might find other cards more practical. If someone anticipates spending significantly below the card’s spending limit, it might be more worthwhile to explore cards with more targeted rewards for different spending categories.

Step-by-Step Guide to Optimization

This structured approach helps maximize your card’s benefits.

- Track Spending Carefully: Maintain meticulous records of all expenses charged to the card. Use a spreadsheet or budgeting software to categorize and track spending. This detailed record helps in monitoring earnings and ensures compliance with spending limits.

- Maximize Earning Potential: Identify and leverage opportunities to maximize point accumulation. For example, if your business has contracts with Marriott hotels, take advantage of those to gain additional rewards.

- Strategic Redemption: Plan your redemption strategy to align with your travel plans. Consider using points for upgrades, free nights, or other benefits when they are most valuable.

- Manage Spending Limits: Be mindful of spending limits to avoid exceeding them. Create a budget and track your spending to prevent potential issues. If spending exceeds the budget, consider adjusting your spending accordingly or utilizing alternative payment methods for necessary expenses.

Booking Travel and Redeeming Points

The process for booking travel and redeeming points is straightforward and can be done online through the Marriott Bonvoy website or app.

- Booking Travel: Access the Marriott Bonvoy website or app to search for available hotels and book your stays using your points. Look for promotional offers to increase the value of your points.

- Redeeming Points: After booking, you can redeem your points for specific perks like upgrades or free nights. This redemption process is typically done during the booking process.

Closing Summary

In conclusion, the Marriott Bonvoy Amex Business card presents a compelling option for business travelers seeking maximized rewards. By understanding its benefits, comparing it to competitors, and mastering practical application strategies, you can strategically leverage this card to enhance your travel experience and gain valuable rewards. Ultimately, careful planning and understanding of earning and redemption options will ensure you get the most out of this powerful travel tool.