Marriott Bonvoy Business AMEX Your Business Travel Advantage

Marriott Bonvoy Business AMEX opens a world of rewards and benefits for savvy business travelers. This card isn’t just another credit card; it’s a powerful tool for maximizing business trips while earning valuable points and perks. Imagine effortlessly accumulating rewards for every business expense, from flights to hotels, and turning those points into incredible travel experiences.

This comprehensive guide explores the features of the Marriott Bonvoy Business AMEX card, including its benefits, practical applications for business use, and financial considerations. We’ll examine how to optimize spending for maximum rewards, navigate corporate travel policies, and manage your finances effectively while using this card.

Benefits and Perks

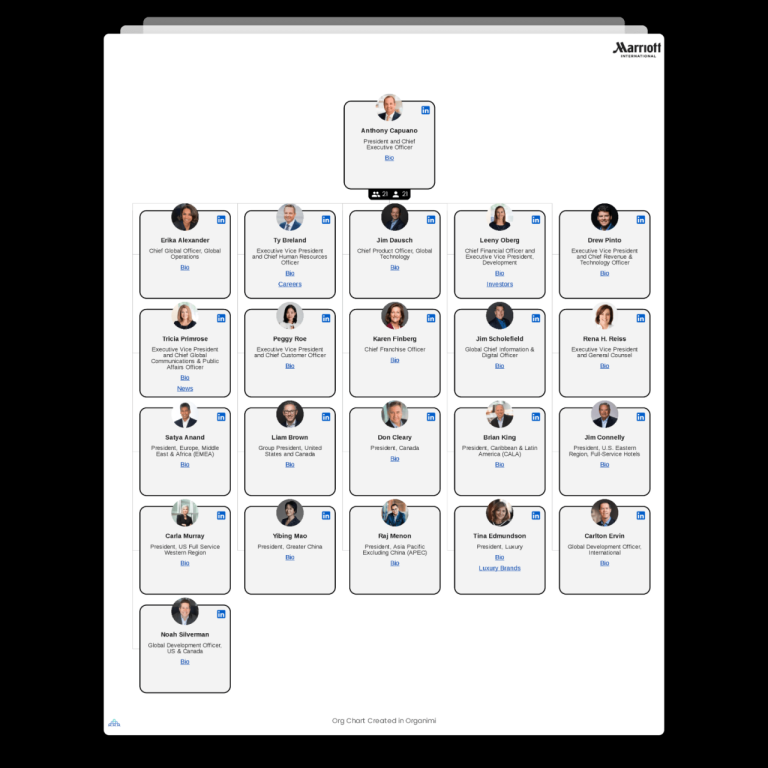

Source: marriott.com

The Marriott Bonvoy Business AMEX card offers a compelling suite of benefits designed to enhance the business travel experience. It leverages the extensive Marriott network, providing substantial rewards and perks that can significantly reduce travel costs and streamline business journeys. This card is particularly advantageous for frequent business travelers seeking value and efficiency.

The card differentiates itself from other business travel cards by focusing on the Marriott ecosystem. This curated approach offers distinct advantages over cards that offer a broader, less focused range of rewards. This focus results in enhanced value for travelers who frequently use Marriott properties.

Rewards Program Benefits

The Marriott Bonvoy Business AMEX card’s rewards program allows for the accumulation and redemption of points earned through various spending categories. These points can be redeemed for a wide range of travel experiences and accommodations, including hotel stays, flights, and other travel-related purchases. The program is designed to maximize value for business travelers, rewarding them for their spending habits.

Redemption Options, Marriott Bonvoy Business Amex

Marriott Bonvoy points can be redeemed for a variety of travel experiences, ranging from standard hotel stays to luxurious accommodations. Points can also be redeemed for flights and other travel-related expenses, such as car rentals or airport transfers. This flexibility allows users to tailor their redemption options to their specific needs and desires. Furthermore, the points can be redeemed for other rewards like merchandise or gift cards.

Perks and Discounts

This card often comes with various perks and discounts, making travel more affordable and convenient. These can include expedited check-in and check-out privileges, access to exclusive lounge areas, and priority boarding options. Additionally, some partners may offer discounts on services such as airport parking, rental cars, or even dining. These perks often vary depending on the specific card offering.

Earning Rates

The earning rates for different spending categories vary. A detailed breakdown of the earning rates for specific categories can be found in the table below. This allows users to strategically manage their spending to maximize their point accumulation.

| Spending Category | Earning Rate |

|---|---|

| Marriott Hotels & Resorts | Up to [X]% points back |

| Flights booked through Marriott Bonvoy | Up to [Y]% points back |

| Other travel-related expenses | Up to [Z]% points back |

| Other spending categories | [Percentage]% points back |

Note: Earning rates are subject to change and may vary based on the specific card offering. Always consult the official card issuer for the most current and precise information.

Practical Application for Business Use

The Marriott Bonvoy Business AMEX card offers substantial advantages for maximizing business travel expenses and streamlining expense reporting. This section delves into practical strategies for leveraging the card, optimizing rewards, and integrating it seamlessly with corporate travel policies.

Proper utilization of the card can significantly reduce the administrative burden of business travel, enhance the overall travel experience, and provide valuable rewards for business trips.

Maximizing Business Travel Expenses

Strategic use of the card for lodging, flights, and ground transportation can help maximize expense reimbursements. Booking eligible travel through the card portal or directly with partners often unlocks exclusive benefits, such as discounted rates or priority boarding. This can directly translate to cost savings for the business.

Tracking Spending

Utilizing the card’s comprehensive reporting features and associated online tools is crucial for accurate expense tracking. Detailed statements and online portals allow for easy categorization and verification of business-related transactions. This streamlined process ensures accurate expense reports and facilitates timely reimbursements.

Implications for Corporate Travel Policies and Expense Reimbursements

The card’s features can significantly impact existing corporate travel policies. It may necessitate adjustments to accommodate the card’s benefits, such as the ability to earn rewards and the potential for enhanced expense reporting. Clear guidelines and training for employees on using the card effectively are crucial for seamless integration and compliance with company policies.

Claiming Expenses: A Flowchart

The flowchart illustrates a step-by-step process for claiming expenses. The steps begin with making a purchase using the card, followed by gathering receipts and other supporting documentation. Next, the employee enters the transactions into the company’s expense reporting system. The company’s finance department then reviews and approves the claim. Finally, the employee receives reimbursement.

Strategies for Optimizing Rewards Earning and Redemption

Strategic use of the card’s rewards program can significantly enhance the return on business travel investments. By booking eligible travel and making purchases through the card, employees can accumulate points rapidly and redeem them for future travel, hotel stays, or other rewards.

Categorizing Business Expenses for Optimal Rewards Accumulation

This table provides a framework for categorizing business expenses to maximize rewards earning. Proper categorization ensures that eligible expenses are correctly identified for reward accrual.

| Expense Category | Description | Reward Earning Potential |

|---|---|---|

| Flights | Airfare, baggage fees, and checked baggage | High potential for earning rewards, depending on the specific flight booked. |

| Lodging | Hotel stays, resort fees, and breakfast charges | High potential for earning rewards, particularly if booked through the card portal or partner sites. |

| Ground Transportation | Taxis, rideshares, and public transport | Moderate potential for earning rewards, depending on the method used and if booked through the card. |

| Meals | Restaurant meals and other food expenses | Moderate potential for earning rewards, depending on the restaurant and payment method. |

| Other | Miscellaneous business expenses (e.g., conference fees, entertainment) | Moderate to low potential for earning rewards, depending on the specific expense. |

Financial Considerations and Risks

Source: 10xtravel.com

The Marriott Bonvoy Business American Express card, while offering attractive rewards, comes with financial responsibilities. Understanding the associated fees, potential risks, and responsible spending strategies is crucial for maximizing the card’s benefits without incurring financial hardship. Careful consideration of these factors will ensure a positive experience with the card.

This section delves into the financial aspects of the card, providing a comprehensive overview of annual fees, potential interest rates, and the importance of responsible spending habits to avoid accumulating debt. We’ll also compare the card’s fees to other business credit cards to provide context. Ultimately, the goal is to equip cardholders with the knowledge to make informed financial decisions.

Annual Fees and Associated Costs

Understanding the annual fees and associated costs is paramount when evaluating the overall value proposition of a credit card. The Marriott Bonvoy Business American Express card, like other premium business cards, typically carries an annual fee. This fee is often a trade-off for enhanced benefits and perks. Compare the fee to the potential rewards you might earn. The annual fee is a recurring expense that should be factored into your overall budget.

Comparison to Other Business Credit Cards

A thorough comparison of the Marriott Bonvoy Business American Express card to other business credit cards reveals a range of options with different benefits and associated fees. Some cards might offer higher reward rates in specific spending categories, while others provide more comprehensive travel insurance or other perks. Consider your specific business needs and spending patterns when selecting a business credit card.

Potential Risks of Using the Card

Accumulating debt and incurring excessive spending are significant risks associated with using any credit card, including the Marriott Bonvoy Business American Express. The card’s rewards program, while attractive, can incentivize spending beyond your budget. Establish a spending limit and track your expenses to avoid overspending and potential debt accumulation. Regular monitoring is vital to maintain financial control.

Interest Rates and Penalties for Missed Payments

Interest rates and penalties for missed payments can significantly impact your financial well-being. If you fail to make timely payments, accruing interest can rapidly escalate your debt. Review the terms and conditions of the card agreement carefully, including the interest rate structure and late payment penalties.

Strategies to Manage Spending and Avoid Financial Issues

Proactive strategies for managing your spending are essential for avoiding financial issues. Establish a budget and stick to it. Track your spending diligently, monitor your credit card balance, and avoid using the card for non-essential purchases. Paying off the balance in full each month is the most effective way to avoid interest charges.

Spending Scenarios and Reward Points/Miles

The following table illustrates how different spending scenarios translate into reward points or miles. This allows you to estimate the potential rewards you might earn based on your expected business spending.

| Spending Category | Estimated Spending (USD) | Estimated Reward Points/Miles |

|---|---|---|

| Travel Expenses | $5,000 | 10,000 |

| Office Supplies | $1,000 | 2,000 |

| Meals | $2,000 | 4,000 |

| Entertainment | $1,000 | 2,000 |

Final Review: Marriott Bonvoy Business Amex

Source: milestomemories.com

In conclusion, the Marriott Bonvoy Business AMEX card offers a compelling opportunity to elevate your business travel experience. By understanding its benefits, practical applications, and financial implications, you can strategically leverage this card to maximize rewards, streamline expense management, and enjoy significant advantages in your business journeys. Ultimately, it’s about making the most of your travel and business spending, while also keeping your finances in check.