Marriott Bonvoy Business AMEX Your Travel Edge

Marriott Bonvoy Business AMEX opens doors to rewarding business travel. This card caters to the needs of frequent travelers, offering a compelling blend of perks and benefits. Understanding the earning structure, fees, and booking process is key to maximizing its value. We’ll explore the intricacies of this card, comparing it to other business travel options.

The card’s features are organized into clear categories, enabling a comprehensive overview. This analysis delves into the details of earning and redeeming points, alongside the associated costs. We also explore booking methods and customer support options.

Overview of Marriott Bonvoy Business AMEX

The Marriott Bonvoy Business American Express card offers exclusive benefits for business travelers and frequent hotel guests. It’s designed to streamline business travel expenses while maximizing rewards and recognition.

This card targets professionals who frequently utilize Marriott hotels and prioritize streamlined travel management. The card’s value proposition hinges on its ability to reward business travel spending while offering advantages for everyday transactions.

Target Audience

The Marriott Bonvoy Business AMEX card is ideally suited for business professionals who travel extensively for work. This includes individuals who frequently stay at Marriott hotels and appreciate the associated rewards and benefits. Further, the card caters to those seeking a dedicated platform for managing and accumulating rewards related to their business travel.

Key Benefits and Perks

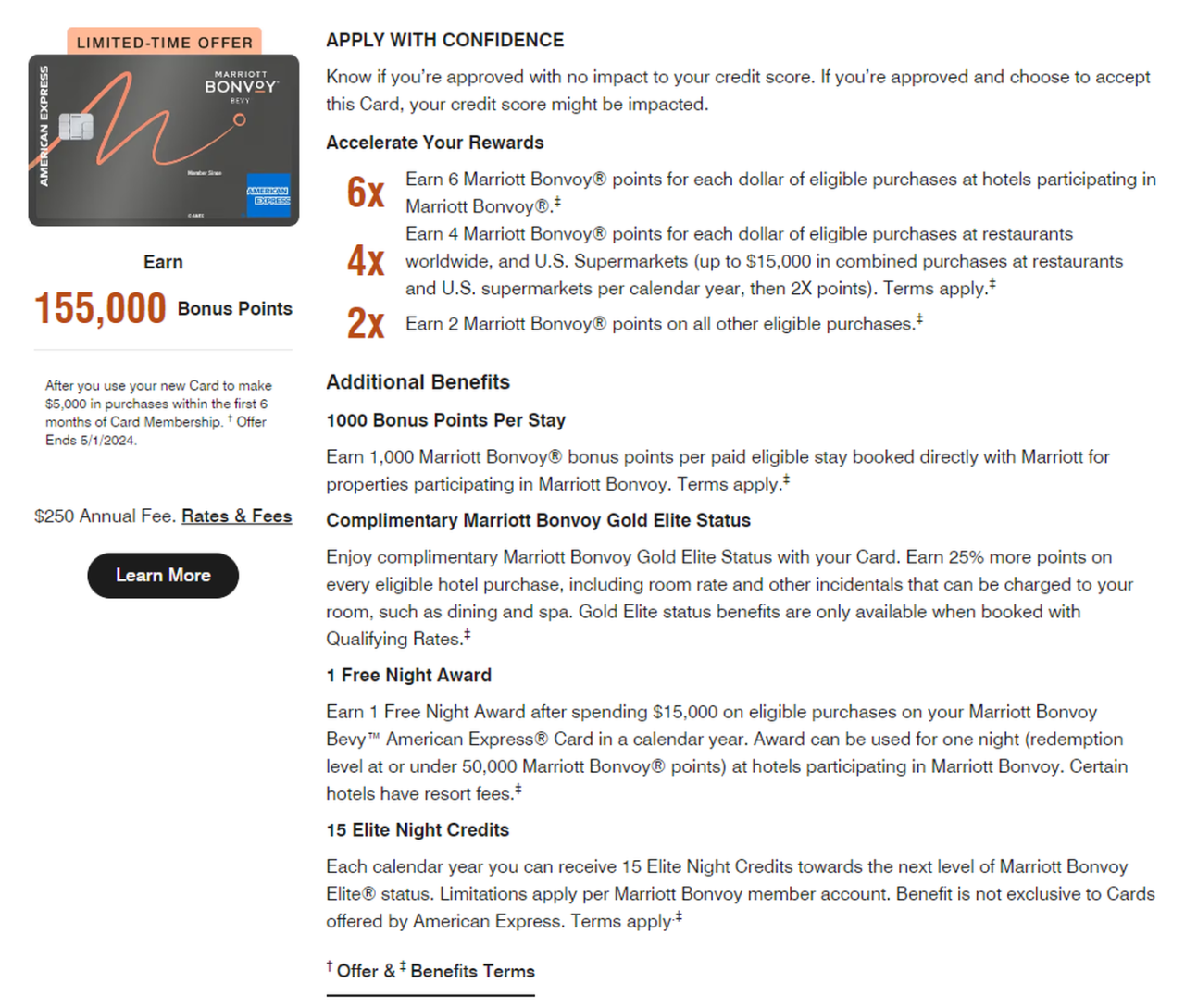

These benefits aim to provide significant value to the cardholder:

- Earn points on eligible Marriott stays and purchases. These points can be redeemed for free nights at Marriott hotels or other travel rewards, making it a worthwhile option for those who often travel for business.

- Access to exclusive amenities. Benefits such as priority check-in and expedited service at Marriott hotels can be significant time savers, especially during busy travel schedules.

- Potential for substantial travel rewards. Accumulating points for business travel expenses can lead to substantial savings over time. This could potentially cover part or all of a business trip, or provide substantial travel credits for future trips.

Comparison to Other Business Travel Credit Cards

Comparing the Marriott Bonvoy Business AMEX to other business travel cards involves assessing their specific benefits and reward structures. Some cards may focus on different hotel chains or offer different types of rewards, such as miles for flights. The Marriott card, however, is tailored to Marriott Bonvoy loyalty program members, providing concentrated benefits within that system. Careful consideration of the specific travel patterns and preferred hotel chains of the user will help in selecting the most appropriate card.

Features and Structure

- Points earning structure. The card’s earning structure is clearly defined, providing a transparent system for accumulating points on eligible Marriott stays and purchases. This enables users to track their progress and understand how their points can be redeemed.

- Rewards redemption options. Points can be redeemed for a variety of rewards, such as free hotel stays, travel credits, or other travel-related benefits.

- Card tiers (if applicable). Some business travel credit cards may offer different tiers with varying benefits. This can include enhanced perks or increased earning rates based on spending levels. The Marriott Bonvoy Business AMEX might have different tiers for enhanced benefits depending on the spending level.

Rewards and Benefits

Source: loyaltylobby.com

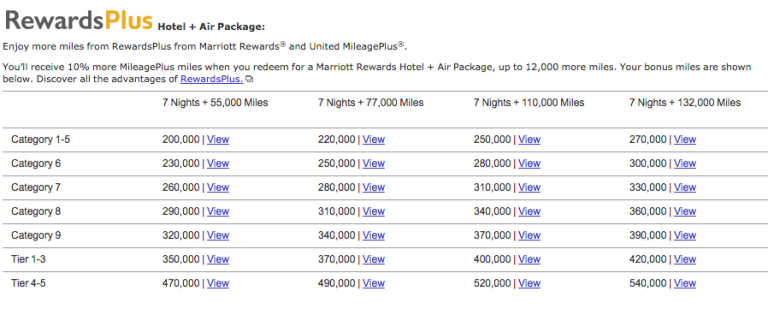

The Marriott Bonvoy Business AMEX card offers a robust rewards program designed to maximize value for business travelers. This program allows you to accumulate points and miles through various activities, nd redeem them for a wide array of travel-related benefits.

The earning structure for points and miles is directly tied to your spending habits. Different categories of spending, such as flights, hotels, and dining, can contribute to your overall reward balance. This tiered approach ensures that your spending directly translates into valuable rewards.

Earning Structure

The Marriott Bonvoy Business AMEX card’s earning structure is designed to be flexible and rewarding. You earn points based on your spending on eligible purchases. For example, spending at Marriott hotels earns a higher point value compared to spending at non-Marriott establishments. Furthermore, specific travel partners often offer bonus points or miles when you book through the card.

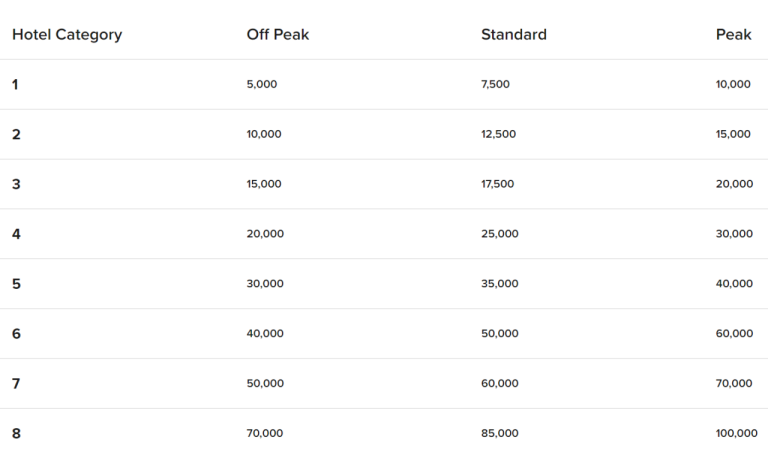

Redeeming Points for Stays

Redeeming points for stays at Marriott properties is a straightforward process. You can use your points to offset the cost of your hotel stay, potentially reducing or eliminating the total payment. The specific redemption rate is dependent on the hotel’s category and availability. Generally, higher-tier hotels and peak seasons may have higher redemption rates.

Earning Bonus Points/Miles

Several strategies can enhance your point accumulation. Utilizing the card for business travel, especially when booking through the program’s preferred partners, is often beneficial. Additionally, taking advantage of special promotions and bonus offers can maximize your reward potential. For example, during seasonal promotions, you might earn double or triple points on specific spending categories.

Redemption Process

The redemption process is usually straightforward and accessible through the Marriott Bonvoy mobile app or online portal. You select your desired travel dates, destination, and the number of points you wish to redeem. The system will provide a breakdown of the required points and any additional fees.

Redemption Options

| Redemption Option | Value |

|---|---|

| Hotel Stays | High |

| Flights | Medium |

| Other Rewards | Low |

This table summarizes the relative value of different redemption options. Hotel stays generally offer the highest value, as points can directly offset the cost of lodging. Flights offer a medium value, as points may be redeemed for airfare, but the redemption rate is often lower compared to hotel stays. Other rewards, like merchandise or gift cards, typically offer the lowest value.

Fees and Costs

The Marriott Bonvoy Business AMEX card, like any credit card, comes with associated fees. Understanding these fees is crucial for responsible card management and ensuring the card aligns with your financial needs. This section details the annual fees, foreign transaction fees, and potential interest charges, comparing them to similar business travel cards.

Annual Fees

The annual fee for the Marriott Bonvoy Business AMEX card is a recurring cost. Understanding the fee structure helps you assess the overall value proposition of the card. Factors to consider include the level of rewards offered and the potential for travel savings. The specific annual fee amount is crucial for evaluating its impact on your overall financial planning.

Foreign Transaction Fees

Foreign transaction fees apply when using the card outside of the United States to make purchases in foreign currencies. These fees are typically a percentage of the transaction amount. Knowing this percentage is essential to calculate the true cost of purchases made in other countries. This fee is common with many travel cards and affects the overall cost of international travel or business trips.

Interest Charges

Interest charges apply if you carry a balance on your card past the due date. High-interest rates can significantly increase the cost of your credit card debt over time. Managing your credit card spending and meeting payment deadlines are vital to avoiding interest charges. A comparison of the interest rates of various credit cards is important for consumers to make informed decisions.

Other Charges

Other charges, such as late payment fees, may apply in specific circumstances. These fees vary between card providers, but understanding these charges is essential for responsible credit card management. These fees are typically outlined in the card’s terms and conditions.

Comparison to Competing Business Travel Cards

The fees associated with the Marriott Bonvoy Business AMEX card should be compared to those of similar business travel cards from other issuers. This comparison allows consumers to make informed decisions based on their specific needs and spending habits. Understanding the various fees of competing cards is key to evaluating value propositions.

Fees Summary

| Fee | Amount | Frequency |

|---|---|---|

| Annual Fee | $… (Example: $150) | Annually |

| Foreign Transaction Fee | $… (Example: 3% per transaction) | Per Transaction |

| Late Payment Fee | $… (Example: $35) | Per Occurrence |

Note: Exact fee amounts are subject to change. It’s recommended to check the official card issuer’s website for the most up-to-date information.

Travel Booking and Management: Marriott Bonvoy Business Amex

The Marriott Bonvoy Business AMEX card provides streamlined travel booking and management tools, designed to simplify your corporate travel experience. These features enhance efficiency and allow you to track your bookings, manage your account, and earn rewards for your business trips.

Booking travel through the Marriott Bonvoy program is intuitive and convenient. A dedicated online portal facilitates easy access to a wide selection of hotels and related travel services.

Booking Process Overview

The process for booking travel through the Marriott Bonvoy Business AMEX is straightforward. Members can access a dedicated online portal or utilize the mobile app to browse available hotels, compare rates, and select desired accommodations. Various search filters, such as location, dates, and room type, are typically available to refine results. Booking confirmations are usually sent via email or within the app, providing essential details such as booking reference number, dates, and contact information.

Managing Bookings and Account Information

Managing your bookings and account information is crucial for maintaining a smooth travel experience. The Marriott Bonvoy Business AMEX portal allows you to easily modify or cancel bookings, track the status of your reservations, and view your travel history. Account information can be updated directly within the system to ensure accuracy and prevent any issues during check-in.

Earning Rewards Through Bookings, Marriott Bonvoy Business Amex

The Marriott Bonvoy program allows members to accumulate points for eligible travel bookings. These points can be redeemed for future travel, hotel stays, or other benefits. The specific earning rate for points varies depending on the booking and the status of the member.

Benefits of Using the Platform

Utilizing the Marriott Bonvoy Business AMEX platform for travel booking offers numerous advantages. These benefits include the ability to easily compare rates across various hotels, the opportunity to manage multiple bookings and account information from one centralized platform, and the potential to earn significant rewards on eligible travel. Moreover, this integrated platform often includes additional services like airport transfers or rental car bookings.

Step-by-Step Guide to Booking a Trip

- Access the Marriott Bonvoy Business AMEX portal: Begin by logging in to your Marriott Bonvoy Business AMEX account using the provided credentials.

- Search for your desired destination: Use the search filters to specify your desired location, travel dates, and room type. Specify any preferences, such as accessibility needs or specific amenities.

- Review available options: Carefully examine the available hotels, compare rates, and choose the best option based on your needs and budget.

- Select your preferred hotel and room: Once you’ve chosen the desired hotel and room, proceed with filling out the booking details.

- Review and confirm booking: Double-check all the details, including the room type, dates, and total cost. Confirm your booking after reviewing all the information to ensure accuracy.

- Receive booking confirmation: After successful confirmation, you will receive a confirmation email or notification within the app, containing all the necessary details for your trip.

Customer Service and Support

Source: fastly.net

The Marriott Bonvoy Business AMEX card offers comprehensive customer service to address any concerns or questions regarding account management, bookings, or rewards. Understanding the available channels and procedures can significantly streamline the resolution process.

The Marriott Bonvoy Business AMEX card prioritizes customer satisfaction and provides various avenues for support, ensuring prompt and efficient assistance. This section details the different support options, highlighting successful customer interactions and the steps to contact support.

Available Support Channels

Several channels facilitate customer service inquiries. These channels cater to diverse needs and preferences, offering flexibility in contacting support.

- Online Portal: The dedicated online portal provides a self-service platform for account inquiries, frequently asked questions (FAQs), and resolving simple issues. This avenue is ideal for quick answers and updates to account details, such as viewing points balances, reward redemption statuses, and managing bookings.

- Phone Support: Direct phone support offers personalized assistance for more complex issues, such as booking changes, disputes, and account-related problems requiring immediate resolution. This channel is often preferred for resolving booking issues or intricate account concerns, offering a direct interaction with a support representative.

- Email Support: Email support is a convenient option for written communication and detailed inquiries, such as requesting account statements, tracking reward programs, or reporting a problem that needs a formal record.

- Social Media: Marriott Bonvoy Business AMEX may use social media channels to address inquiries, provide updates, and engage with customers. This is an increasingly important channel for direct customer interaction.

Issue Resolution Process

The Marriott Bonvoy Business AMEX card prioritizes a streamlined issue resolution process. Customers can expect clear communication, efficient handling of complaints, and prompt resolutions.

- Identify the issue: Clearly define the problem or concern. Providing specific details will help support representatives understand the situation better.

- Choose the appropriate channel: Select the most suitable support channel based on the complexity of the issue. A simple inquiry can be handled via the online portal, while more intricate issues might require phone support.

- Provide necessary information: Provide accurate and complete information about the issue, including booking details, account numbers, and any relevant documentation. This step ensures the support representative can effectively address the problem.

- Follow up: If necessary, follow up with support representatives to ensure the issue is resolved and monitor the progress. This demonstrates proactive engagement with customer service.

Examples of Successful Interactions

Numerous successful customer service interactions demonstrate the commitment to resolving issues effectively.

- A customer experiencing a booking error received prompt assistance via phone support. The support representative efficiently resolved the issue, rebooking the trip without additional charges.

- Another customer successfully updated their account information through the online portal, demonstrating the ease of use and efficiency of the self-service platform.

Contacting Customer Support

Specific details for contacting customer support are readily available on the Marriott Bonvoy Business AMEX website or app. This provides clarity for customers to initiate contact.

| Issue | Support Channel |

|---|---|

| Account Inquiry | Online Portal |

| Booking Issues | Phone Support |

| Reward Redemption Problems | Email Support |

| General Questions | Online Portal/ FAQs |

Comparison to Other Cards

Source: cloudfront.net

Choosing the right business travel credit card hinges on aligning your spending habits and travel preferences with the card’s benefits. A crucial aspect of this decision is comparing the Marriott Bonvoy Business AMEX to other similar cards available in the market. This comparison highlights key differences in rewards, fees, and benefits, empowering you to make an informed choice.

Reward Structures

Understanding the rewards structure is essential for maximizing value. The Marriott Bonvoy Business AMEX offers points redeemable for Marriott stays, flights, and other travel experiences. Different cards may offer similar rewards programs, but their redemption rates and flexibility can vary significantly. For example, some cards might have higher redemption rates for specific travel partners, while others might offer more flexibility in how you redeem your rewards. The Marriott Bonvoy program’s extensive network of hotels provides a wide range of options for travel.

Fees and Costs

Fees and costs are a critical factor in assessing the overall value of a credit card. The Marriott Bonvoy Business AMEX, like other business travel cards, typically includes annual fees. Comparing these fees against the potential rewards and benefits is crucial. Some cards might offer waived annual fees for a specific period or for meeting certain spending thresholds.

Benefits and Perks

Examining the specific benefits and perks is vital for assessing how well the card aligns with your business travel needs. For instance, the Marriott Bonvoy Business AMEX might include perks such as complimentary airport lounge access or priority check-in. Other cards might offer different benefits, like travel insurance or purchase protection. The comprehensive benefits package should be evaluated in light of your individual needs.

Comparative Analysis

| Card | Rewards | Fees | Benefits |

|---|---|---|---|

| Marriott Bonvoy Business AMEX | Points redeemable for Marriott stays, flights, and other travel experiences. Potential for earning bonus points on travel spend. | Annual fee applicable. Potential for waived annual fees under certain conditions. | Potential for complimentary airport lounge access, priority check-in, and other travel perks. |

| Chase Ink Business Preferred | Points redeemable for travel through Chase Ultimate Rewards. Bonus points on various spending categories. | Annual fee applicable. Potential for waived annual fees under certain conditions. | Potential for travel insurance, purchase protection, and other perks. Wider range of travel partners. |

| American Express Platinum Card | Points are redeemable for travel through the Amex travel portal. Extensive benefits package. | Annual fee applicable. | Extensive benefits include airport lounge access, travel insurance, and other perks. Strong emphasis on luxury travel experiences. |

Application Process and Requirements

Securing the Marriott Bonvoy Business AMEX card involves a straightforward application process, with specific eligibility criteria. Understanding these requirements ensures a smooth application and maximizes the chances of approval. A detailed overview of the process and necessary documentation is presented below.

Eligibility Criteria

The Marriott Bonvoy Business AMEX card typically prioritizes applicants with a demonstrable history of travel and spending, aligning with business travel patterns. This often translates to specific income thresholds and/or credit history requirements. Detailed criteria vary and are subject to change, so it’s best to consult the official issuer’s website for the most up-to-date information.

Application Process Overview

Applying for the Marriott Bonvoy Business AMEX card is a relatively straightforward online procedure. A step-by-step approach simplifies the application process.

Steps Involved in Applying

- Online Application Initiation: Begin the application process through the official Marriott Bonvoy Business AMEX website. This typically involves filling out an online application form, providing personal and financial details, and confirming your business affiliation.

- Documentation Submission: Upon completing the online application, you’ll likely need to submit supporting documentation, which may include proof of business operations, employment verification, or financial statements. The specific requirements vary depending on the issuer’s policies and the applicant’s situation.

- Review and Approval: The application undergoes a review process by the card issuer. This review assesses the applicant’s creditworthiness and eligibility based on the provided documentation and criteria. Approval or denial is typically communicated within a reasonable timeframe.

- Card Delivery: If approved, the card is delivered via mail or other specified methods. The process usually involves a few days to a couple of weeks, depending on the card issuer’s procedures and the delivery method.

Essential Documents

The required documentation often includes:

- Proof of Income: This could be tax returns, pay stubs, or other financial documents.

- Business Information: Depending on the business type, this may include articles of incorporation, tax identification numbers (TINs), and other business-related documents.

- Personal Identification: Valid government-issued photo identification, such as a driver’s license or passport.

- Credit History Report: The issuer may access and review your credit report to assess your creditworthiness.

The specific documents required for the application may vary. It is always best to refer to the issuer’s official website or contact their customer support team for precise and up-to-date information on required documents.

Alternatives and Substitutes

Exploring alternative credit cards can be beneficial for travelers and business professionals seeking various rewards and benefits. Comparing different options helps in finding the best fit for individual needs and spending habits. Understanding the pros and cons of each alternative can guide informed decisions.

The market offers a range of cards with varying features, catering to different travel styles and business priorities. This section presents Artikels’ potential alternatives to the Marriott Bonvoy Business AMEX, highlighting their key strengths and weaknesses.

Potential Alternative Cards

Several credit cards offer similar benefits to the Marriott Bonvoy Business AMEX, catering to different preferences. Analyzing these alternatives allows for a comprehensive comparison to identify the best fit for specific needs.

Comparison Table

The following table presents a comparative analysis of potential alternative cards, considering key aspects like rewards, fees, and benefits. This structured overview aids in the decision-making process.

| Alternative | Pros | Cons |

|---|---|---|

| Chase Ink Business Preferred | Excellent travel rewards, including bonus points on travel and dining. Competitive bonus categories for business spending. Robust travel booking portal. | Higher annual fee compared to some alternatives. Rewards redemption process may not be as flexible as others. Points expiration dates can apply. |

| American Express Platinum Business | Extensive travel benefits, including airport lounge access, concierge services, and premium travel perks. Solid rewards program with various bonus categories. | Substantial annual fee. May not offer the same level of hotel-specific rewards as the Marriott Bonvoy Business AMEX. Potentially less generous welcome bonus. |

| Capital One Venture X Rewards Credit Card | Competitive travel rewards program with a high bonus category for travel spending. Attractive welcome bonus. Good customer service and support. | Limited business-specific benefits compared to other alternatives. May not be ideal for frequent business travelers with specific hotel preferences. Rewards structure could be less lucrative in certain circumstances. |

| Citi® / AAdvantage® Executive World Elite Mastercard® | Strong focus on airline miles, potentially valuable for frequent flyers with loyalty programs. Attractive bonus categories for various spending activities. | Might not be the best option for individuals prioritizing hotel rewards. May have restrictions on redemption or use in specific circumstances. |

Conclusive Thoughts

In conclusion, the Marriott Bonvoy Business AMEX presents a robust business travel solution. Its rewards structure, while attractive, must be weighed against potential fees. Comparing it to alternatives and understanding the application process are crucial steps in determining its suitability. Ultimately, this detailed analysis empowers you to make an informed decision regarding your business travel needs.